Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 3 3. Calculation questions (5 pointsx4=20 points) (1) Assuming that two stocks constitute a market portfolio, the expected return, standard deviation, and share data

question 3

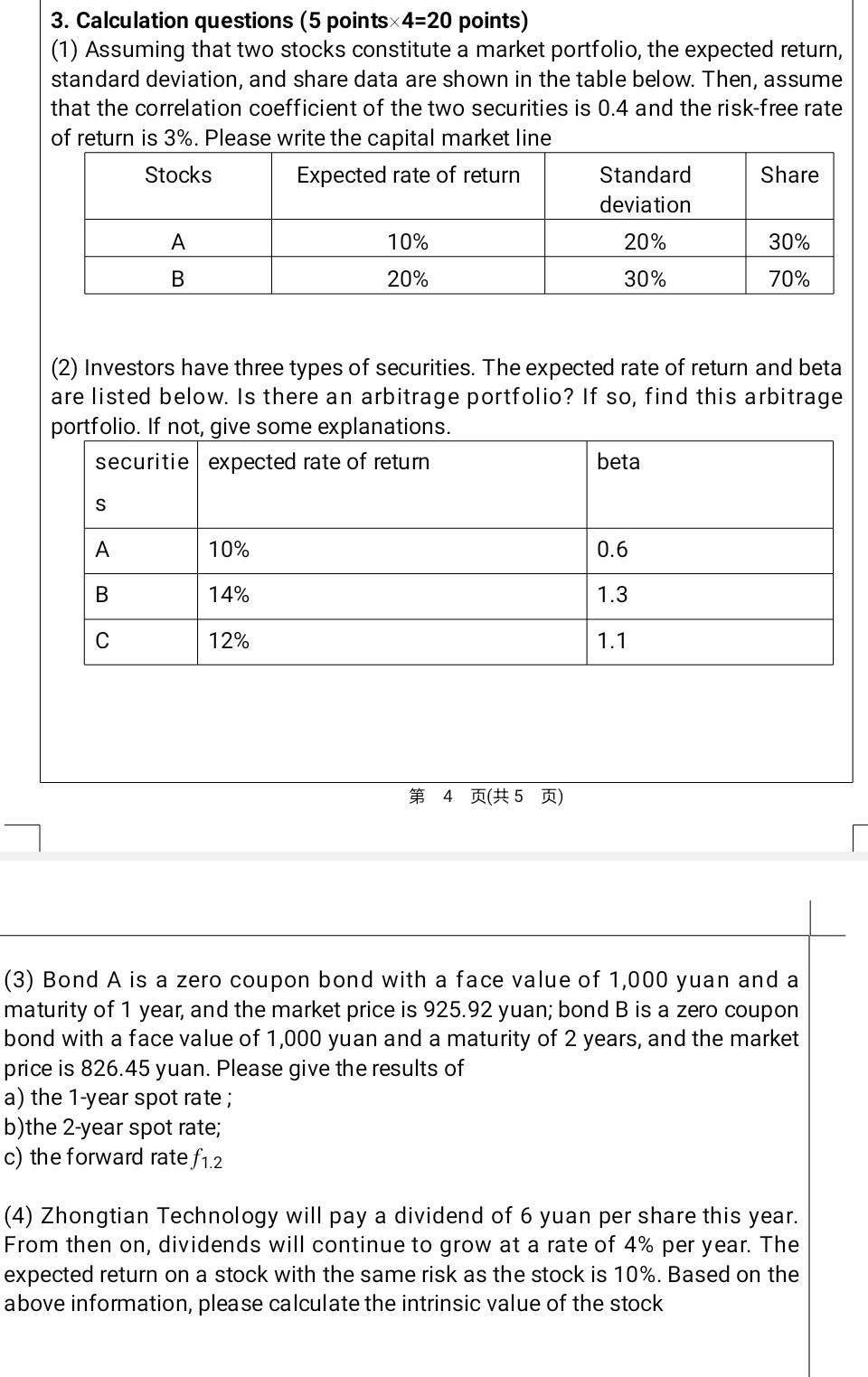

3. Calculation questions (5 pointsx4=20 points) (1) Assuming that two stocks constitute a market portfolio, the expected return, standard deviation, and share data are shown in the table below. Then, assume that the correlation coefficient of the two securities is 0.4 and the risk-free rate of return is 3%. Please write the capital market line Stocks Expected rate of return Standard Share deviation A 10% 20% 30% B 20% 30% 70% (2) Investors have three types of securities. The expected rate of return and beta are listed below. Is there an arbitrage portfolio? If so, find this arbitrage portfolio. If not, give some explanations. securitie expected rate of return beta S . 10% 0.6 14% 1.3 12% 1.1 4(5 ) (3) Bond A is a zero coupon bond with a face value of 1,000 yuan and a maturity of 1 year, and the market price is 925.92 yuan; bond B is a zero coupon bond with a face value of 1,000 yuan and a maturity of 2 years, and the market price is 826.45 yuan. Please give the results of a) the 1-year spot rate; b)the 2-year spot rate; c) the forward rate f1.2 (4) Zhongtian Technology will pay a dividend of 6 yuan per share this year. From then on, dividends will continue to grow at a rate of 4% per year. The expected return on a stock with the same risk as the stock is 10%. Based on the above information, please calculate the intrinsic value of the stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started