Answered step by step

Verified Expert Solution

Question

1 Approved Answer

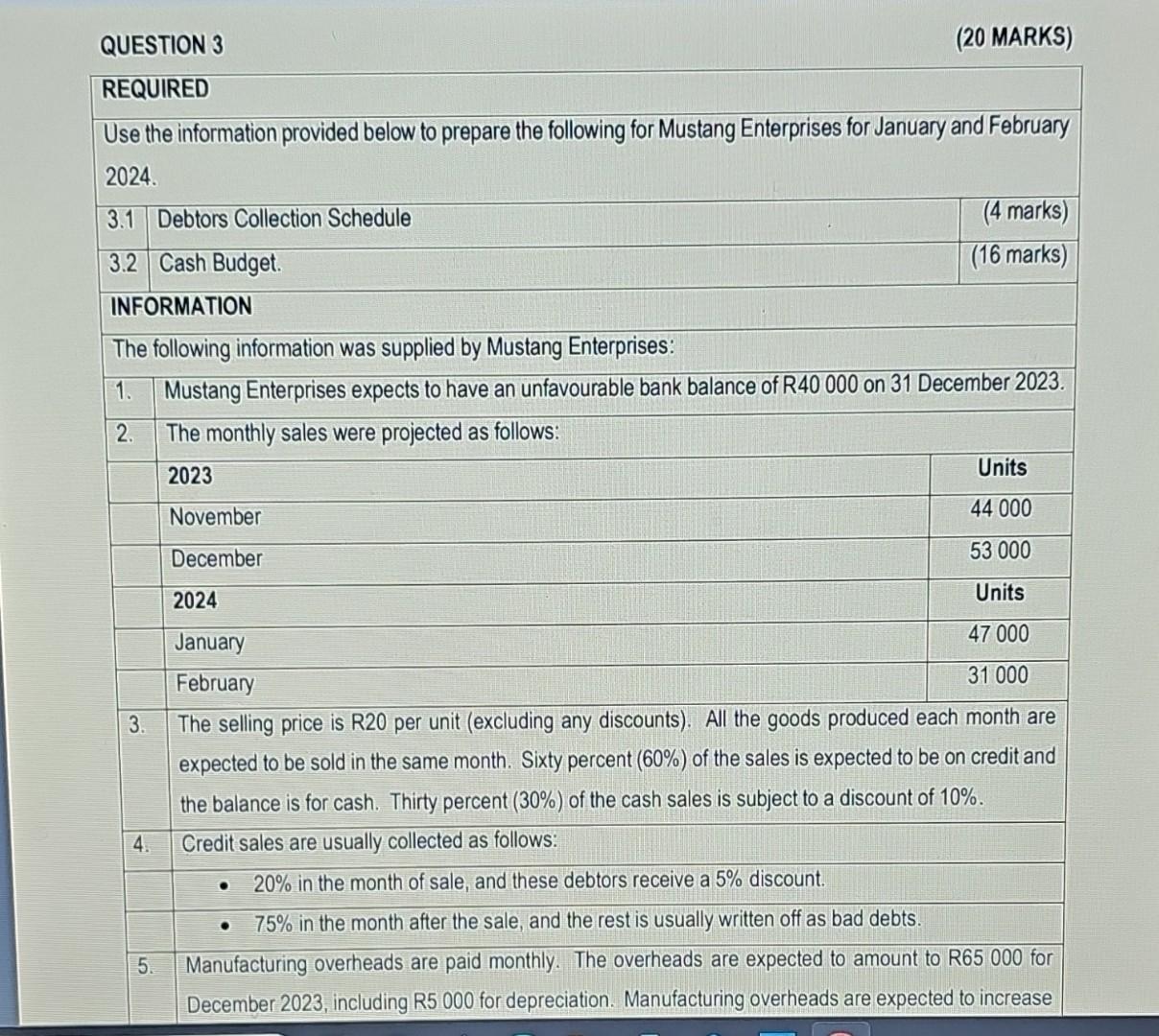

QUESTION 3 (20 MARKS) REQUIRED Use the information provided below to prepare the following for Mustang Enterprises for January and February 2024. begin{tabular}{|l|l|r|} hline 3.1

QUESTION 3 (20 MARKS) REQUIRED Use the information provided below to prepare the following for Mustang Enterprises for January and February 2024. \begin{tabular}{|l|l|r|} \hline 3.1 & Debtors Collection Schedule & (4 marks) \\ \hline 3.2 & Cash Budget. & (16 marks) \\ \hline INFORMATION & \\ \hline \end{tabular} The following information was supplied by Mustang Enterprises: 1. Mustang Enterprises expects to have an unfavourable bank balance of R40000 on 31 December 2023. 2. The monthly sales were projected as follows: \begin{tabular}{|l|c|} \hline 2023 & Units \\ \hline November & 44000 \\ \hline December & 53000 \\ \hline 2024 & Units \\ \hline January & 47000 \\ \hline February & 31000 \\ \hline \end{tabular} 3. The selling price is R20 per unit (excluding any discounts). All the goods produced each month are expected to be sold in the same month. Sixty percent (60%) of the sales is expected to be on credit and the balance is for cash. Thirty percent (30%) of the cash sales is subject to a discount of 10%. 4. Credit sales are usually collected as follows: - 20% in the month of sale, and these debtors receive a 5% discount. - 75% in the month after the sale, and the rest is usually written off as bad debts. 5. Manufacturing overheads are paid monthly. The overheads are expected to amount to R65 000 for December 2023 , including R5 000 for depreciation. Manufacturing overheads are expected to increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started