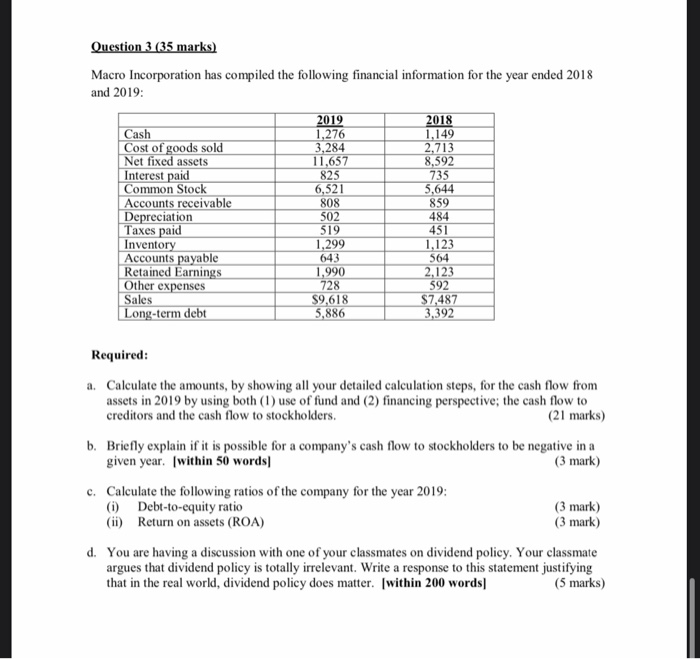

Question 3 (35 marks) Macro Incorporation has compiled the following financial information for the year ended 2018 and 2019: Cash Cost of goods sold Net fixed assets Interest paid Common Stock Accounts receivable Depreciation Taxes paid Inventory Accounts payable Retained Earnings Other expenses Sales Long-term debt 2019 1,276 3,284 11,657 825 6,521 808 502 519 1,299 643 1,990 728 $9,618 5,886 2018 1,149 2,713 8.592 735 5,644 859 484 451 1,123 564 2,123 592 $7,487 3,392 Required: a. Calculate the amounts, by showing all your detailed calculation steps, for the cash flow from assets in 2019 by using both (1) use of fund and (2) financing perspective; the cash flow to creditors and the cash flow to stockholders. (21 marks) b. Briefly explain if it is possible for a company's cash flow to stockholders to be negative in a given year. (within 50 words (3 mark) c. Calculate the following ratios of the company for the year 2019: () Debt-to-equity ratio (ii) Return on assets (ROA) (3 mark) (3 mark) d. You are having a discussion with one of your classmates on dividend policy. Your classmate argues that dividend policy is totally irrelevant. Write a response to this statement justifying that in the real world, dividend policy does matter. (within 200 words] (5 marks) Question 3 (35 marks) Macro Incorporation has compiled the following financial information for the year ended 2018 and 2019: Cash Cost of goods sold Net fixed assets Interest paid Common Stock Accounts receivable Depreciation Taxes paid Inventory Accounts payable Retained Earnings Other expenses Sales Long-term debt 2019 1,276 3,284 11,657 825 6,521 808 502 519 1,299 643 1,990 728 $9,618 5,886 2018 1,149 2,713 8.592 735 5,644 859 484 451 1,123 564 2,123 592 $7,487 3,392 Required: a. Calculate the amounts, by showing all your detailed calculation steps, for the cash flow from assets in 2019 by using both (1) use of fund and (2) financing perspective; the cash flow to creditors and the cash flow to stockholders. (21 marks) b. Briefly explain if it is possible for a company's cash flow to stockholders to be negative in a given year. (within 50 words (3 mark) c. Calculate the following ratios of the company for the year 2019: () Debt-to-equity ratio (ii) Return on assets (ROA) (3 mark) (3 mark) d. You are having a discussion with one of your classmates on dividend policy. Your classmate argues that dividend policy is totally irrelevant. Write a response to this statement justifying that in the real world, dividend policy does matter. (within 200 words]