Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 (25 marks) You are the external auditor of Life & Style Ltd, a company running a group of nurseries and home accessories

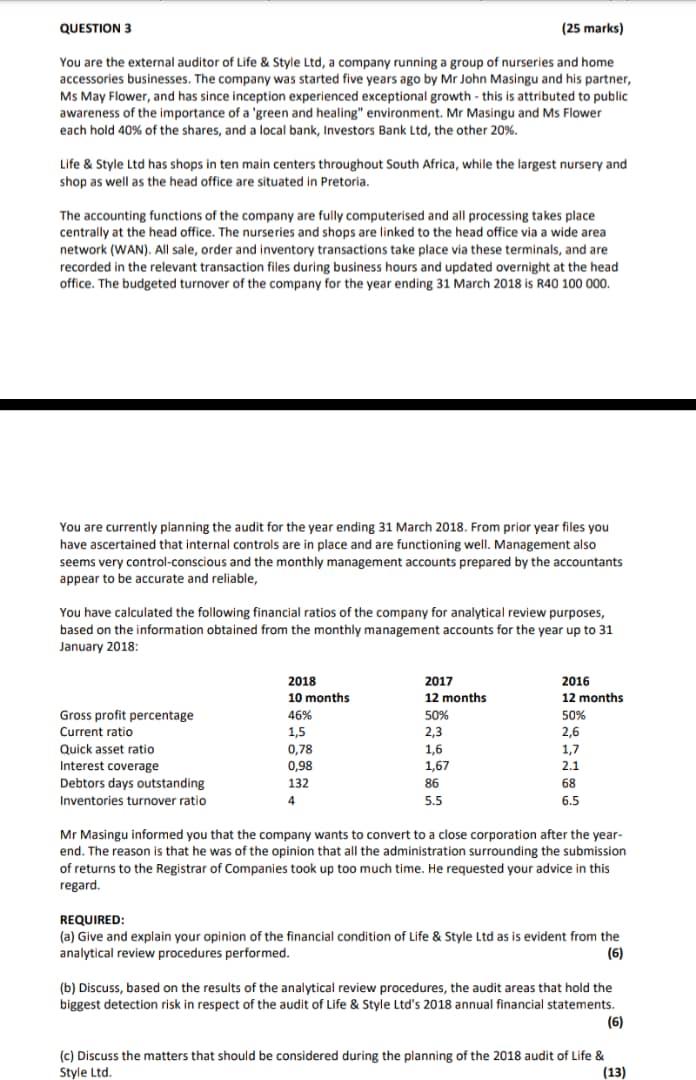

QUESTION 3 (25 marks) You are the external auditor of Life & Style Ltd, a company running a group of nurseries and home accessories businesses. The company was started five years ago by Mr John Masingu and his partner, Ms May Flower, and has since inception experienced exceptional growth - this is attributed to public awareness of the importance of a 'green and healing" environment. Mr Masingu and Ms Flower each hold 40% of the shares, and a local bank, Investors Bank Ltd, the other 20%. Life & Style Ltd has shops in ten main centers throughout South Africa, while the largest nursery and shop as well as the head office are situated in Pretoria. The accounting functions of the company are fully computerised and all processing takes place centrally at the head office. The nurseries and shops are linked to the head office via a wide area network (WAN). All sale, order and inventory transactions take place via these terminals, and are recorded in the relevant transaction files during business hours and updated overnight at the head office. The budgeted turnover of the company for the year ending 31 March 2018 is R40 100 000. You are currently planning the audit for the year ending 31 March 2018. From prior year files you have ascertained that internal controls are in place and are functioning well. Management also seems very control-conscious and the monthly management accounts prepared by the accountants appear to be accurate and reliable, You have calculated the following financial ratios of the company for analytical review purposes, based on the information obtained from the monthly management accounts for the year up to 31 January 2018: 2018 2017 2016 10 months 12 months 12 months Gross profit percentage Current ratio 46% 50% 50% 1,5 2,3 2,6 Quick asset ratio 0,78 1,6 1,7 Interest coverage Debtors days outstanding 0,98 1,67 2.1 132 86 68 Inventories turnover ratio 4 5.5 6.5 Mr Masingu informed you that the company wants to convert to a close corporation after the year- end. The reason is that he was of the opinion that all the administration surrounding the submission of returns to the Registrar of Companies took up too much time. He requested your advice in this regard. REQUIRED: (a) Give and explain your opinion of the financial condition of Life & Style Ltd as is evident from the analytical review procedures performed. (6) (b) Discuss, based on the results of the analytical review procedures, the audit areas that hold the biggest detection risk in respect of the audit of Life & Style Ltd's 2018 annual financial statements. (6) (c) Discuss the matters that should be considered during the planning of the 2018 audit of Life & Style Ltd. (13)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Opinion about financial condition of life style Ltd The Gross profit margin decreased as compared to 2016 and 2017 which is 46 in 2018 where as it w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started