Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 20 marks 3(a) Complete the information requested for each of the following GHC1000 face value, zero coupon bond assuming semi-annual compounding: 3(b) Take

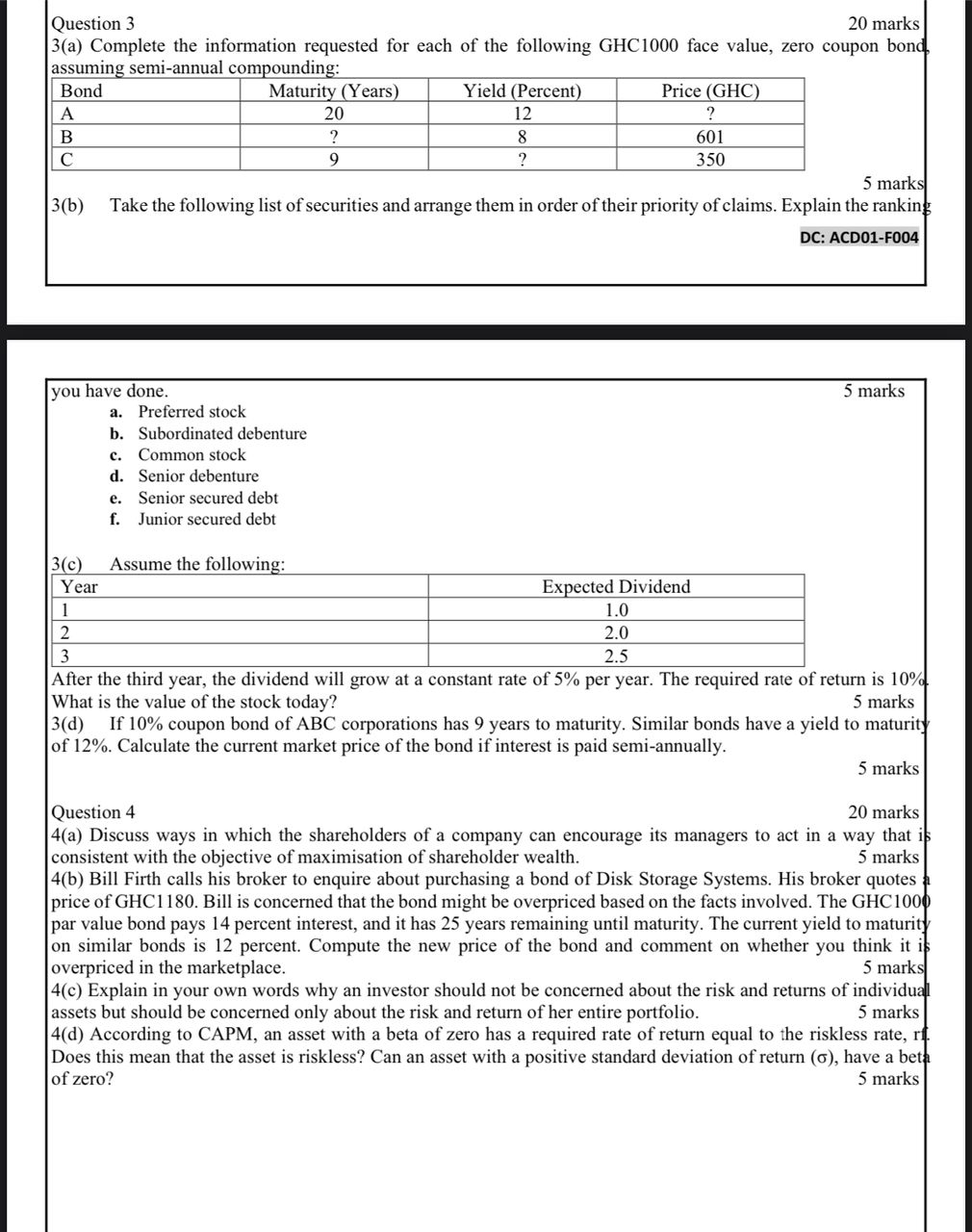

Question 3 20 marks 3(a) Complete the information requested for each of the following GHC1000 face value, zero coupon bond assuming semi-annual compounding: 3(b) Take the following list of securities and arrange them in order of their priority of claims. Explain the rankinz DC: ACD01-F004 you have done. 5 marks a. Preferred stock b. Subordinated debenture c. Common stock d. Senior debenture e. Senior secured debt f. Junior secured debt 2(n) ecume the followina. After the third year, the dividend will grow at a constant rate of 5% per year. The required rate of return is 10%. What is the value of the stock today? 5 marks 3(d) If 10% coupon bond of ABC corporations has 9 years to maturity. Similar bonds have a yield to maturity of 12%. Calculate the current market price of the bond if interest is paid semi-annually. Question 4 5 marks 4(a) Discuss ways in which the shareholders of a company can encourage its managers to act in a way that is consistent with the objective of maximisation of shareholder wealth. 5 marks 4(b) Bill Firth calls his broker to enquire about purchasing a bond of Disk Storage Systems. His broker quotes price of GHC1180. Bill is concerned that the bond might be overpriced based on the facts involved. The GHC100 par value bond pays 14 percent interest, and it has 25 years remaining until maturity. The current yield to maturity on similar bonds is 12 percent. Compute the new price of the bond and comment on whether you think it i; overpriced in the marketplace. 5 marks 4(c) Explain in your own words why an investor should not be concerned about the risk and returns of individual assets but should be concerned only about the risk and return of her entire portfolio. 5 marks 4(d) According to CAPM, an asset with a beta of zero has a required rate of return equal to the riskless rate, r. Does this mean that the asset is riskless? Can an asset with a positive standard deviation of return (), have a bet of zero? 5 marks

Question 3 20 marks 3(a) Complete the information requested for each of the following GHC1000 face value, zero coupon bond assuming semi-annual compounding: 3(b) Take the following list of securities and arrange them in order of their priority of claims. Explain the rankinz DC: ACD01-F004 you have done. 5 marks a. Preferred stock b. Subordinated debenture c. Common stock d. Senior debenture e. Senior secured debt f. Junior secured debt 2(n) ecume the followina. After the third year, the dividend will grow at a constant rate of 5% per year. The required rate of return is 10%. What is the value of the stock today? 5 marks 3(d) If 10% coupon bond of ABC corporations has 9 years to maturity. Similar bonds have a yield to maturity of 12%. Calculate the current market price of the bond if interest is paid semi-annually. Question 4 5 marks 4(a) Discuss ways in which the shareholders of a company can encourage its managers to act in a way that is consistent with the objective of maximisation of shareholder wealth. 5 marks 4(b) Bill Firth calls his broker to enquire about purchasing a bond of Disk Storage Systems. His broker quotes price of GHC1180. Bill is concerned that the bond might be overpriced based on the facts involved. The GHC100 par value bond pays 14 percent interest, and it has 25 years remaining until maturity. The current yield to maturity on similar bonds is 12 percent. Compute the new price of the bond and comment on whether you think it i; overpriced in the marketplace. 5 marks 4(c) Explain in your own words why an investor should not be concerned about the risk and returns of individual assets but should be concerned only about the risk and return of her entire portfolio. 5 marks 4(d) According to CAPM, an asset with a beta of zero has a required rate of return equal to the riskless rate, r. Does this mean that the asset is riskless? Can an asset with a positive standard deviation of return (), have a bet of zero? 5 marks Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started