Answered step by step

Verified Expert Solution

Question

1 Approved Answer

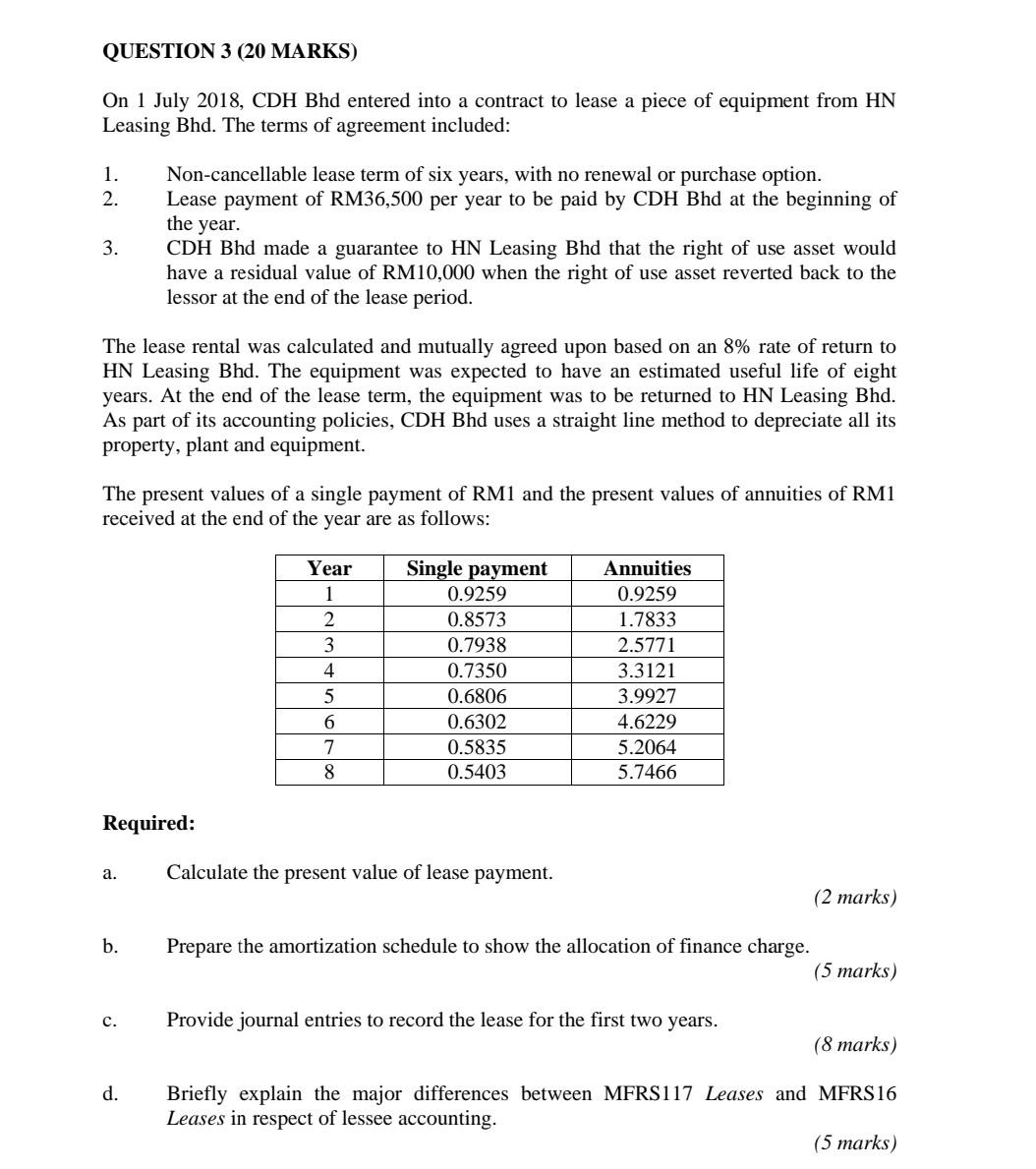

QUESTION 3 (20 MARKS) On 1 July 2018, CDH Bhd entered into a contract to lease a piece of equipment from HN Leasing Bhd. The

QUESTION 3 (20 MARKS) On 1 July 2018, CDH Bhd entered into a contract to lease a piece of equipment from HN Leasing Bhd. The terms of agreement included: 1. 2. Non-cancellable lease term of six years, with no renewal or purchase option. Lease payment of RM36,500 per year to be paid by CDH Bhd at the beginning of the year. 3. CDH Bhd made a guarantee to HN Leasing Bhd that the right of use asset would have a residual value of RM10,000 when the right of use asset reverted back to the lessor at the end of the lease period. The lease rental was calculated and mutually agreed upon based on an 8% rate of return to HN Leasing Bhd. The equipment was expected to have an estimated useful life of eight years. At the end of the lease term, the equipment was to be returned to HN Leasing Bhd. As part of its accounting policies, CDH Bhd uses a straight line method to depreciate all its property, plant and equipment. The present values of a single payment of RM1 and the present values of annuities of RM1 received at the end of the year are as follows: Year 1 2 3 4 5 Il + Single payment 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 Annuities 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 inlonlod 6 7 8 Required: a. Calculate the present value of lease payment. (2 marks) b. Prepare the amortization schedule to show the allocation of finance charge. (5 marks) c. Provide journal entries to record the lease for the first two years. (8 marks) d. Briefly explain the major differences between MFRS117 Leases and MFRS16 Leases in respect of lessee accounting. (5 marks) QUESTION 3 (20 MARKS) On 1 July 2018, CDH Bhd entered into a contract to lease a piece of equipment from HN Leasing Bhd. The terms of agreement included: 1. 2. Non-cancellable lease term of six years, with no renewal or purchase option. Lease payment of RM36,500 per year to be paid by CDH Bhd at the beginning of the year. 3. CDH Bhd made a guarantee to HN Leasing Bhd that the right of use asset would have a residual value of RM10,000 when the right of use asset reverted back to the lessor at the end of the lease period. The lease rental was calculated and mutually agreed upon based on an 8% rate of return to HN Leasing Bhd. The equipment was expected to have an estimated useful life of eight years. At the end of the lease term, the equipment was to be returned to HN Leasing Bhd. As part of its accounting policies, CDH Bhd uses a straight line method to depreciate all its property, plant and equipment. The present values of a single payment of RM1 and the present values of annuities of RM1 received at the end of the year are as follows: Year 1 2 3 4 5 Il + Single payment 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 Annuities 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 inlonlod 6 7 8 Required: a. Calculate the present value of lease payment. (2 marks) b. Prepare the amortization schedule to show the allocation of finance charge. (5 marks) c. Provide journal entries to record the lease for the first two years. (8 marks) d. Briefly explain the major differences between MFRS117 Leases and MFRS16 Leases in respect of lessee accounting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started