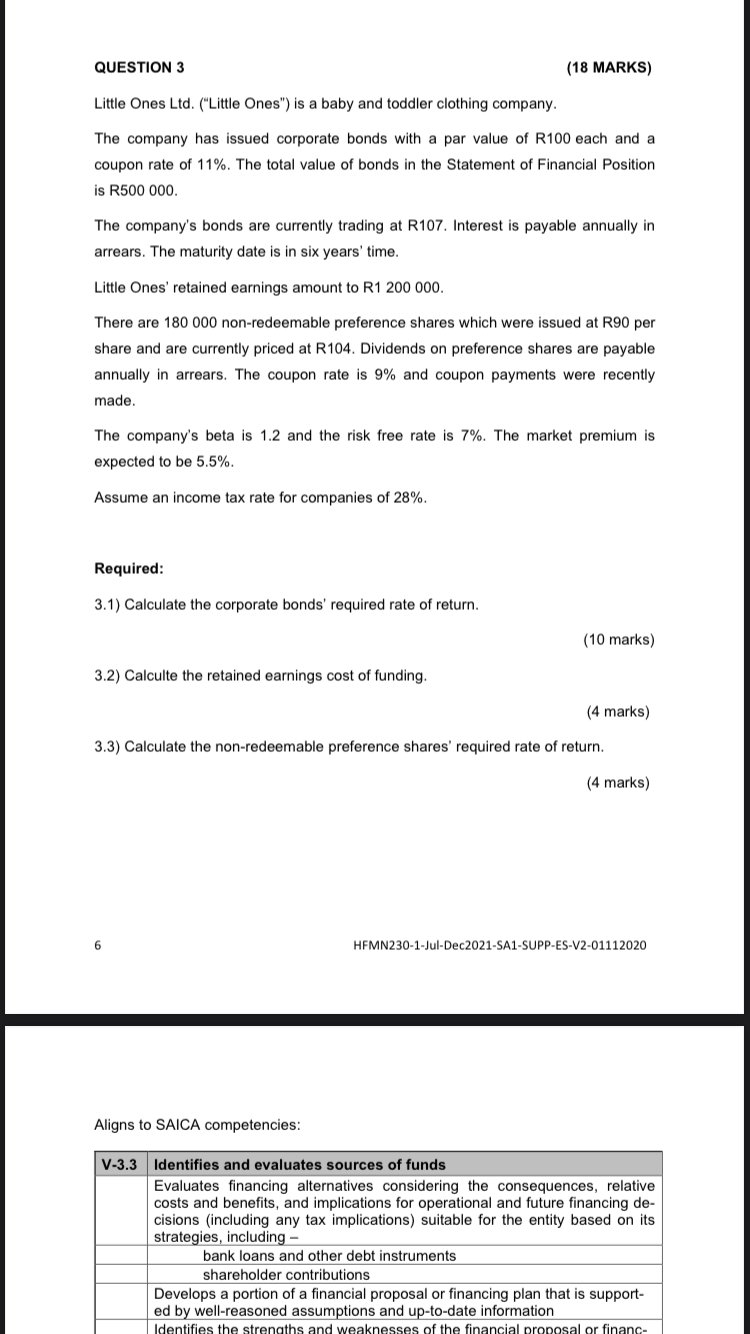

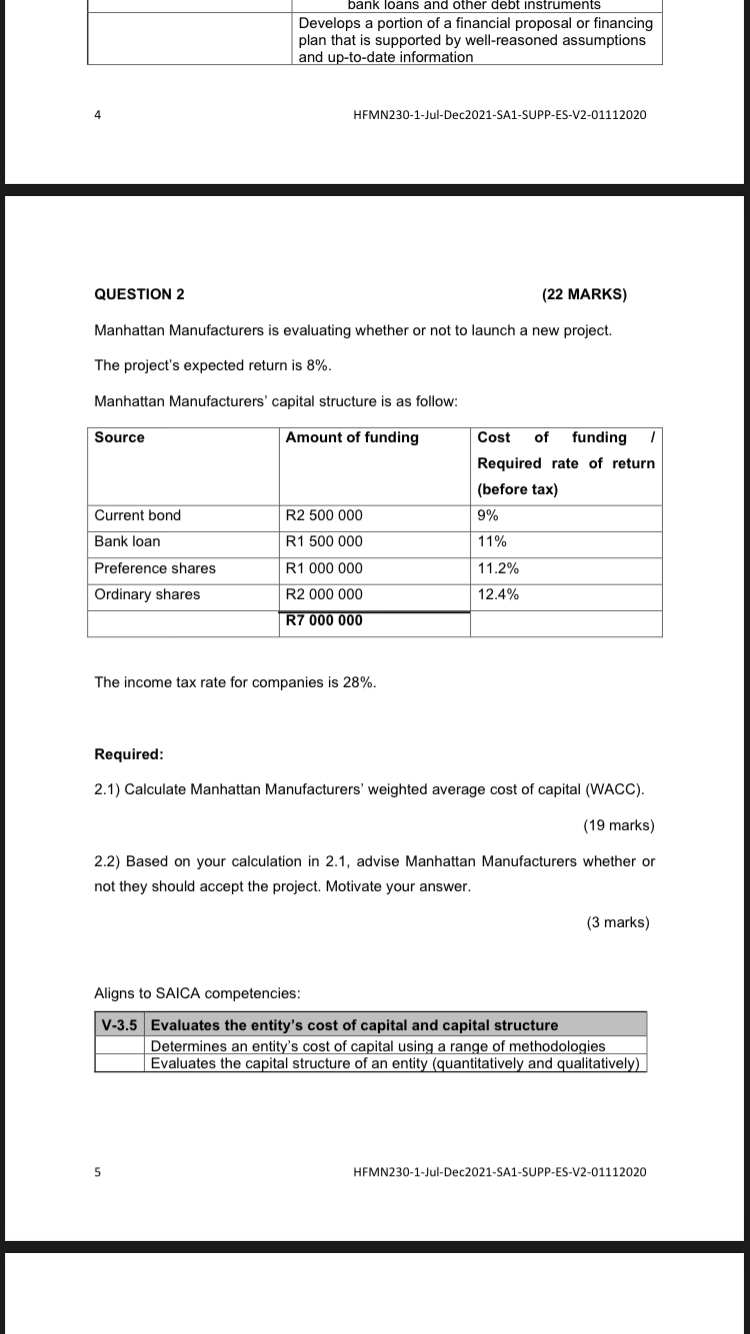

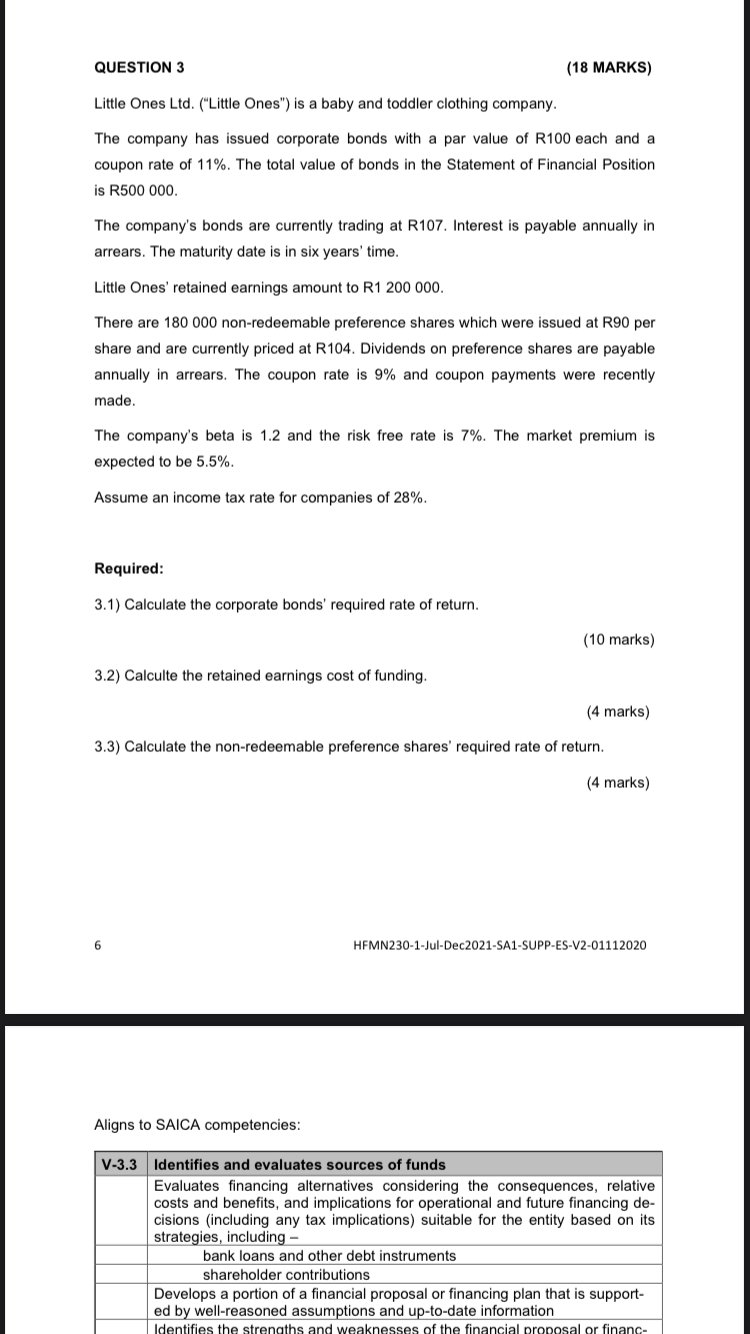

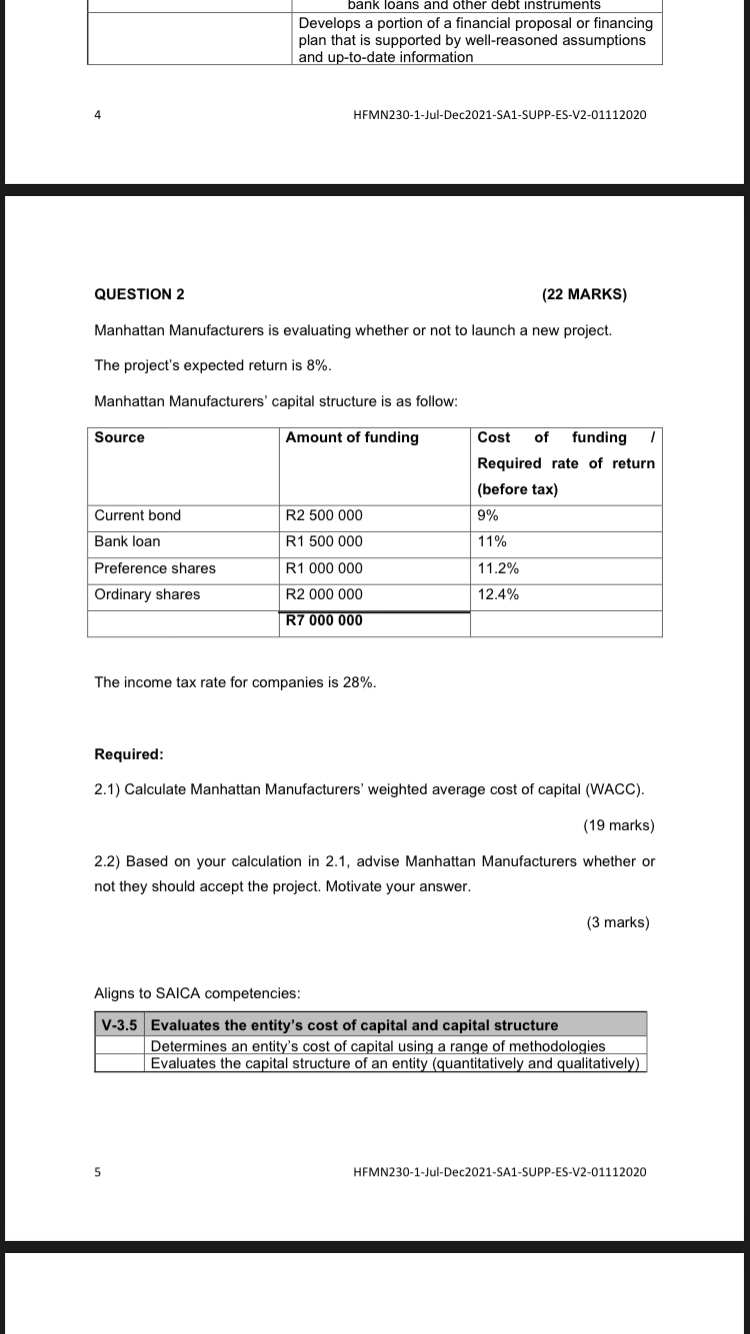

QUESTION 3 (18 MARKS) Little Ones Ltd. ("Little Ones") is a baby and toddler clothing company. The company has issued corporate bonds with a par value of R100 each and a coupon rate of 11%. The total value of bonds in the Statement of Financial Position is R500 000 The company's bonds are currently trading at R107. Interest is payable annually in arrears. The maturity date is in six years' time. Little Ones' retained earnings amount to R1 200 000. There are 180 000 non-redeemable preference shares which were issued at R90 per share and are currently priced at R104. Dividends on preference shares are payable annually in arrears. The coupon rate is 9% and coupon payments were recently made. The company's beta is 1.2 and the risk free rate is 7%. The market premium is expected to be 5.5%. Assume an income tax rate for companies of 28%. Required: 3.1) Calculate the corporate bonds' required rate of return. (10 marks) 3.2) Calculte the retained earnings cost of funding. (4 marks) 3.3) Calculate the non-redeemable preference shares' required rate of return. (4 marks) HEMN230-1-Jul-Dec2021-SA1-SUPP-ES-V2-01112020 Aligns to SAICA competencies: V-3.3 Identifies and evaluates sources of funds Evaluates financing alternatives considering the consequences, relative costs and benefits, and implications for operational and future financing de- cisions (including any tax implications) suitable for the entity based on its strategies, including - bank loans and other debt instruments shareholder contributions Develops a portion of a financial proposal or financing plan that is support- ed by well-reasoned assumptions and up-to-date information Identifies the strengths and weaknesses of the financial proposal or financ- bank loans and other debt instruments Develops a portion of a financial proposal or financing plan that is supported by well-reasoned assumptions and up-to-date information HEMN230-1-Jul-Dec2021-SA1-SUPP-ES-V2-01112020 QUESTION 2 (22 MARKS) Manhattan Manufacturers is evaluating whether or not to launch a new project. The project's expected return is 8%. Manhattan Manufacturers' capital structure is as follow: Source Amount of funding Cost of funding Required rate of return (before tax) 9% Current bond R2 500 000 Bank loan R1 500 000 11% R1 000 000 11.2% Preference shares Ordinary shares R2 000 000 12.4% R7 000 000 The income tax rate for companies is 28%. Required: 2.1) Calculate Manhattan Manufacturers' weighted average cost of capital (WACC). (19 marks) 2.2) Based on your calculation in 2.1, advise Manhattan Manufacturers whether or not they should accept the project. Motivate your answer. (3 marks) Aligns to SAICA competencies: V-3.5 Evaluates the entity's cost of capital and capital structure Determines an entity's cost of capital using a range of methodologies Evaluates the capital structure of an entity (quantitatively and qualitatively) 5 HEMN230-1-Jul-Dec2021-SA1-SUPP-ES-V2-01112020