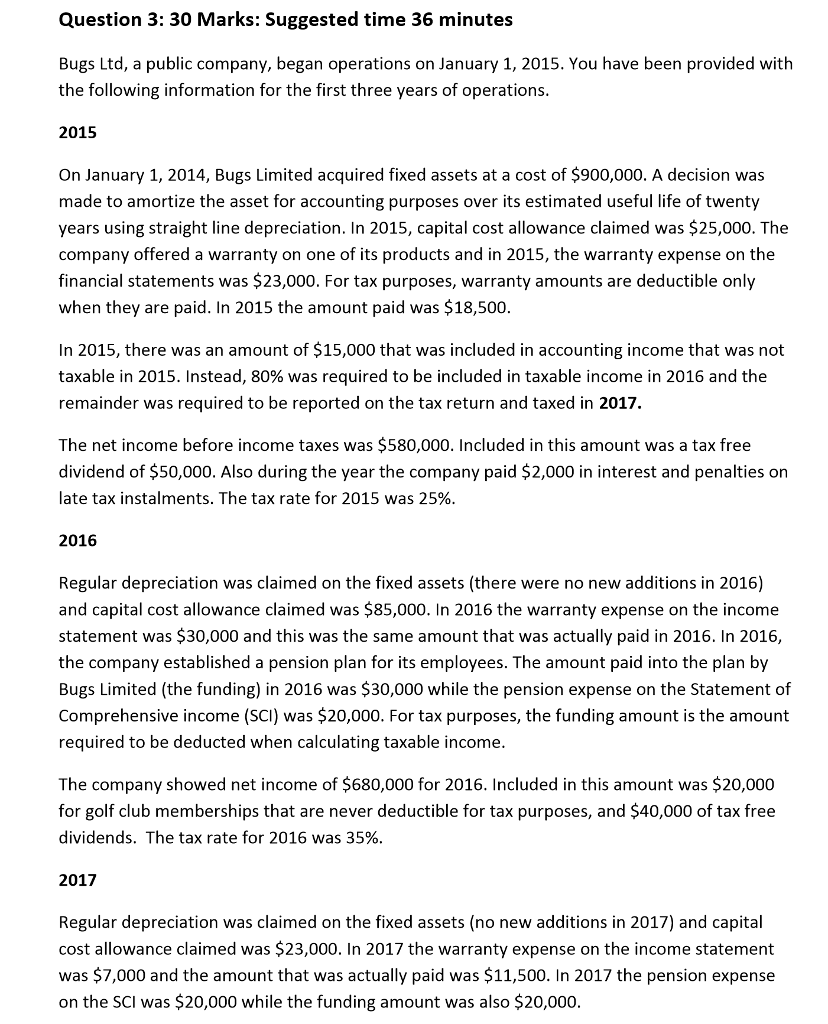

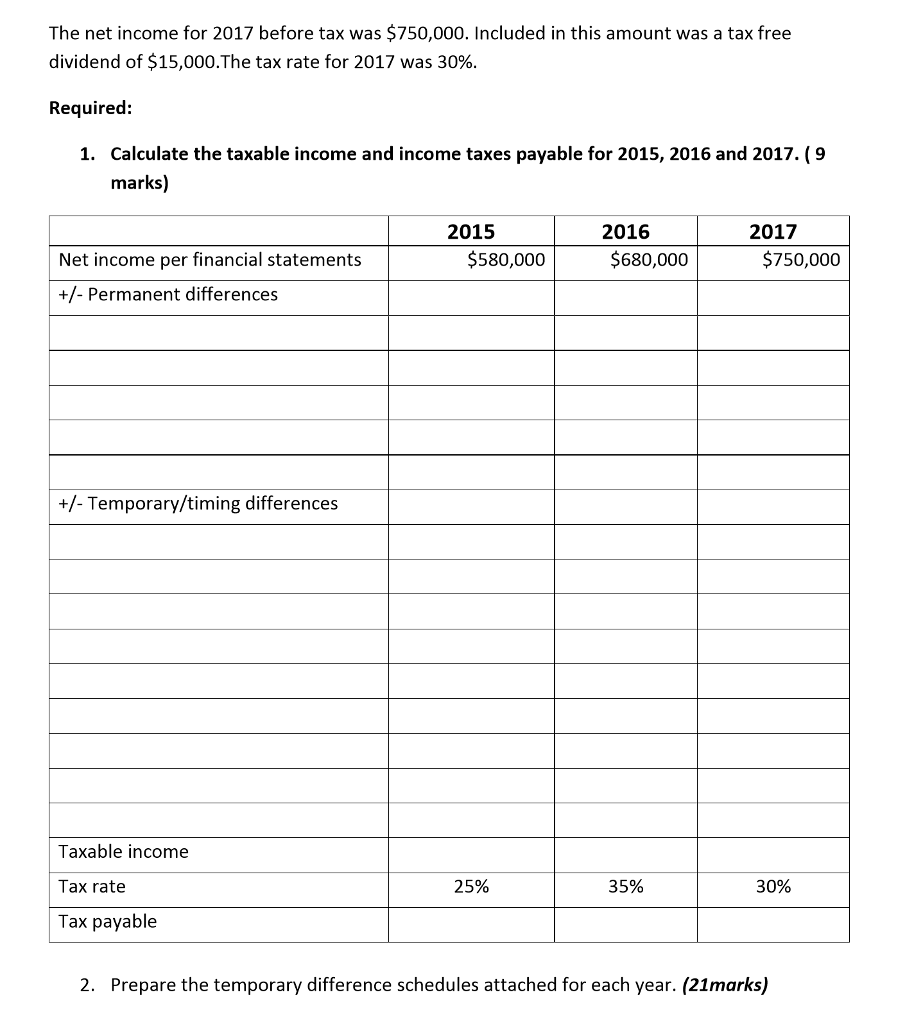

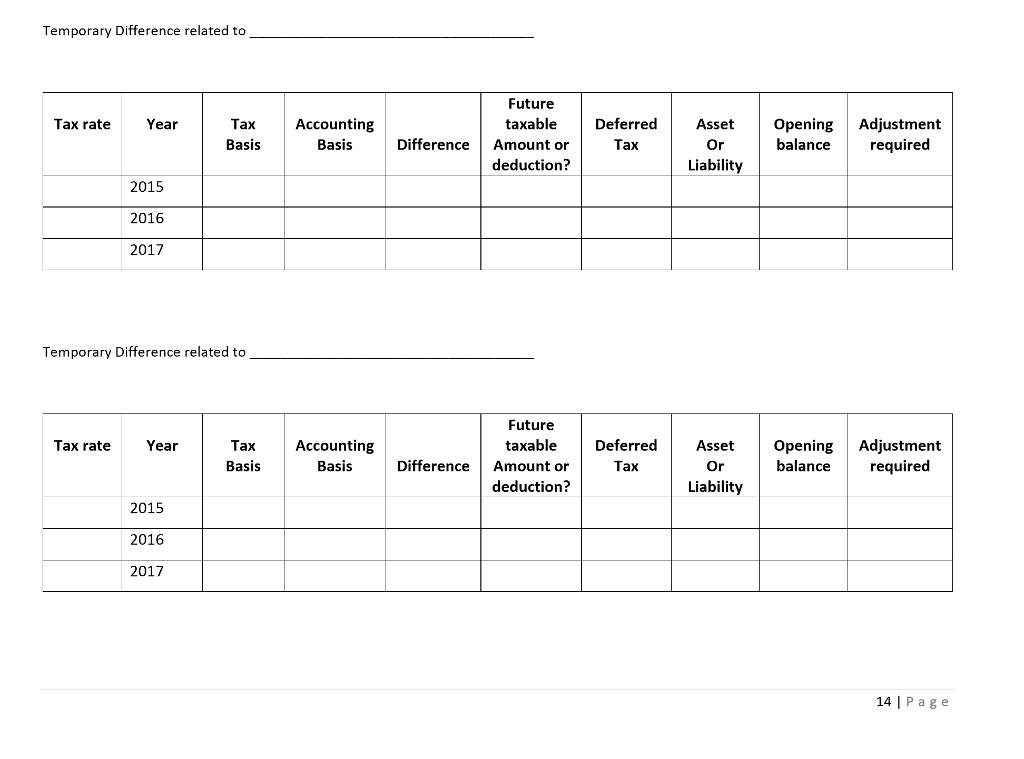

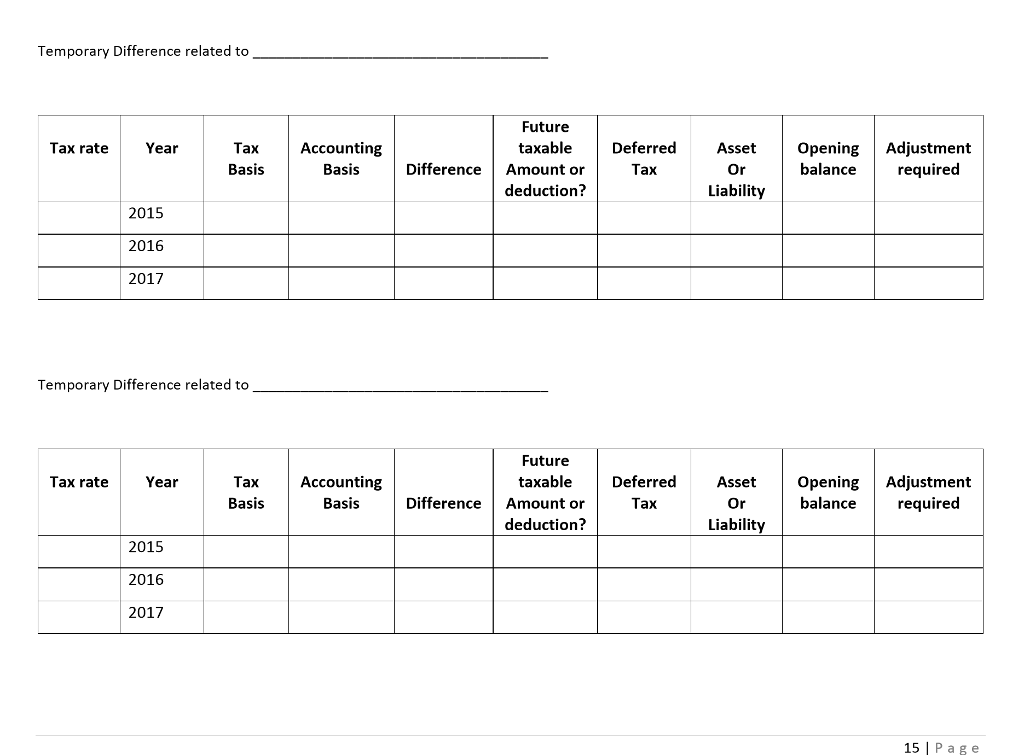

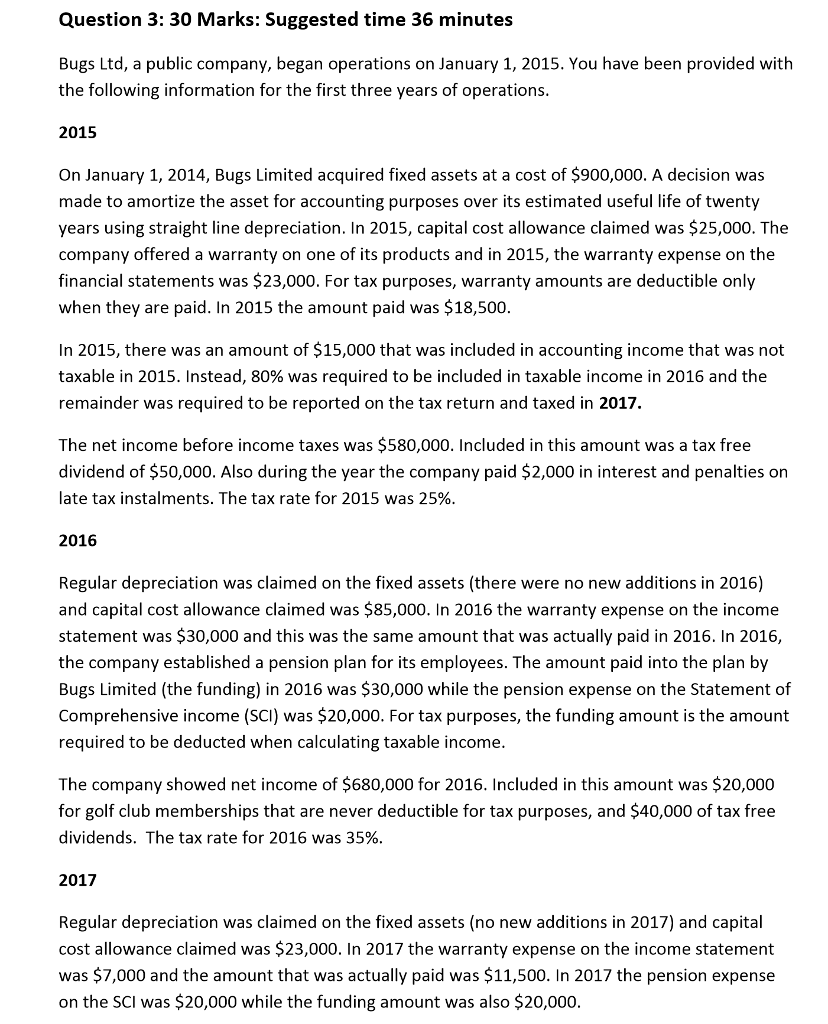

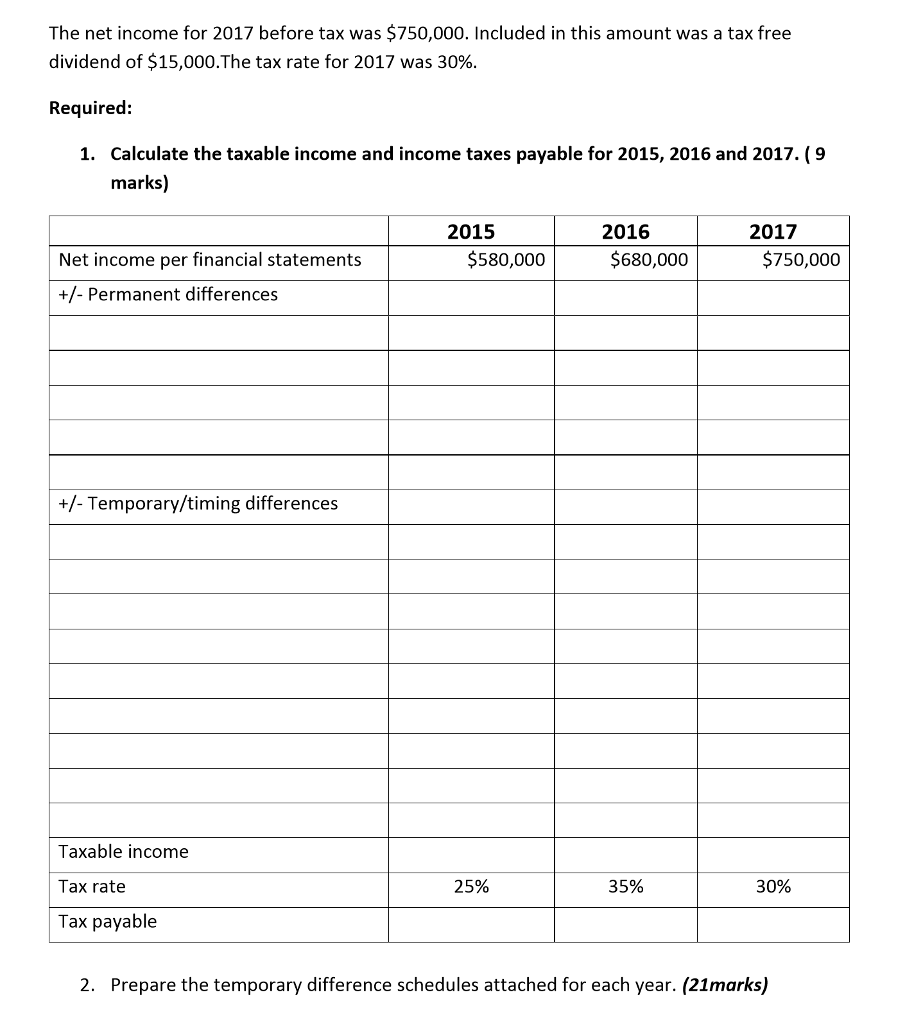

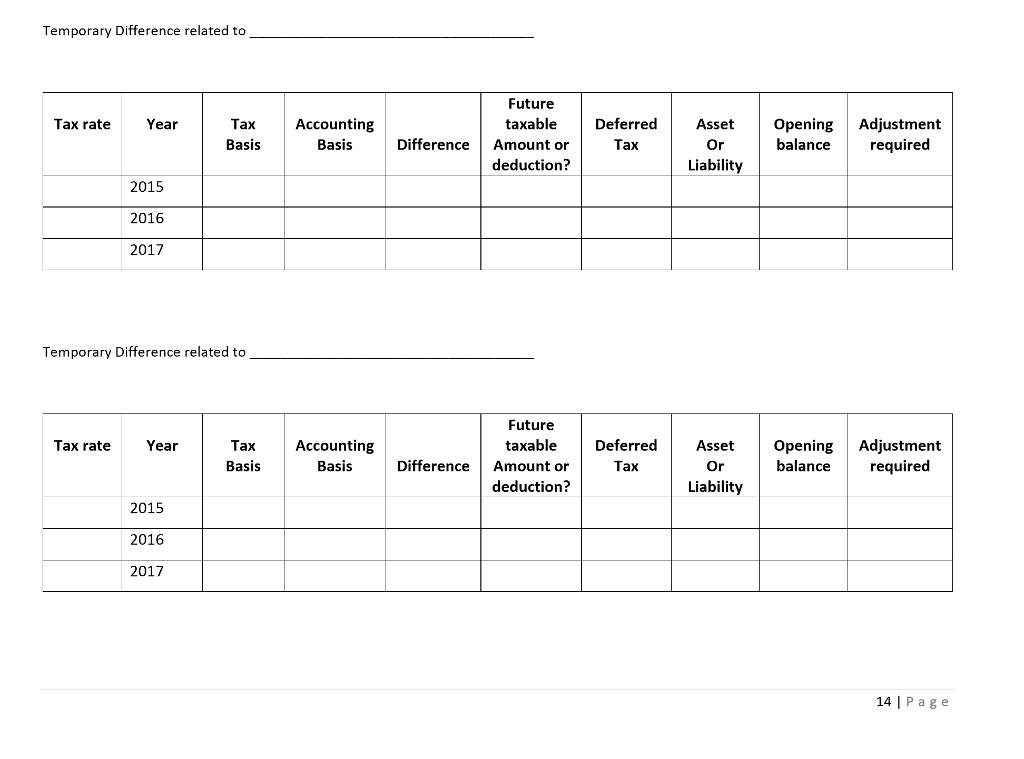

Question 3: 30 Marks: Suggested time 36 minutes Bugs Ltd, a public company, began operations on January 1, 2015. You have been provided with the following information for the first three years of operations 2015 On January 1, 2014, Bugs Limited acquired fixed assets at a cost of S900,000. A decision was made to amortize the asset for accounting purposes over its estimated useful life of twenty years using straight line depreciation. In 2015, capital cost allowance claimed was $25,000. The company offered a warranty on one of its products and in 2015, the warranty expense on the financial statements was $23,000. For tax purposes, warranty amounts are deductible only when they are paid. In 2015 the amount paid was $18,500 In 2015, there was an amount of $15,000 that was included in accounting income that was not taxable in 2015. Instead, 80% was required to be included in taxable income in 2016 and the remainder was required to be reported on the tax return and taxed in 2017 The net income before income taxes was $580,000. Included in this amount was a tax free dividend of $50,000. Also during the year the company paid $2,000 in interest and penalties on late tax instalments. The tax rate for 2015 was 25% 2016 Regular depreciation was claimed on the fixed assets (there were no new additions in 2016) and capital cost allowance claimed was $85,000. In 2016 the warranty expense on the income statement was $30,000 and this was the same amount that was actually paid in 2016. In 2016 the company established a pension plan for its employees. The amount paid into the plan by Bugs Limited (the funding) in 2016 was $30,000 while the pension expense on the Statement of Comprehensive income (SCI) was $20,000. For tax purposes, the funding amount is the amount required to be deducted when calculating taxable income The company showed net income of $680,000 for 2016. Included in this amount was $20,000 for golf club memberships that are never deductible for tax purposes, and $40,000 of tax free dividends. The tax rate for 2016 was 35% 2017 Regular depreciation was claimed on the fixed assets (no new additions in 2017) and capital cost allowance claimed was $23,000. In 2017 the warranty expense on the income statement was $7,000 and the amount that was actually paid was $11,500. In 2017 the pension expense on the SCI was $20,000 while the funding amount was also $20,000