Answered step by step

Verified Expert Solution

Question

1 Approved Answer

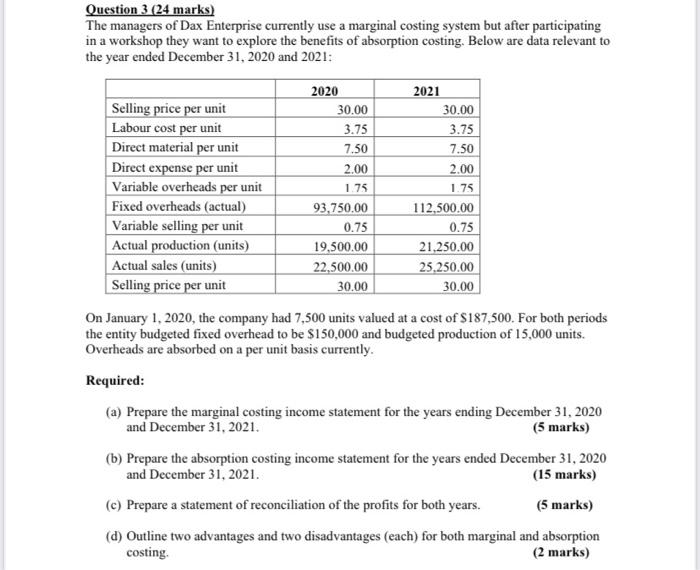

Question 3 (24 marks) The managers of Dax Enterprise currently use a marginal costing system but after participating in a workshop they want to

Question 3 (24 marks) The managers of Dax Enterprise currently use a marginal costing system but after participating in a workshop they want to explore the benefits of absorption costing. Below are data relevant to the year ended December 31, 2020 and 2021: 2020 2021 Selling price per unit Labour cost per unit Direct material per unit Direct expense per unit Variable overheads per unit Fixed overheads (actual) Variable selling per unit Actual production (units) Actual sales (units) Selling price per unit 30.00 3.75 30.00 3.75 7.50 7.50 2.00 2.00 1.75 1.75 93,750.00 0.75 19.500.00 112,500.00 0.75 21,250.00 22,500.00 30.00 25.250.00 30.00 On January 1, 2020, the company had 7,500 units valued at a cost of $187,500. For both periods the entity budgeted fixed overhead to be S150,000 and budgeted production of 15,000 units. Overheads are absorbed on a per unit basis currently. Required: (a) Prepare the marginal costing income statement for the years ending December 31, 2020 and December 31, 2021. (5 marks) (b) Prepare the absorption costing income statement for the years ended December 31, 2020 and December 31, 2021. (15 marks) (c) Prepare a statement of reconciliation of the profits for both years. (5 marks) (d) Outline two advantages and two disadvantages (each) for both marginal and absorption costing. (2 marks)

Step by Step Solution

★★★★★

3.57 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Working notes Product cost Marginal costing 2020 2021 Direct materials 750 750 Direct labor Direct e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started