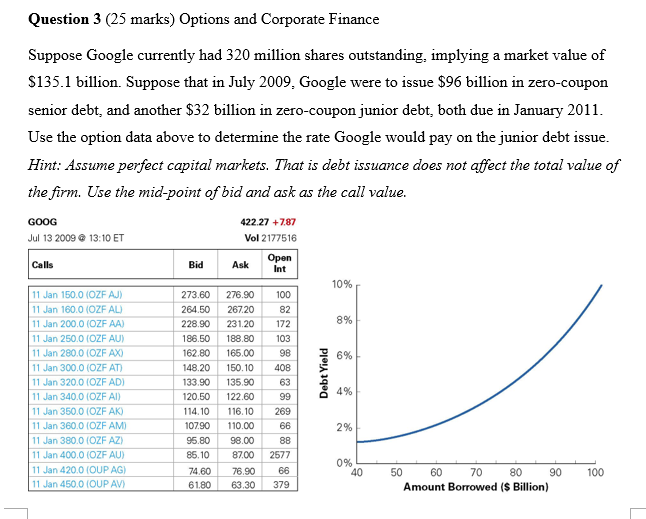

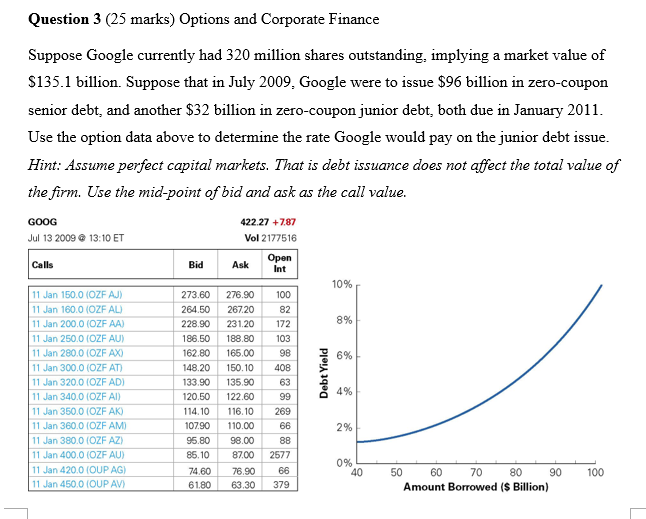

Question 3 (25 marks) Options and Corporate Finance Suppose Google currently had 320 million shares outstanding, implying a market value of $135.1 billion. Suppose that in July 2009, Google were to issue $96 billion in zero-coupon senior debt, and another $32 billion in zero-coupon junior debt, both due in January 2011 Use the option data above to determine the rate Google would pay on the junior debt issue Hint: Assume perfect capital markets. That is debt issuance does not affect the total value of the firm. Use the mid-point of bid and ask as the call value. GOOG 422.27 +7.87 Jul 13 200913:10 ET Vol 2177516 Ask Open Int Calls Bid 10% 11 Jan 150.0 (OZF AJ) 273.60 276.90 100 11 Jan 160.0 (OZF AL 264.50 267.20 82 8% 1 Jan 200.0 (OZF AA) 228.90 231.20 172 11 Jan 250.0 (OZF AU) 186.50 188.80 103 98| 11 Jan 280.0 (OZF AX) 162.80 165.00 6% 11 Jan 300.0 (OZF AT 148.20 150.10 408 11 Jan 320.0 (OZF AD) 133.90 135.90 4% 11 Jan 340.0 (OZF AI 120.50 122.60 11 Jan 350.0 (OZF AK) 114.10 116.10 269 11 Jan 360.0 (OZF AM 10790 110.00 11 Jan 380.0 (OZF AZ) 95.80 98.00 11 Jan 400.0 (OZF AU 85.10 87002577 0% 0 50 60 11 Jan 420.0 (OUP AG 74.60 76.066 70 80 90 100 11 Jan 450.0 (OUP AV 61.80 63.30 379 Amount Borrowed ($ Billion) Question 3 (25 marks) Options and Corporate Finance Suppose Google currently had 320 million shares outstanding, implying a market value of $135.1 billion. Suppose that in July 2009, Google were to issue $96 billion in zero-coupon senior debt, and another $32 billion in zero-coupon junior debt, both due in January 2011 Use the option data above to determine the rate Google would pay on the junior debt issue Hint: Assume perfect capital markets. That is debt issuance does not affect the total value of the firm. Use the mid-point of bid and ask as the call value. GOOG 422.27 +7.87 Jul 13 200913:10 ET Vol 2177516 Ask Open Int Calls Bid 10% 11 Jan 150.0 (OZF AJ) 273.60 276.90 100 11 Jan 160.0 (OZF AL 264.50 267.20 82 8% 1 Jan 200.0 (OZF AA) 228.90 231.20 172 11 Jan 250.0 (OZF AU) 186.50 188.80 103 98| 11 Jan 280.0 (OZF AX) 162.80 165.00 6% 11 Jan 300.0 (OZF AT 148.20 150.10 408 11 Jan 320.0 (OZF AD) 133.90 135.90 4% 11 Jan 340.0 (OZF AI 120.50 122.60 11 Jan 350.0 (OZF AK) 114.10 116.10 269 11 Jan 360.0 (OZF AM 10790 110.00 11 Jan 380.0 (OZF AZ) 95.80 98.00 11 Jan 400.0 (OZF AU 85.10 87002577 0% 0 50 60 11 Jan 420.0 (OUP AG 74.60 76.066 70 80 90 100 11 Jan 450.0 (OUP AV 61.80 63.30 379 Amount Borrowed ($ Billion)