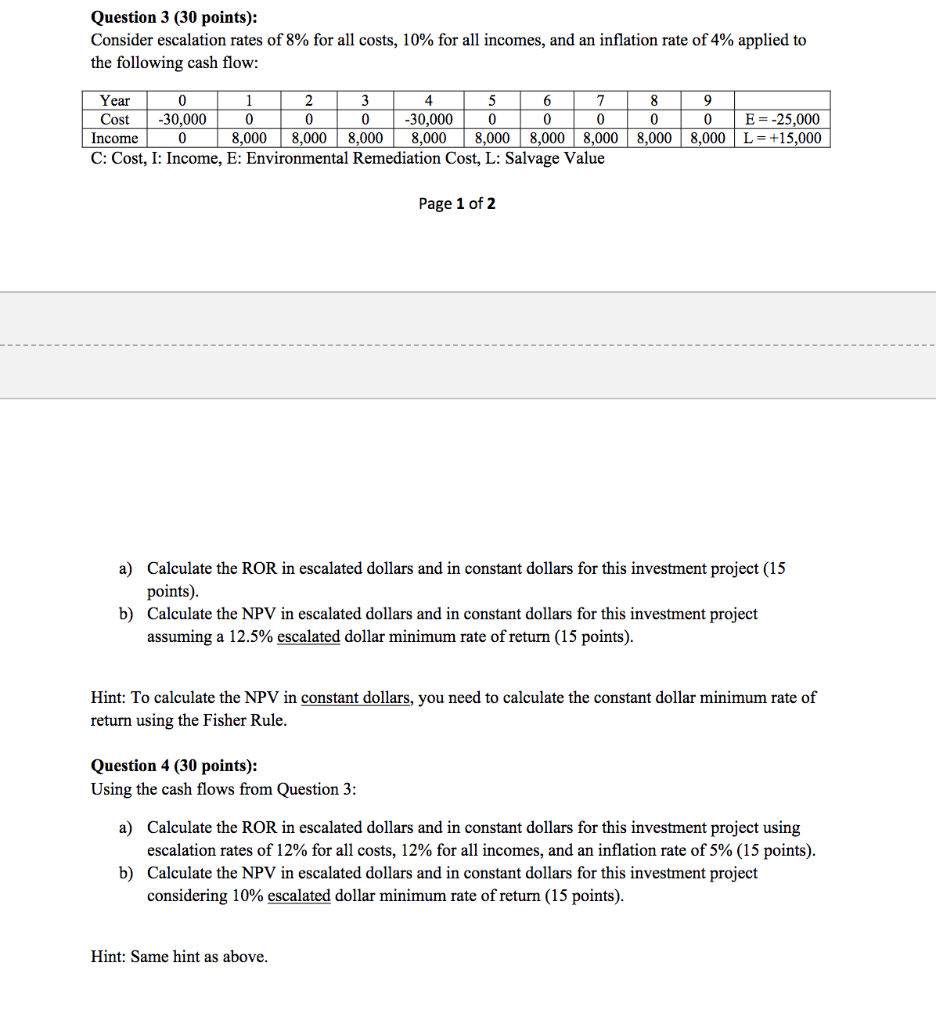

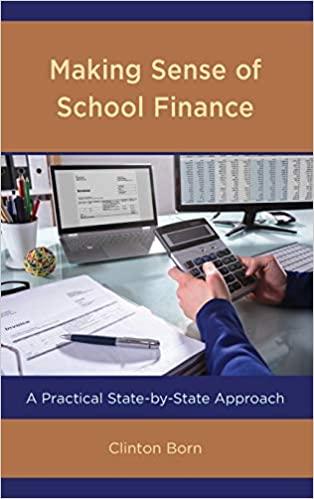

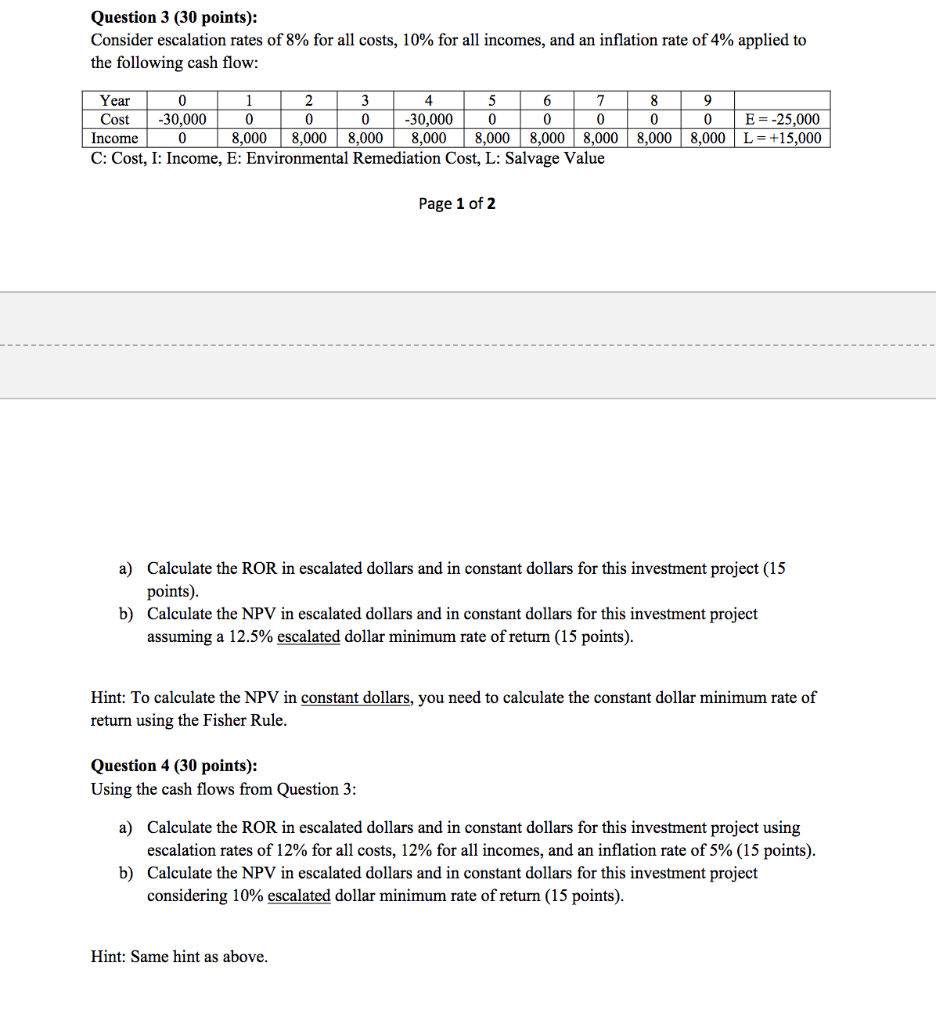

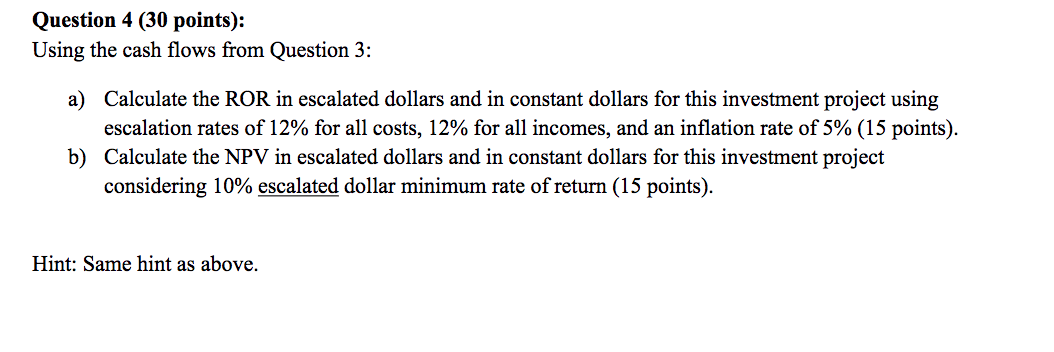

Question 3 (30 points): Consider escalation rates of 8% for all costs, 10% for all incomes, and an inflation rate of 4% applied to the following cash flow: Year 0 1 2 3 4 5 6 7 8 Cost -30,000 0 0 0 -30,00000100 Income | 0 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 C: Cost, I: Income, E: Environmental Remediation Cost, L: Salvage Value 9 0 8,000 E= -25,000 L = +15,000 Page 1 of 2 a) Calculate the ROR in escalated dollars and in constant dollars for this investment project (15 points) b) Calculate the NPV in escalated dollars and in constant dollars for this investment project assuming a 12.5% escalated dollar minimum rate of return (15 points). Hint: To calculate the NPV in constant dollars, you need to calculate the constant dollar minimum rate of return using the Fisher Rule. Question 4 (30 points): Using the cash flows from Question 3: a) Calculate the ROR in escalated dollars and in constant dollars for this investment project using escalation rates of 12% for all costs, 12% for all incomes, and an inflation rate of 5% (15 points). b) Calculate the NPV in escalated dollars and in constant dollars for this investment project considering 10% escalated dollar minimum rate of return (15 points). Hint: Same hint as above. Question 4 (30 points): Using the cash flows from Question 3: a) Calculate the ROR in escalated dollars and in constant dollars for this investment project using escalation rates of 12% for all costs, 12% for all incomes, and an inflation rate of 5% (15 points). b) Calculate the NPV in escalated dollars and in constant dollars for this investment project considering 10% escalated dollar minimum rate of return (15 points). Hint: Same hint as above. Question 3 (30 points): Consider escalation rates of 8% for all costs, 10% for all incomes, and an inflation rate of 4% applied to the following cash flow: Year 0 1 2 3 4 5 6 7 8 Cost -30,000 0 0 0 -30,00000100 Income | 0 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 C: Cost, I: Income, E: Environmental Remediation Cost, L: Salvage Value 9 0 8,000 E= -25,000 L = +15,000 Page 1 of 2 a) Calculate the ROR in escalated dollars and in constant dollars for this investment project (15 points) b) Calculate the NPV in escalated dollars and in constant dollars for this investment project assuming a 12.5% escalated dollar minimum rate of return (15 points). Hint: To calculate the NPV in constant dollars, you need to calculate the constant dollar minimum rate of return using the Fisher Rule. Question 4 (30 points): Using the cash flows from Question 3: a) Calculate the ROR in escalated dollars and in constant dollars for this investment project using escalation rates of 12% for all costs, 12% for all incomes, and an inflation rate of 5% (15 points). b) Calculate the NPV in escalated dollars and in constant dollars for this investment project considering 10% escalated dollar minimum rate of return (15 points). Hint: Same hint as above. Question 4 (30 points): Using the cash flows from Question 3: a) Calculate the ROR in escalated dollars and in constant dollars for this investment project using escalation rates of 12% for all costs, 12% for all incomes, and an inflation rate of 5% (15 points). b) Calculate the NPV in escalated dollars and in constant dollars for this investment project considering 10% escalated dollar minimum rate of return (15 points). Hint: Same hint as above