Answered step by step

Verified Expert Solution

Question

1 Approved Answer

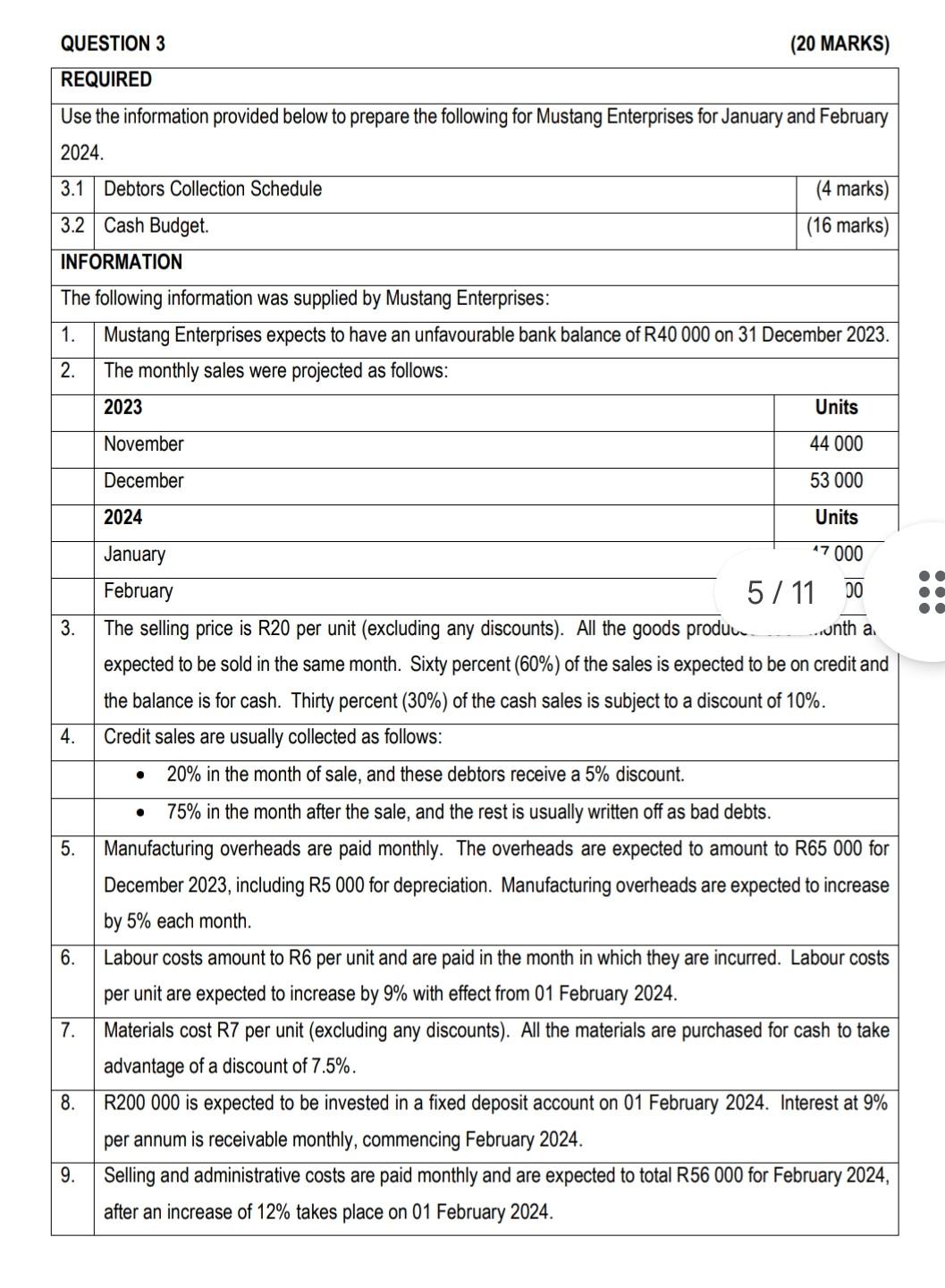

QUESTION 3 (20 MARKS) begin{tabular}{|c|c|c|} hline multicolumn{3}{|c|}{ REQUIRED } hline multirow{2}{*}{multicolumn{3}{|c|}{begin{tabular}{l} Use the information provided below to prepare the following for Mustang Enterprises for

QUESTION 3 (20 MARKS) \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ REQUIRED } \\ \hline \multirow{2}{*}{\multicolumn{3}{|c|}{\begin{tabular}{l} Use the information provided below to prepare the following for Mustang Enterprises for January and February \\ 2024 . \end{tabular}}} \\ \hline & & \\ \hline 3.1 & Debtors Collection Schedule & (4 marks) \\ \hline 3.2 & Cash Budget. & (16 marks) \\ \hline \multicolumn{3}{|c|}{ INFORMATION } \\ \hline \multicolumn{3}{|c|}{ The following information was supplied by Mustang Enterprises: } \\ \hline 1. & \multicolumn{2}{|c|}{ Mustang Enterprises expects to have an unfavourable bank balance of R40 000 on 31 December 2023.} \\ \hline \multirow[t]{7}{*}{2.} & \multicolumn{2}{|c|}{ The monthly sales were projected as follows: } \\ \hline & 2023 & Units \\ \hline & November & 44000 \\ \hline & December & 53000 \\ \hline & 2024 & Units \\ \hline & January & 17000 \\ \hline & February & 1100 \\ \hline 3. & \multicolumn{2}{|c|}{\begin{tabular}{l} The selling price is R20 per unit (excluding any discounts). All the goods produc. \\ expected to be sold in the same month. Sixty percent (60%) of the sales is expected to be on credit and \\ the balance is for cash. Thirty percent (30%) of the cash sales is subject to a discount of 10%. \end{tabular}} \\ \hline \multirow[t]{3}{*}{4.} & \multicolumn{2}{|c|}{ Credit sales are usually collected as follows: } \\ \hline & \multicolumn{2}{|c|}{ - 20% in the month of sale, and these debtors receive a 5% discount. } \\ \hline & \multicolumn{2}{|c|}{ - 75% in the month after the sale, and the rest is usually written off as bad debts. } \\ \hline 5. & \multicolumn{2}{|c|}{\begin{tabular}{l} Manufacturing overheads are paid monthly. The overheads are expected to amount to R65 000 for \\ December 2023 , including R5 000 for depreciation. Manufacturing overheads are expected to increase \\ by 5% each month. \end{tabular}} \\ \hline \begin{tabular}{|l} 6. \\ \end{tabular} & \multicolumn{2}{|c|}{\begin{tabular}{l} Labour costs amount to R6 per unit and are paid in the month in which they are incurred. Labour costs \\ per unit are expected to increase by 9% with effect from 01 February 2024 . \end{tabular}} \\ \hline \begin{tabular}{l} 7. \\ \end{tabular} & \multicolumn{2}{|c|}{\begin{tabular}{l} Materials cost R7 per unit (excluding any discounts). All the materials are purchased for cash to take \\ advantage of a discount of 7.5%. \end{tabular}} \\ \hline 8. & \multicolumn{2}{|c|}{\begin{tabular}{l} R200 000 is expected to be invested in a fixed deposit account on 01 February 2024. Interest at 9\% \\ per annum is receivable monthly, commencing February 2024 . \end{tabular}} \\ \hline 9. & \multicolumn{2}{|c|}{\begin{tabular}{l} Selling and administrative costs are paid monthly and are expected to total R56 000 for February 2024, \\ after an increase of 12% takes place on 01 February 2024 . \end{tabular}} \\ \hline \end{tabular} QUESTION 3 (20 MARKS) \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ REQUIRED } \\ \hline \multirow{2}{*}{\multicolumn{3}{|c|}{\begin{tabular}{l} Use the information provided below to prepare the following for Mustang Enterprises for January and February \\ 2024 . \end{tabular}}} \\ \hline & & \\ \hline 3.1 & Debtors Collection Schedule & (4 marks) \\ \hline 3.2 & Cash Budget. & (16 marks) \\ \hline \multicolumn{3}{|c|}{ INFORMATION } \\ \hline \multicolumn{3}{|c|}{ The following information was supplied by Mustang Enterprises: } \\ \hline 1. & \multicolumn{2}{|c|}{ Mustang Enterprises expects to have an unfavourable bank balance of R40 000 on 31 December 2023.} \\ \hline \multirow[t]{7}{*}{2.} & \multicolumn{2}{|c|}{ The monthly sales were projected as follows: } \\ \hline & 2023 & Units \\ \hline & November & 44000 \\ \hline & December & 53000 \\ \hline & 2024 & Units \\ \hline & January & 17000 \\ \hline & February & 1100 \\ \hline 3. & \multicolumn{2}{|c|}{\begin{tabular}{l} The selling price is R20 per unit (excluding any discounts). All the goods produc. \\ expected to be sold in the same month. Sixty percent (60%) of the sales is expected to be on credit and \\ the balance is for cash. Thirty percent (30%) of the cash sales is subject to a discount of 10%. \end{tabular}} \\ \hline \multirow[t]{3}{*}{4.} & \multicolumn{2}{|c|}{ Credit sales are usually collected as follows: } \\ \hline & \multicolumn{2}{|c|}{ - 20% in the month of sale, and these debtors receive a 5% discount. } \\ \hline & \multicolumn{2}{|c|}{ - 75% in the month after the sale, and the rest is usually written off as bad debts. } \\ \hline 5. & \multicolumn{2}{|c|}{\begin{tabular}{l} Manufacturing overheads are paid monthly. The overheads are expected to amount to R65 000 for \\ December 2023 , including R5 000 for depreciation. Manufacturing overheads are expected to increase \\ by 5% each month. \end{tabular}} \\ \hline \begin{tabular}{|l} 6. \\ \end{tabular} & \multicolumn{2}{|c|}{\begin{tabular}{l} Labour costs amount to R6 per unit and are paid in the month in which they are incurred. Labour costs \\ per unit are expected to increase by 9% with effect from 01 February 2024 . \end{tabular}} \\ \hline \begin{tabular}{l} 7. \\ \end{tabular} & \multicolumn{2}{|c|}{\begin{tabular}{l} Materials cost R7 per unit (excluding any discounts). All the materials are purchased for cash to take \\ advantage of a discount of 7.5%. \end{tabular}} \\ \hline 8. & \multicolumn{2}{|c|}{\begin{tabular}{l} R200 000 is expected to be invested in a fixed deposit account on 01 February 2024. Interest at 9\% \\ per annum is receivable monthly, commencing February 2024 . \end{tabular}} \\ \hline 9. & \multicolumn{2}{|c|}{\begin{tabular}{l} Selling and administrative costs are paid monthly and are expected to total R56 000 for February 2024, \\ after an increase of 12% takes place on 01 February 2024 . \end{tabular}} \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started