Answered step by step

Verified Expert Solution

Question

1 Approved Answer

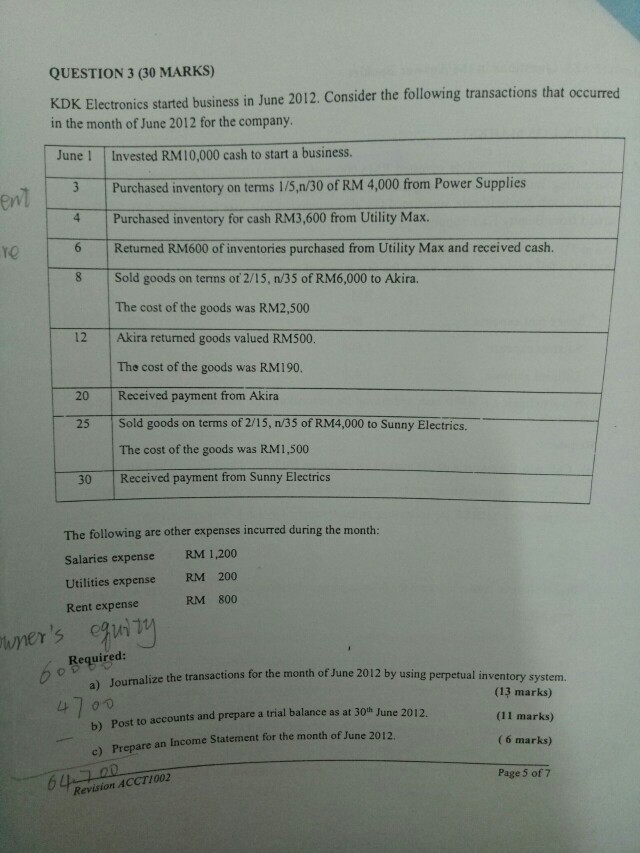

QUESTION 3 (30 MARKS) K Electronics started business in June 2012. Consider the following transactions that occurred in the month of June 2012 for the

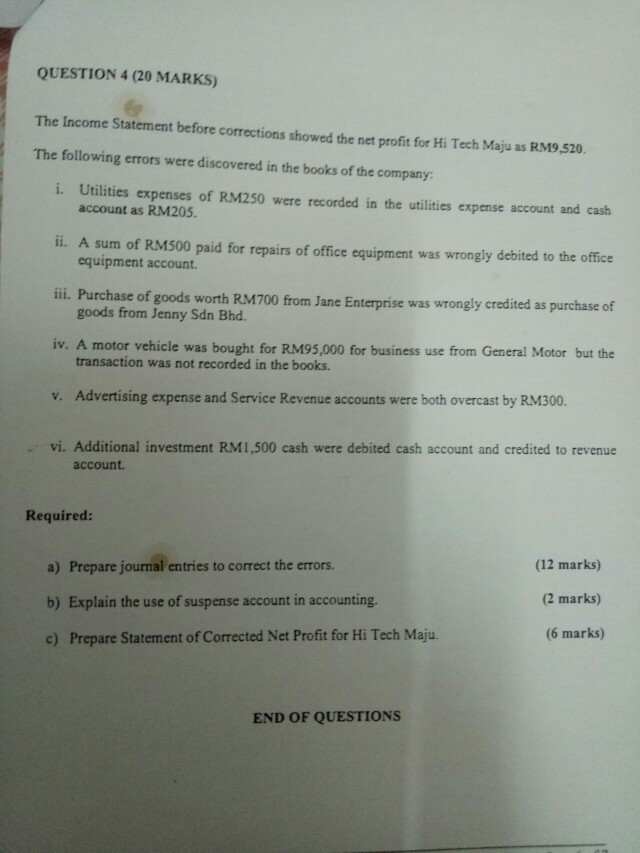

QUESTION 3 (30 MARKS) K Electronics started business in June 2012. Consider the following transactions that occurred in the month of June 2012 for the company June 1 Invested RM10,000 cash to start a business. 3Purchased inventory on terms 1/5,n/30 of RM 4,000 from Power Supplies en 4 Purchased inventory for cash RM3,600 from Utility Max. 6 Returnmed RM600 of inventories purchased 8Sold goods on terms ot 2/15, n/35 of RM6,000 to Akira. from Utility Max and received cash. The cost of the goods was RM2,500 Akira returned goods valued RM500 The cost of the goods was RM190. 12 20 Received payment from Akira 25 Sold goods on terms of 2/15, n/3S of RM4,000 to Sunny Electrics The cost of the goods was RM1,500 30 Received payment trom Sunny Electrics The following are other expenses incurred during the month Salaries expense RM 1,200 Utilities expense RM 200 Rent expense RM 800 Required ize the transactions for the month of June 2012 by using perpetual inventory system. a) Journali b) Post to accounts and prepare a trial balance as at 30% June 2012. c) Prepare (13 marks) (11 marks) (6 marks) Page 5 of 7 an Income Statement for the month of June 2012. Revision ACCT/00 ACCT1002 QUESTION 4 (20 MARKS) The Income Statement before corrections showed the net profit for Hi Tech Maju as RM9,520. The following errors were discovered in the books of the company i. Utilities expenses of RM250 were recorded in the utilities expense account and cash account as RM205. ii. A sum of RM500 paid for repairs of office equipment was wrongly debited to the office ii Purchase of goods worth RM700 from Jane Enterprise was wrongly credited as purchase of iv. A motor vehicle was bought for RM95,000 for business use from General Motor but the equipment account. goods from Jenny Sdn Bhd. transaction was not recorded in the books. v. Advertising expense and Service Revenue accounts were both overcast by RM300. vi. Additional investment RM1,500 cash were debited cash account and credited to revenue . account. Required: a) Prepare journal entries to correct the errors. b) Explain the use of suspense account in accounting. c) Prepare Statement of Corrected Net Profit for Hi Tech Maju. (12 marks) (2 marks) (6 marks) END OF QUESTIONS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started