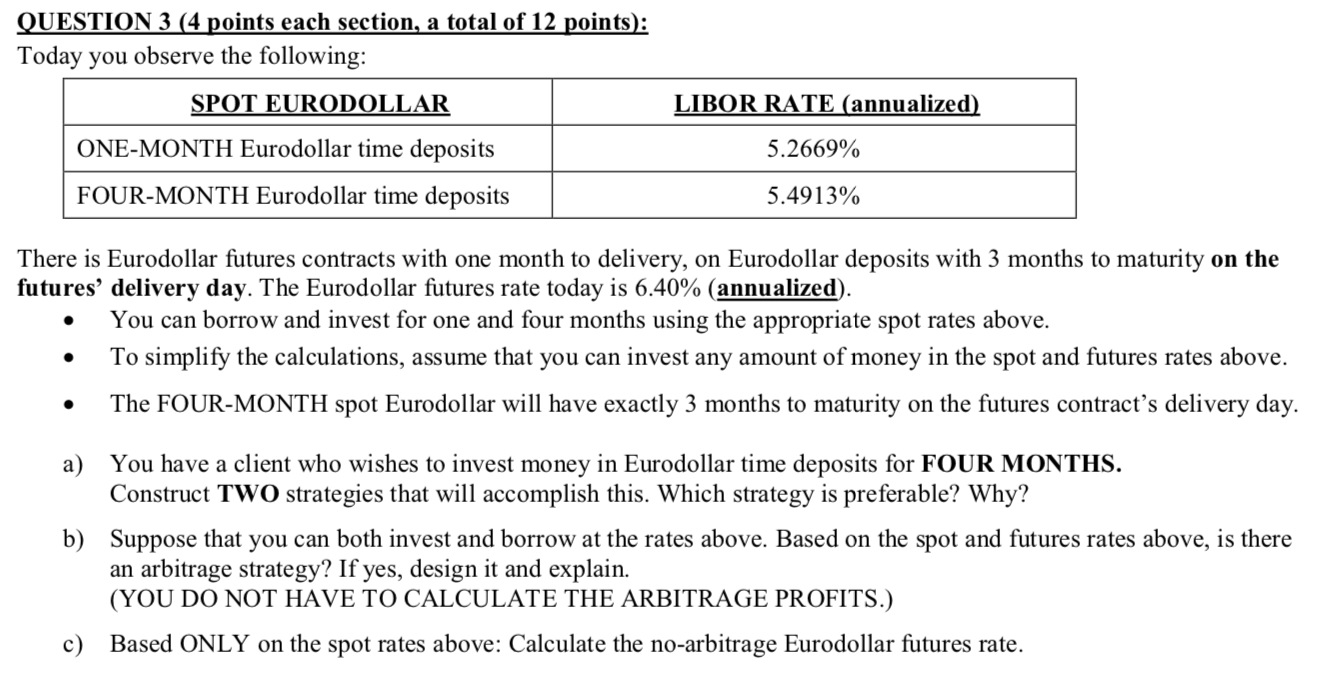

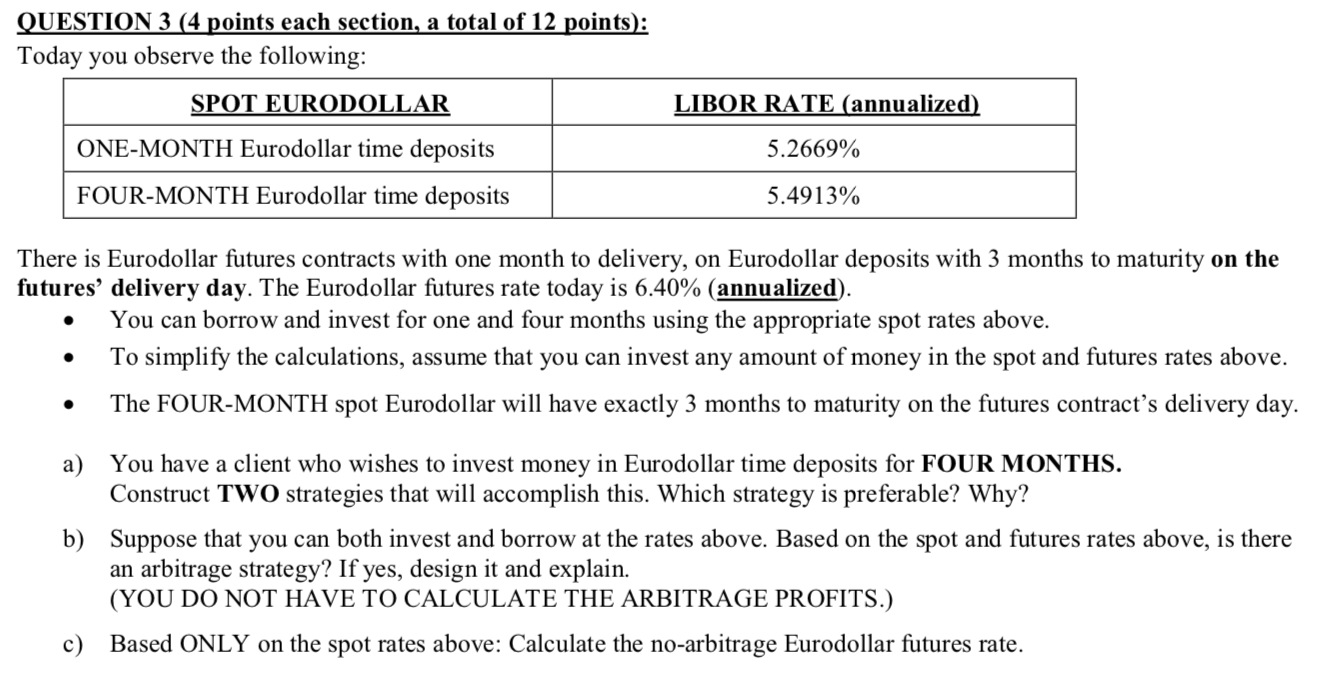

QUESTION 3 (4 points each section, a total of 12 points): Today you observe the following: SPOT EURODOLLAR LIBOR RATE (annualized) ONE-MONTH Eurodollar time deposits 5.2669% FOUR-MONTH Eurodollar time deposits 5.4913% There is Eurodollar futures contracts with one month to delivery, on Eurodollar deposits with 3 months to maturity on the futures' delivery day. The Eurodollar futures rate today is 6.40% (annualized). You can borrow and invest for one and four months using the appropriate spot rates above. To simplify the calculations, assume that you can invest any amount of money in the spot and futures rates above. The FOUR-MONTH spot Eurodollar will have exactly 3 months to maturity on the futures contract's delivery day. a) You have a client who wishes to invest money in Eurodollar time deposits for FOUR MONTHS. Construct TWO strategies that will accomplish this. Which strategy is preferable? Why? Suppose that you can both invest and borrow at the rates above. Based on the spot and futures rates above, is there an arbitrage strategy? If yes, design it and explain. (YOU DO NOT HAVE TO CALCULATE THE ARBITRAGE PROFITS.) c) Based ONLY on the spot rates above: Calculate the no-arbitrage Eurodollar futures rate. QUESTION 3 (4 points each section, a total of 12 points): Today you observe the following: SPOT EURODOLLAR LIBOR RATE (annualized) ONE-MONTH Eurodollar time deposits 5.2669% FOUR-MONTH Eurodollar time deposits 5.4913% There is Eurodollar futures contracts with one month to delivery, on Eurodollar deposits with 3 months to maturity on the futures' delivery day. The Eurodollar futures rate today is 6.40% (annualized). You can borrow and invest for one and four months using the appropriate spot rates above. To simplify the calculations, assume that you can invest any amount of money in the spot and futures rates above. The FOUR-MONTH spot Eurodollar will have exactly 3 months to maturity on the futures contract's delivery day. a) You have a client who wishes to invest money in Eurodollar time deposits for FOUR MONTHS. Construct TWO strategies that will accomplish this. Which strategy is preferable? Why? Suppose that you can both invest and borrow at the rates above. Based on the spot and futures rates above, is there an arbitrage strategy? If yes, design it and explain. (YOU DO NOT HAVE TO CALCULATE THE ARBITRAGE PROFITS.) c) Based ONLY on the spot rates above: Calculate the no-arbitrage Eurodollar futures rate