Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 [25 MARKS] (a) Fair Trade Ltd, operating in the Pharmaceutical Industry, is preparing its accounts for the year ended 31 October 2020 and

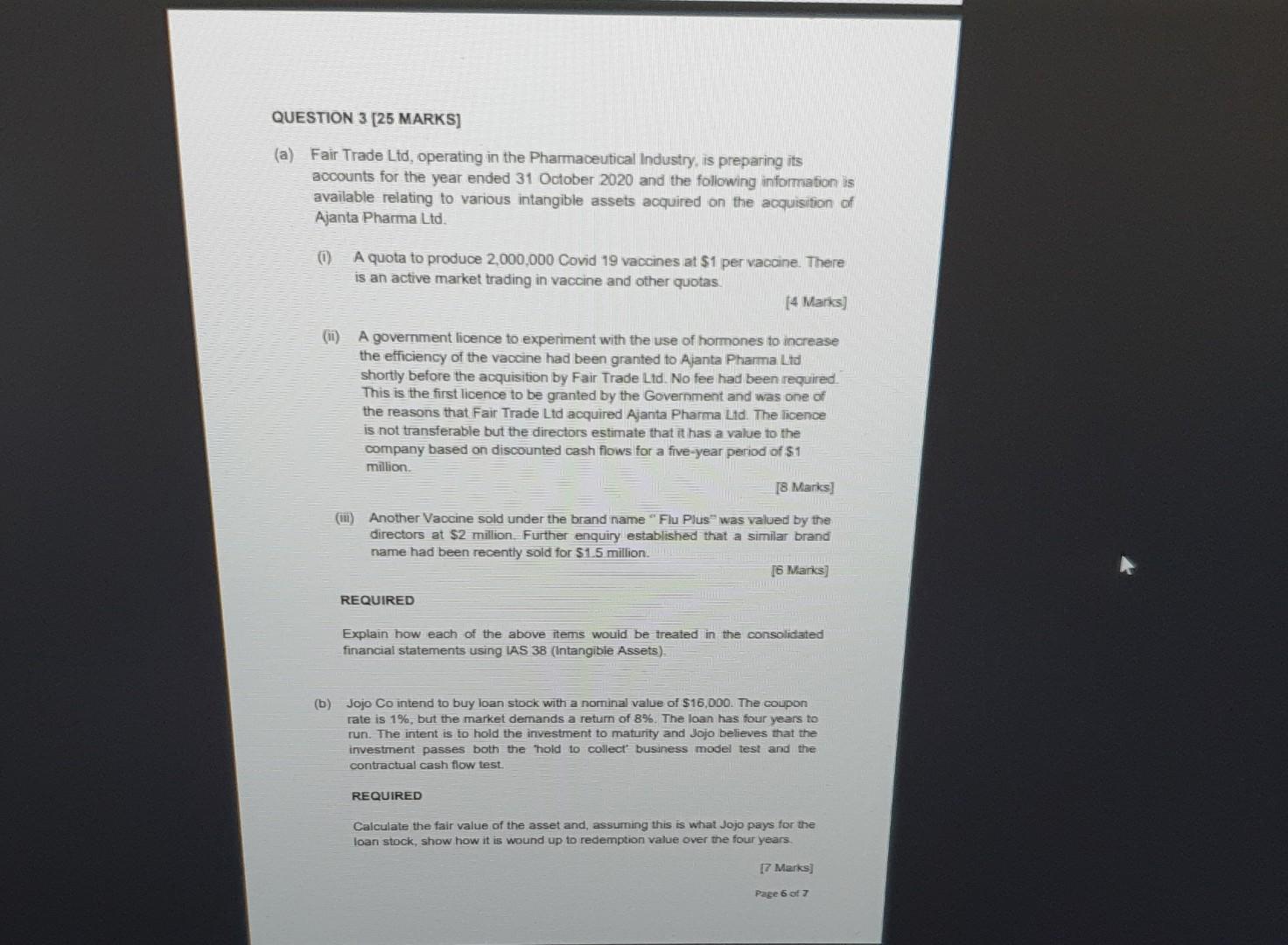

QUESTION 3 [25 MARKS] (a) Fair Trade Ltd, operating in the Pharmaceutical Industry, is preparing its accounts for the year ended 31 October 2020 and the following information is available relating to various intangible assets acquired on the acquisition of Ajanta Pharma Ltd. (i) A quota to produce 2,000,000 Covid 19 vaccines at $1 per vacaine. There is an active market trading in vaccine and other quotas. [4 Marks] (ii) A government licence to experiment with the use of hormones to increase the efficiency of the vaccine had been granted to Ajanta Pharma Ltd shortly before the acquisition by Fair Trade Lid. No fee had been required. This is the first licence to be granted by the Government and was one of the reasons that Fair Trade Ltd acquired Ajanta Pharma Ltd. The licence is not transferable but the directors estimate that it has a value to the company based on discounted cash flows for a five-year period of $1 million. [8 Marks] (iii) Another Vaccine sold under the brand name "Flu Plus" was valued by the directors at $2 million. Further enquiry established that a similar brand name had been recently sold for $1.5 million. [6 Marks] REQUIRED Explain how each of the above items would be treated in the consolidated financial statements using IAS 38 (Intangible Assets) (b) Jojo Co intend to buy loan stock with a nominal value of $16,000. The coupon rate is 1%, but the market dernands a return of 8%. The laan has four years to run. The intent is to hold the investment to maturity and Jojo believes that the investment passes both the hold to collect' business model test and the contractual cash flow test. REQUIRED Calculate the fair value of the asset and, assuming this is what Jojo pays for the loan stock, show how it is wound up to redemption value over the four years. [7 Marks] Page 6 of 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started