Answered step by step

Verified Expert Solution

Question

1 Approved Answer

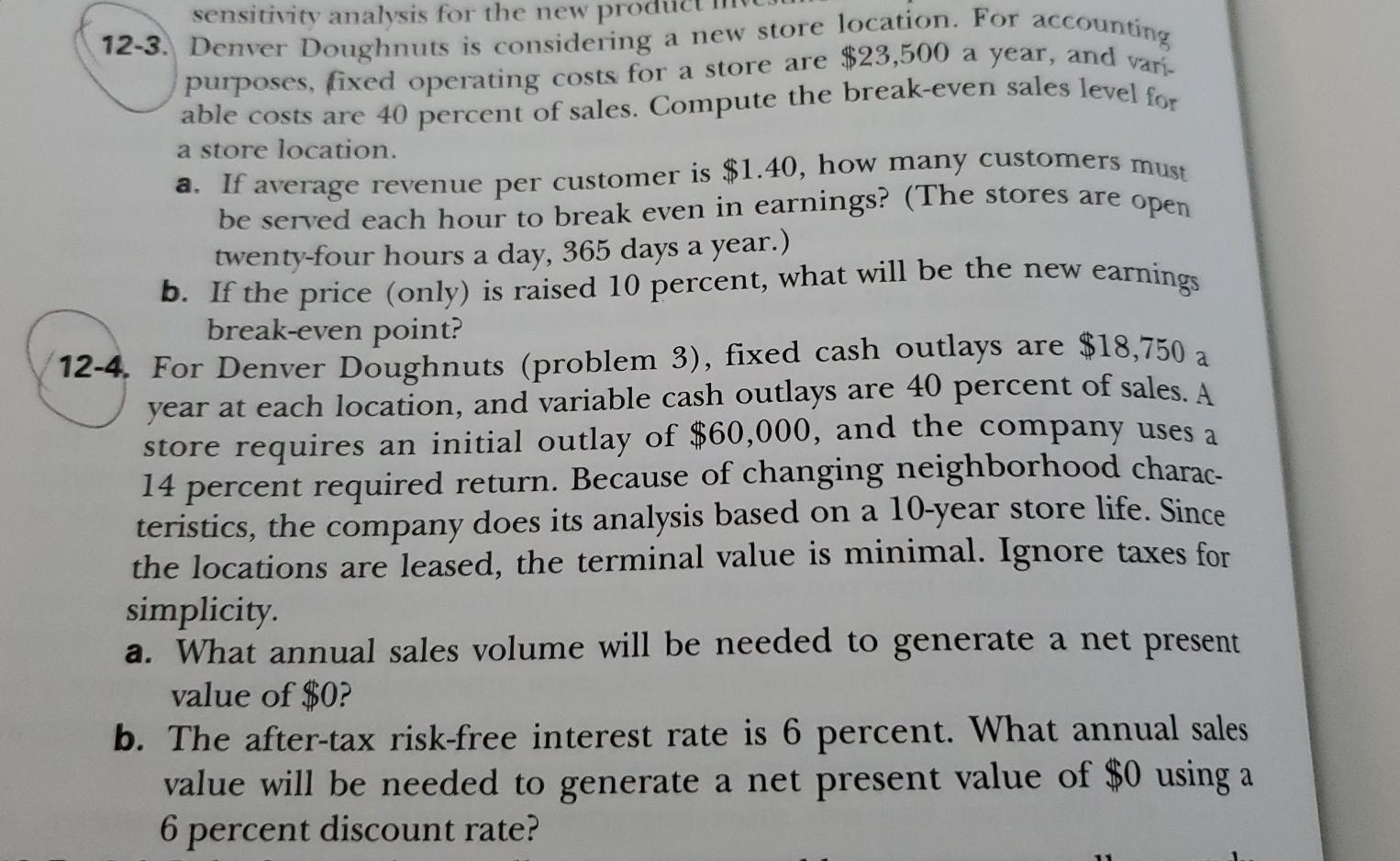

QUESTION 3 & 4 PLEASE sensitivity analysis for the new prodi 12-3. Denver Doughnuts is considering a new store location. For accounting purposes, fixed operating

QUESTION 3 & 4 PLEASE

sensitivity analysis for the new prodi 12-3. Denver Doughnuts is considering a new store location. For accounting purposes, fixed operating costs for a store are $23,500 a year, and van able costs are 40 percent of sales. Compute the break-even sales level to a store location. a. If average revenue per customer is $1.40, how many customers must earnings a be served each hour to break even in earnings? (The stores are open twenty-four hours a day, 365 days a year.) b. If the price (only) is raised 10 percent, what will be the new break-even point? 12-4. For Denver Doughnuts (problem 3), fixed cash outlays are $18,750 a year at each location, and variable cash outlays are 40 percent of sales. A store requires an initial outlay of $60,000, and the company uses a 14 percent required return. Because of changing neighborhood charac- teristics, the company does its analysis based on a 10-year store life. Since the locations are leased, the terminal value is minimal. Ignore taxes for simplicity. a. What annual sales volume will be needed to generate a net present value of $0? b. The after-tax risk-free interest rate is 6 percent. What annual sales value will be needed to generate a net present value of $0 using a 6 percent discount rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started