Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 3- Mr. David Lawson, the CFO of Golden Cup plans to increase the company's long-term debt from $40,000 to $80,000 by getting

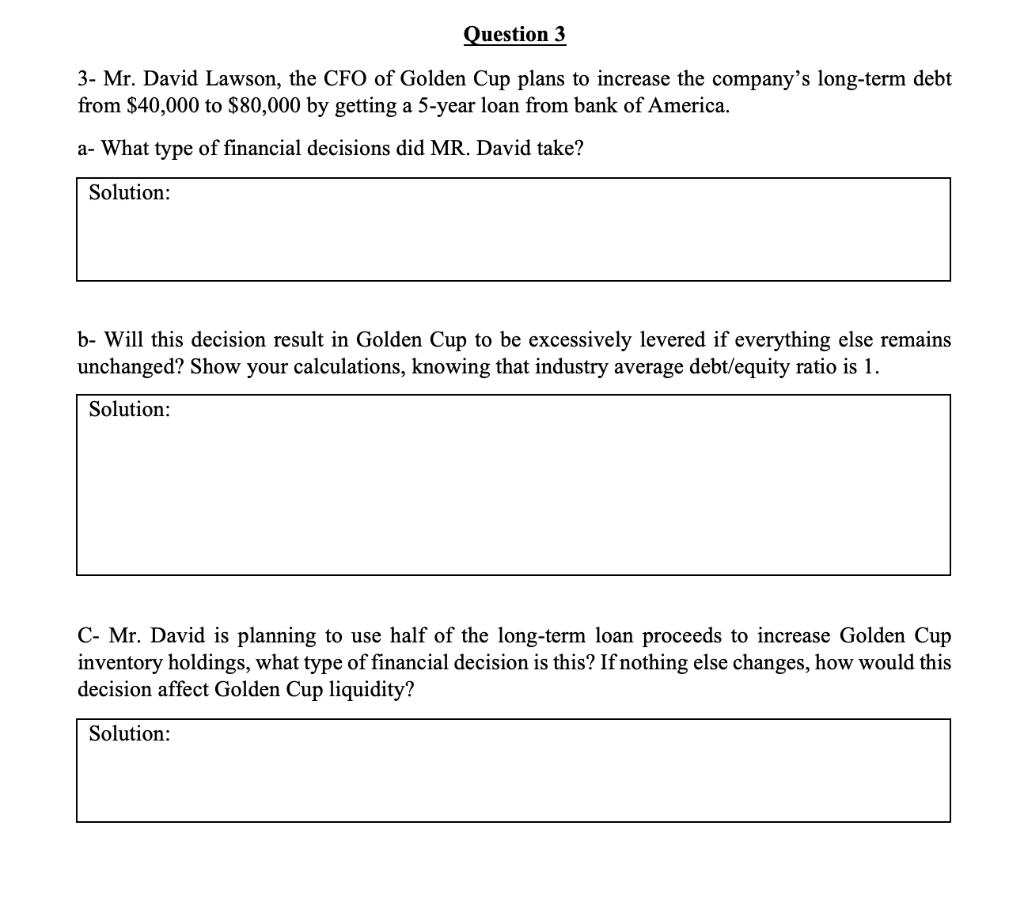

Question 3 3- Mr. David Lawson, the CFO of Golden Cup plans to increase the company's long-term debt from $40,000 to $80,000 by getting a 5-year loan from bank of America. a- What type of financial decisions did MR. David take? Solution: b- Will this decision result in Golden Cup to be excessively levered if everything else remains unchanged? Show your calculations, knowing that industry average debt/equity ratio is 1. Solution: C- Mr. David is planning to use half of the long-term loan proceeds to increase Golden Cup inventory holdings, what type of financial decision is this? If nothing else changes, how would this decision affect Golden Cup liquidity? Solution:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address the questions lets break them down step by step a What type of financial decisions did Mr David take Solution Mr David made a financing dec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started