Answered step by step

Verified Expert Solution

Question

1 Approved Answer

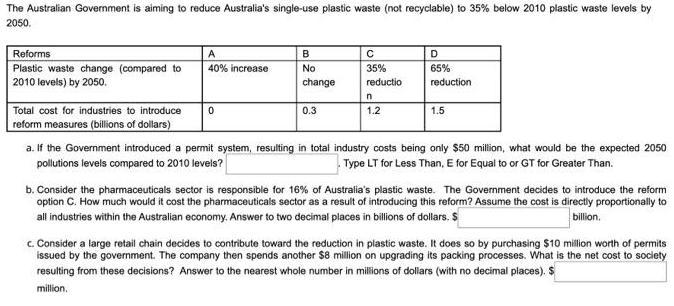

The Australian Government is aiming to reduce Australia's single-use plastic waste (not recyclable) to 35% below 2010 plastic waste levels by 2050. Reforms Plastic

The Australian Government is aiming to reduce Australia's single-use plastic waste (not recyclable) to 35% below 2010 plastic waste levels by 2050. Reforms Plastic waste change (compared to 2010 levels) by 2050. Total cost for industries to introduce reform measures (billions of dollars) A 40% increase 0 B No change 0.3 35% reductio n 1.2 D 65% reduction 1.5 a. If the Government introduced a permit system, resulting in total industry costs being only $50 million, what would be the expected 2050 pollutions levels compared to 2010 levels? Type LT for Less Than, E for Equal to or GT for Greater Than. b. Consider the pharmaceuticals sector is responsible for 16% of Australia's plastic waste. The Government decides to introduce the reform option C. How much would it cost the pharmaceuticals sector as a result of introducing this reform? Assume the cost is directly proportionally to all industries within the Australian economy. Answer to two decimal places in billions of dollars. $ billion. c. Consider a large retail chain decides to contribute toward the reduction in plastic waste. It does so by purchasing $10 million worth of permits issued by the government. The company then spends another $8 million on upgrading its packing processes. What is the net cost to society resulting from these decisions? Answer to the nearest whole number in millions of dollars (with no decimal places). S million.

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

aLT 35 The expected pollution levels would be less than 35 below 2010 levels The governments propose...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started