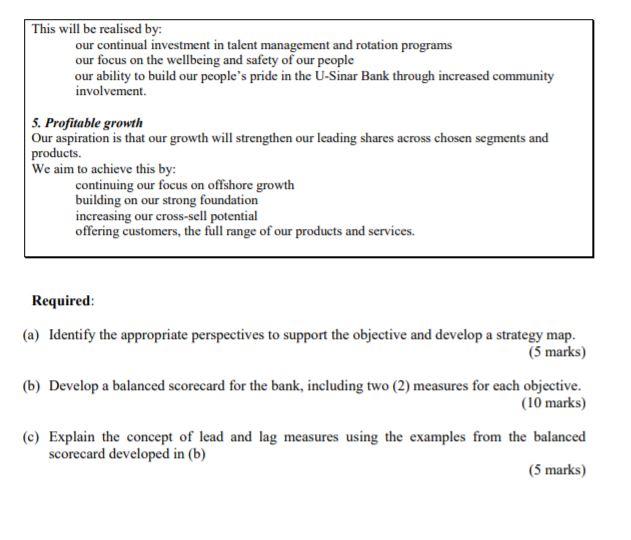

QUESTION 3 (20 MARKS) U-Sinar Bank is one of the leading financial services organisation in Malaysia. The organisation places a high value on their customer as a means to remain sustainable in the industry. Below are the corporate charter and strategic priorities on U-Sinar Bank. Strategy Our vision The U-Sinar Bank's vision is to be Malaysia's finest financial services organisation through excelling in customer service. We aspire to: provide a service experience our customers appreciate have people that are engaged, passionate and valued deliver top quartile returns to our shareholders be respected and admired in our community. Ultimately, we want to be known as a great company to bank with, work in and invest in. Our strategy We recognise there are significant opportunities within our businesses to create even more value for our customers, our people and our shareholders. Our strategy focuses on five priority areas and emphasises the importance of getting the basics right- first time, every time. 1. Customer service Improving customer service is our highest priority. We want our customers to experience our people as knowledgeable, proactive, friendly and able to meet their needs. This will be achieved by: ensuring a wide focus on sales and service disciplines improving customer engagement ensuring the U-Sinar Bank is easy to do business with providing value-for-money products and services. 2. Business banking We want to be regarded as the business banking partner of choice. To enhance our position in the market, we are: simplifying policies and procedures investing in technology solutions expanding our business banking footprint by extending business banking services and refining the sales model to ensure it meets evolving customer needs. 3. Technology and operational excellence We need to make the best use of our technology resources so our people and customers are supported by best practice technologies and processes, now and in the future. To ensure we do this, we are: leveraging technology capabilities and expertise to revitalise systems and processes implementing smarter sourcing continuing to develop lean and efficient processes employing a Group-wide approach to IT. 4. Trust and team spirit Trust and team spirit focuses on achieving a culture of teamwork and collaboration where our people feel engaged, passionate and valued. This will be realised by: our continual investment in talent management and rotation programs our focus on the wellbeing and safety of our people our ability to build our people's pride in the U-Sinar Bank through increased community involvement. 5. Profitable growth Our aspiration is that our growth will strengthen our leading shares across chosen segments and products. We aim to achieve this by: continuing our focus on offshore growth building on our strong foundation increasing our cross-sell potential offering customers, the full range of our products and services. Required: (a) Identify the appropriate perspectives to support the objective and develop a strategy map. (5 marks) (b) Develop a balanced Scorecard for the bank, including two (2) measures for each objective. (10 marks) (c) Explain the concept of lead and lag measures using the examples from the balanced scorecard developed in (b) (5 marks) QUESTION 3 (20 MARKS) U-Sinar Bank is one of the leading financial services organisation in Malaysia. The organisation places a high value on their customer as a means to remain sustainable in the industry. Below are the corporate charter and strategic priorities on U-Sinar Bank. Strategy Our vision The U-Sinar Bank's vision is to be Malaysia's finest financial services organisation through excelling in customer service. We aspire to: provide a service experience our customers appreciate have people that are engaged, passionate and valued deliver top quartile returns to our shareholders be respected and admired in our community. Ultimately, we want to be known as a great company to bank with, work in and invest in. Our strategy We recognise there are significant opportunities within our businesses to create even more value for our customers, our people and our shareholders. Our strategy focuses on five priority areas and emphasises the importance of getting the basics right- first time, every time. 1. Customer service Improving customer service is our highest priority. We want our customers to experience our people as knowledgeable, proactive, friendly and able to meet their needs. This will be achieved by: ensuring a wide focus on sales and service disciplines improving customer engagement ensuring the U-Sinar Bank is easy to do business with providing value-for-money products and services. 2. Business banking We want to be regarded as the business banking partner of choice. To enhance our position in the market, we are: simplifying policies and procedures investing in technology solutions expanding our business banking footprint by extending business banking services and refining the sales model to ensure it meets evolving customer needs. 3. Technology and operational excellence We need to make the best use of our technology resources so our people and customers are supported by best practice technologies and processes, now and in the future. To ensure we do this, we are: leveraging technology capabilities and expertise to revitalise systems and processes implementing smarter sourcing continuing to develop lean and efficient processes employing a Group-wide approach to IT. 4. Trust and team spirit Trust and team spirit focuses on achieving a culture of teamwork and collaboration where our people feel engaged, passionate and valued. This will be realised by: our continual investment in talent management and rotation programs our focus on the wellbeing and safety of our people our ability to build our people's pride in the U-Sinar Bank through increased community involvement. 5. Profitable growth Our aspiration is that our growth will strengthen our leading shares across chosen segments and products. We aim to achieve this by: continuing our focus on offshore growth building on our strong foundation increasing our cross-sell potential offering customers, the full range of our products and services. Required: (a) Identify the appropriate perspectives to support the objective and develop a strategy map. (5 marks) (b) Develop a balanced Scorecard for the bank, including two (2) measures for each objective. (10 marks) (c) Explain the concept of lead and lag measures using the examples from the balanced scorecard developed in (b)