Answered step by step

Verified Expert Solution

Question

1 Approved Answer

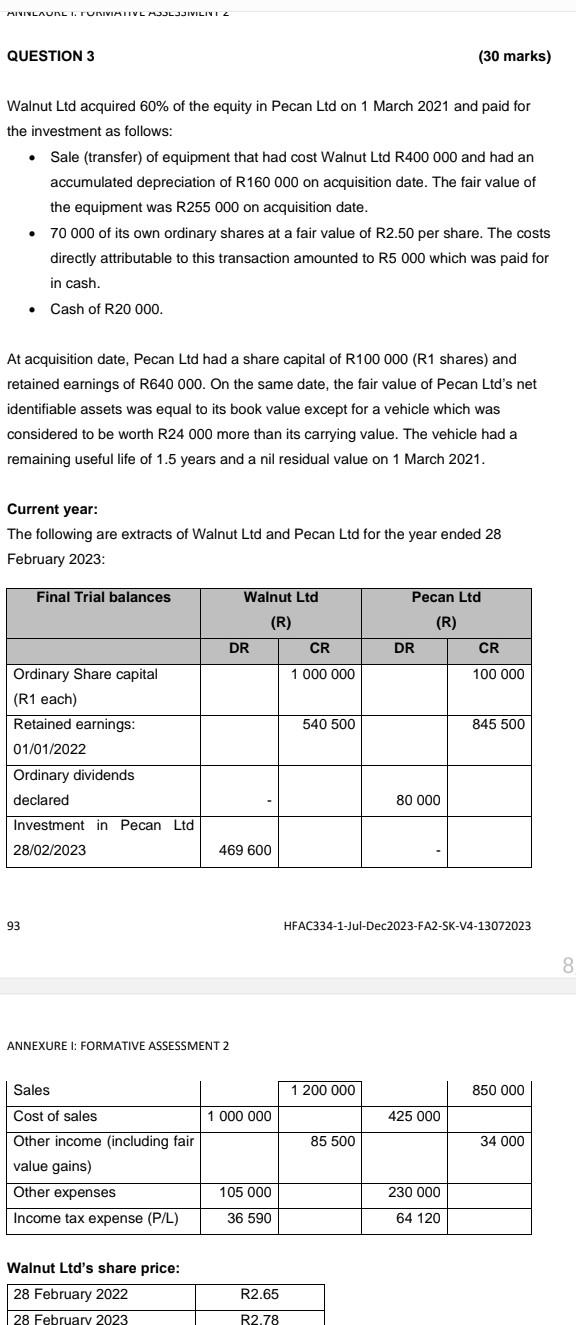

QUESTION 3 (30 marks) Walnut Ltd acquired 60% of the equity in Pecan Ltd on 1 March 2021 and paid for the investment as follows:

QUESTION 3 (30 marks) Walnut Ltd acquired 60% of the equity in Pecan Ltd on 1 March 2021 and paid for the investment as follows: - Sale (transfer) of equipment that had cost Walnut Ltd R400 000 and had an accumulated depreciation of R160 000 on acquisition date. The fair value of the equipment was R255 000 on acquisition date. - 70000 of its own ordinary shares at a fair value of R2.50 per share. The costs directly attributable to this transaction amounted to R5 000 which was paid for in cash. - Cash of R20 000. At acquisition date, Pecan Ltd had a share capital of R100 000 (R1 shares) and retained earnings of R640 000. On the same date, the fair value of Pecan Ltd's net identifiable assets was equal to its book value except for a vehicle which was considered to be worth R24 000 more than its carrying value. The vehicle had a remaining useful life of 1.5 years and a nil residual value on 1 March 2021. Current year: The following are extracts of Walnut Ltd and Pecan Ltd for the year ended 28 February 2023: 93 HFAC334-1-Jul-Dec2023-FA2-SK-V4-13072023 ANNEXURE I: FORMATIVE ASSESSMENT 2 Walnut Ltd's share price: QUESTION 3 (30 marks) Walnut Ltd acquired 60% of the equity in Pecan Ltd on 1 March 2021 and paid for the investment as follows: - Sale (transfer) of equipment that had cost Walnut Ltd R400 000 and had an accumulated depreciation of R160 000 on acquisition date. The fair value of the equipment was R255 000 on acquisition date. - 70000 of its own ordinary shares at a fair value of R2.50 per share. The costs directly attributable to this transaction amounted to R5 000 which was paid for in cash. - Cash of R20 000. At acquisition date, Pecan Ltd had a share capital of R100 000 (R1 shares) and retained earnings of R640 000. On the same date, the fair value of Pecan Ltd's net identifiable assets was equal to its book value except for a vehicle which was considered to be worth R24 000 more than its carrying value. The vehicle had a remaining useful life of 1.5 years and a nil residual value on 1 March 2021. Current year: The following are extracts of Walnut Ltd and Pecan Ltd for the year ended 28 February 2023: 93 HFAC334-1-Jul-Dec2023-FA2-SK-V4-13072023 ANNEXURE I: FORMATIVE ASSESSMENT 2 Walnut Ltd's share price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started