Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3 (35 MARKS) James Bond, aged 40, is about to sign to revised employment agreement and has approached you to clarify some of the

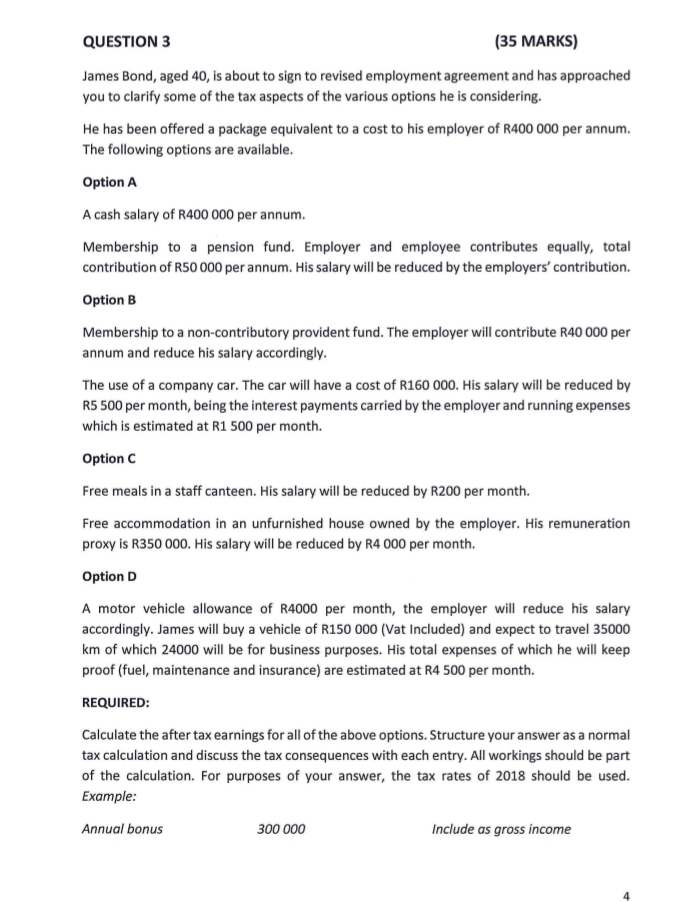

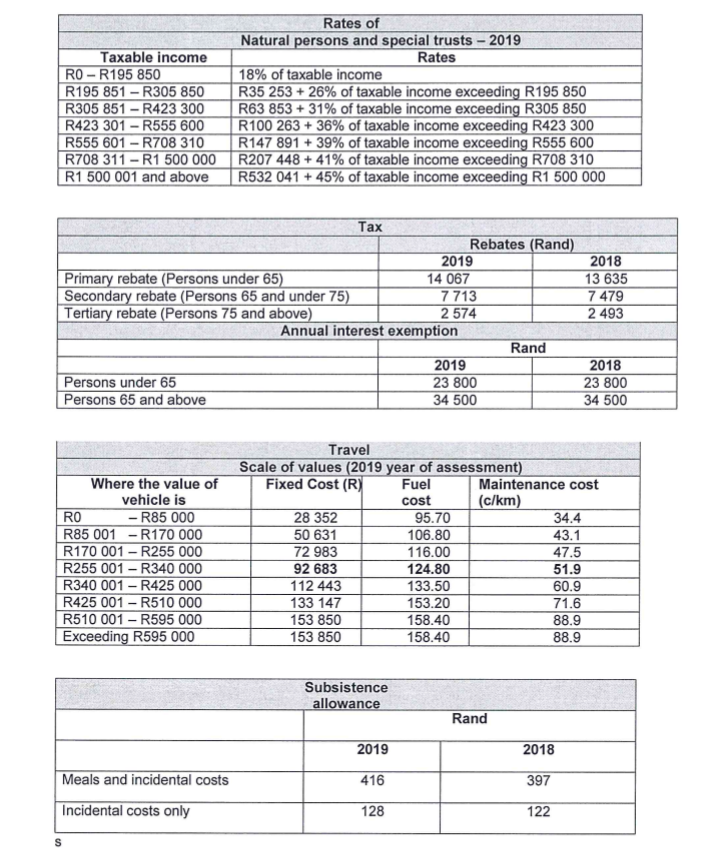

QUESTION 3 (35 MARKS) James Bond, aged 40, is about to sign to revised employment agreement and has approached you to clarify some of the tax aspects of the various options he is considering. He has been offered a package equivalent to a cost to his employer of R400 000 per annum. The following options are available. Option A A cash salary of R400 000 per annum. Membership to a pension fund. Employer and employee contributes equally, total contribution of R50 000 per annum. His salary will be reduced by the employers' contribution. Option B Membership to a non-contributory provident fund. The employer will contribute R40 000 per annum and reduce his salary accordingly. The use of a company car. The car will have a cost of R160 000. His salary will be reduced by R5 500 per month, being the interest payments carried by the employer and running expenses which is estimated at R1 500 per month. Option C Free meals in a staff canteen. His salary will be reduced by R200 per month. Free accommodation in an unfurnished house owned by the employer. His remuneration proxy is R350 000. His salary will be reduced by R4 000 per month. Option D A motor vehicle allowance of R4000 per month, the employer will reduce his salary accordingly. James will buy a vehicle of R150 000 (Vat Included) and expect to travel 35000 km of which 24000 will be for business purposes. His total expenses of which he will keep proof (fuel, maintenance and insurance) are estimated at R4 500 per month. REQUIRED: Calculate the after tax earnings for all of the above options. Structure your answer as a normal tax calculation and discuss the tax consequences with each entry. All workings should be part of the calculation. For purposes of your answer, the tax rates of 2018 should be used. Example: Annual bonus 300 000 Include as gross income Taxable income RO - R195 850 R195 851 - R305 850 R305 851 -R423 300 R423 301 - R555 600 R555 601 - R708 310 R708 311 -R1 500 000 R1 500 001 and above Rates of Natural persons and special trusts - 2019 Rates 18% of taxable income R35 253 + 26% of taxable income exceeding R195 850 R63 853 + 31% of taxable income exceeding R305 850 R100 263 + 36% of taxable income exceeding R423 300 R147 891 + 39% of taxable income exceeding R555 600 R207 448 + 41% of taxable income exceeding R708 310 R532 041 + 45% of taxable income exceeding R1 500 000 Tax Rebates (Rand) 2019 2018 Primary rebate (Persons under 65) 14 067 13 635 Secondary rebate (Persons 65 and under 75) 7 713 7479 Tertiary rebate (Persons 75 and above) 2 574 2493 Annual interest exemption Rand 2019 2018 Persons under 65 23 800 23 800 Persons 65 and above 34 500 34 500 RO Where the value of vehicle is - R85 000 R85 001 - R170 000 R170 001 -R255 000 R255 001 - R340 000 R340 001 - R425 000 R425 001 - R510 000 R510 001 - 595 000 Exceeding R595 000 Travel Scale of values (2019 year of assessment) Fixed Cost (R) Fuel Maintenance cost cost (c/km) 28 352 95.70 34.4 50 631 106.80 43.1 72 983 116.00 47.5 92 683 124.80 51.9 112 443 133.50 60.9 133 147 153.20 71.6 153 850 158.40 88.9 153 850 158.40 88.9 Subsistence allowance Rand 2019 2018 Meals and incidental costs 416 397 Incidental costs only 128 122 QUESTION 3 (35 MARKS) James Bond, aged 40, is about to sign to revised employment agreement and has approached you to clarify some of the tax aspects of the various options he is considering. He has been offered a package equivalent to a cost to his employer of R400 000 per annum. The following options are available. Option A A cash salary of R400 000 per annum. Membership to a pension fund. Employer and employee contributes equally, total contribution of R50 000 per annum. His salary will be reduced by the employers' contribution. Option B Membership to a non-contributory provident fund. The employer will contribute R40 000 per annum and reduce his salary accordingly. The use of a company car. The car will have a cost of R160 000. His salary will be reduced by R5 500 per month, being the interest payments carried by the employer and running expenses which is estimated at R1 500 per month. Option C Free meals in a staff canteen. His salary will be reduced by R200 per month. Free accommodation in an unfurnished house owned by the employer. His remuneration proxy is R350 000. His salary will be reduced by R4 000 per month. Option D A motor vehicle allowance of R4000 per month, the employer will reduce his salary accordingly. James will buy a vehicle of R150 000 (Vat Included) and expect to travel 35000 km of which 24000 will be for business purposes. His total expenses of which he will keep proof (fuel, maintenance and insurance) are estimated at R4 500 per month. REQUIRED: Calculate the after tax earnings for all of the above options. Structure your answer as a normal tax calculation and discuss the tax consequences with each entry. All workings should be part of the calculation. For purposes of your answer, the tax rates of 2018 should be used. Example: Annual bonus 300 000 Include as gross income Taxable income RO - R195 850 R195 851 - R305 850 R305 851 -R423 300 R423 301 - R555 600 R555 601 - R708 310 R708 311 -R1 500 000 R1 500 001 and above Rates of Natural persons and special trusts - 2019 Rates 18% of taxable income R35 253 + 26% of taxable income exceeding R195 850 R63 853 + 31% of taxable income exceeding R305 850 R100 263 + 36% of taxable income exceeding R423 300 R147 891 + 39% of taxable income exceeding R555 600 R207 448 + 41% of taxable income exceeding R708 310 R532 041 + 45% of taxable income exceeding R1 500 000 Tax Rebates (Rand) 2019 2018 Primary rebate (Persons under 65) 14 067 13 635 Secondary rebate (Persons 65 and under 75) 7 713 7479 Tertiary rebate (Persons 75 and above) 2 574 2493 Annual interest exemption Rand 2019 2018 Persons under 65 23 800 23 800 Persons 65 and above 34 500 34 500 RO Where the value of vehicle is - R85 000 R85 001 - R170 000 R170 001 -R255 000 R255 001 - R340 000 R340 001 - R425 000 R425 001 - R510 000 R510 001 - 595 000 Exceeding R595 000 Travel Scale of values (2019 year of assessment) Fixed Cost (R) Fuel Maintenance cost cost (c/km) 28 352 95.70 34.4 50 631 106.80 43.1 72 983 116.00 47.5 92 683 124.80 51.9 112 443 133.50 60.9 133 147 153.20 71.6 153 850 158.40 88.9 153 850 158.40 88.9 Subsistence allowance Rand 2019 2018 Meals and incidental costs 416 397 Incidental costs only 128 122

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started