Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Big Screen Ltd is a company that manufactures flat screen televisions and is listed on the Johannesburg Stock Exchange. Mark Joust is the chief

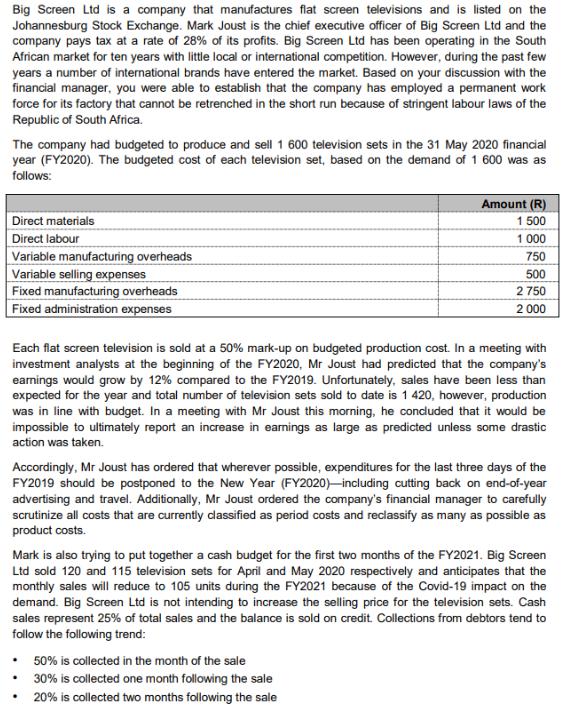

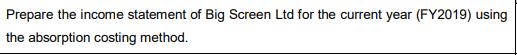

Big Screen Ltd is a company that manufactures flat screen televisions and is listed on the Johannesburg Stock Exchange. Mark Joust is the chief executive officer of Big Screen Ltd and the company pays tax at a rate of 28% of its profits. Big Screen Ltd has been operating in the South African market for ten years with little local or international competition. However, during the past few years a number of international brands have entered the market. Based on your discussion with the financial manager, you were able to establish that the company has employed a permanent work force for its factory that cannot be retrenched in the short run because of stringent labour laws of the Republic of South Africa. The company had budgeted to produce and sell 1 600 television sets in the 31 May 2020 financial year (FY2020). The budgeted cost of each television set, based on the demand of 1 600 was as follows: Amount (R) Direct materials Direct labour Variable manufacturing overheads Variable selling expenses Fixed manufacturing overheads Fixed administration expenses 1 500 1 000 750 500 2 750 2 000 Each flat screen television is sold at a 50% mark-up on budgeted production cost. In a meeting with investment analysts at the beginning of the FY2020, Mr Joust had predicted that the company's earmings would grow by 12% compared to the FY2019. Unfortunately, sales have been less than expected for the year and total number of television sets sold to date is 1 420, however, production was in line with budget. In a meeting with Mr Joust this morning, he concduded that it would be impossible to ultimately report an increase in eamings as large as predicted unless some drastic action was taken. Accordingly, Mr Joust has ordered that wherever possible, expenditures for the last three days of the FY2019 should be postponed to the New Year (FY2020)including cutting back on end-of-year advertising and travel. Additionally, Mr Joust ordered the company's financial manager to carefully scrutinize all costs that are currently dassified as period costs and reclassify as many as possible as product costs. Mark is also trying to put together a cash budget for the first two months of the FY2021. Big Screen Ltd sold 120 and 115 television sets for April and May 2020 respectively and anticipates that the monthly sales will reduce to 105 units during the FY2021 because of the Covid-19 impact on the demand. Big Screen Ltd is not intending to increase the selling price for the television sets. Cash sales represent 25% of total sales and the balance is sold on credit. Collections from debtors tend to follow the following trend: 50% is collected in the month of the sale 30% is collected one month following the sale 20% is collected two months following the sale Prepare the income statement of Big Screen Ltd for the current year (FY2019) using the absorption costing method.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Unit Cost Direct material 1500 Direct labor 1000 Variable manufact...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started