Answered step by step

Verified Expert Solution

Question

1 Approved Answer

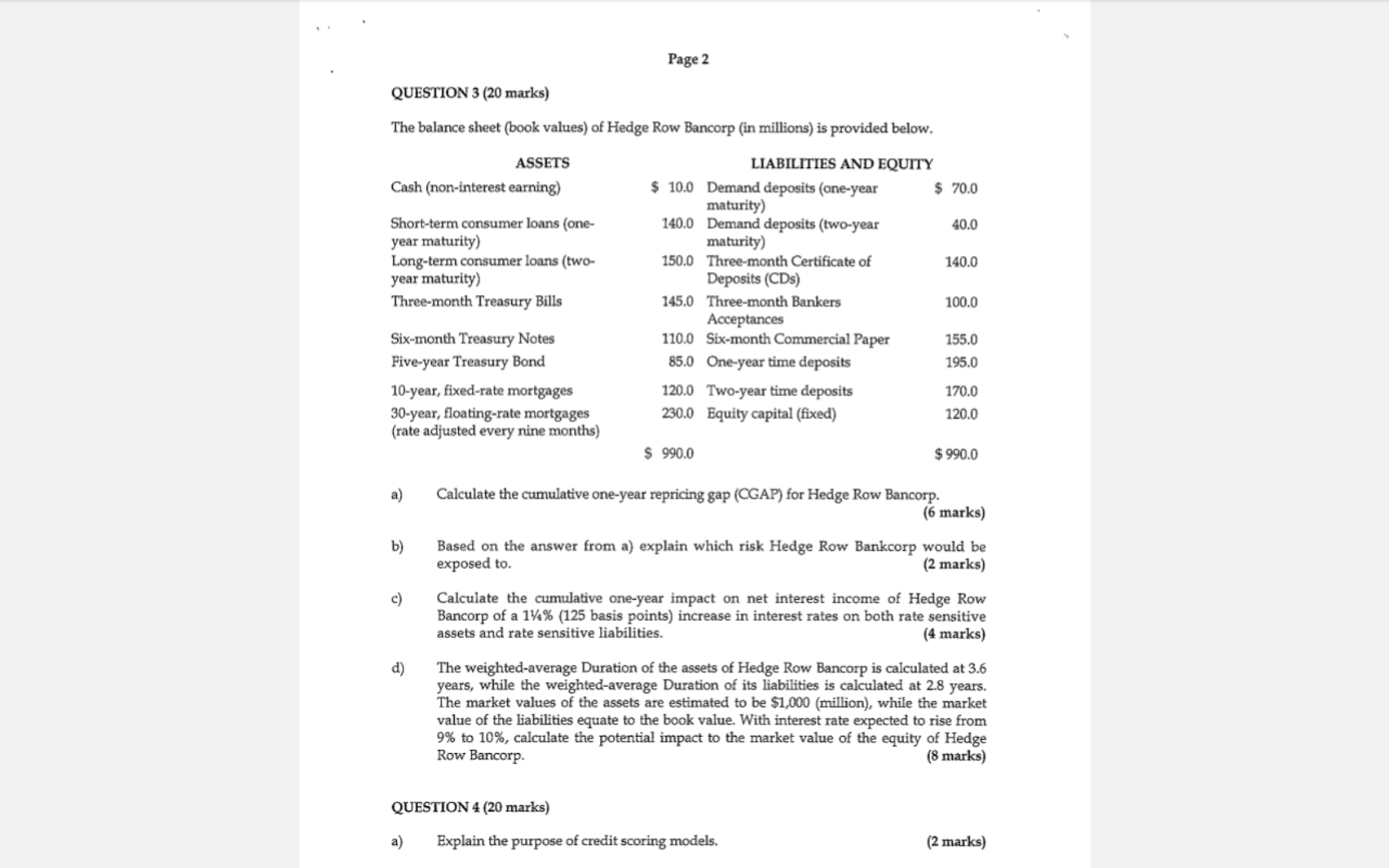

QUESTION 3 ( 2 0 marks ) The balance sheet ( book values ) of Hedge Row Bancorp ( in millions ) is provided below.

QUESTION marks

The balance sheet book values of Hedge Row Bancorp in millions is provided below.

a Calculate the cumulative oneyear repricing gap CGAP for Hedge Row Bancorp.

marks

b Based on the answer from a explain which risk Hedge Row Bankcorp would be

exposed to

c Calculate the cumulative oneyear impact on net interest income of Hedge Row

Bancorp of a basis points increase in interest rates on both rate sensitive

assets and rate sensitive liabilities.

marks

d The weightedaverage Duration of the assets of Hedge Row Bancorp is calculated at

years, while the weightedaverage Duration of its liabilities is calculated at years.

The market values of the assets are estimated to be $million while the market

value of the liabilities equate to the book value. With interest rate expected to rise from

to calculate the potential impact to the market value of the equity of Hedge

Row Bancorp.

marks

QUESTION marks

a Explain the purpose of credit scoring models.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started