Answered step by step

Verified Expert Solution

Question

1 Approved Answer

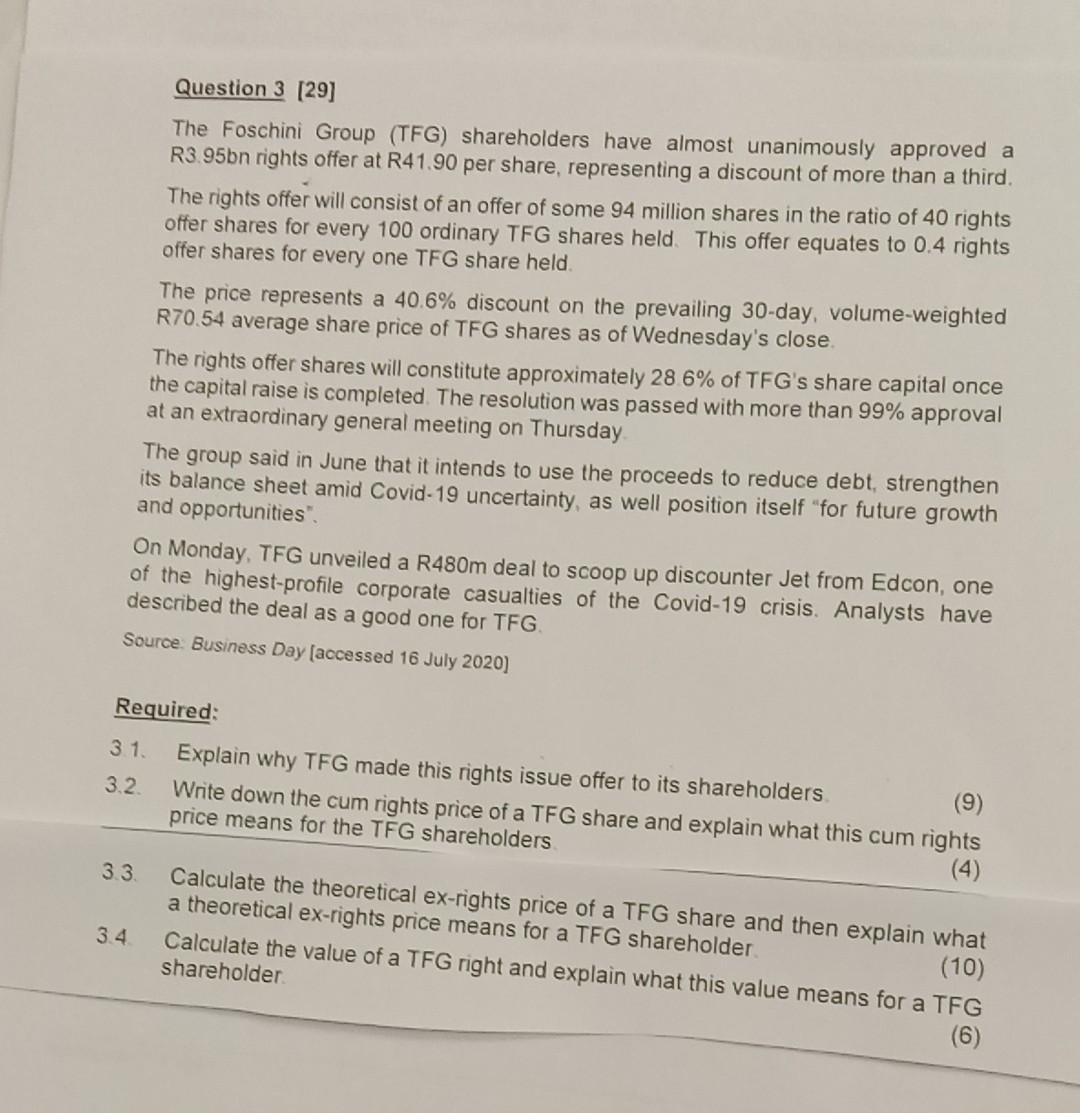

Question 3 [29] The Foschini Group (TFG) shareholders have almost unanimously approved a R3.95bn rights offer at R41.90 per share, representing a discount of more

Question 3 [29] The Foschini Group (TFG) shareholders have almost unanimously approved a R3.95bn rights offer at R41.90 per share, representing a discount of more than a third. The rights offer will consist of an offer of some 94 million shares in the ratio of 40 rights offer shares for every 100 ordinary TFG shares held This offer equates to 0.4 rights offer shares for every one TFG share held The price represents a 40.6% discount on the prevailing 30-day, volume-weighted R70.54 average share price of TFG shares as of Wednesday's close The rights offer shares will constitute approximately 28 6% of TFG's share capital once the capital raise is completed. The resolution was passed with more than 99% approval at an extraordinary general meeting on Thursday The group said in June that it intends to use the proceeds to reduce debt, strengthen its balance sheet amid Covid-19 uncertainty, as well position itself "for future growth and opportunities On Monday, TFG unveiled a R480m deal to scoop up discounter Jet from Edcon, one of the highest-profile corporate casualties of the Covid-19 crisis. Analysts have described the deal as a good one for TFG Source Business Day (accessed 16 July 2020) Required: 3.1. 3.2 Explain why TFG made this rights issue offer to its shareholders (9) Write down the cum rights price of a TFG share and explain what this cum rights price means for the TFG shareholders (4) 3.3 3.4 Calculate the theoretical ex-rights price of a TFG share and then explain what a theoretical ex-rights price means for a TFG shareholder (10) Calculate the value of a TFG right and explain what this value means for a TFG shareholder (6)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started