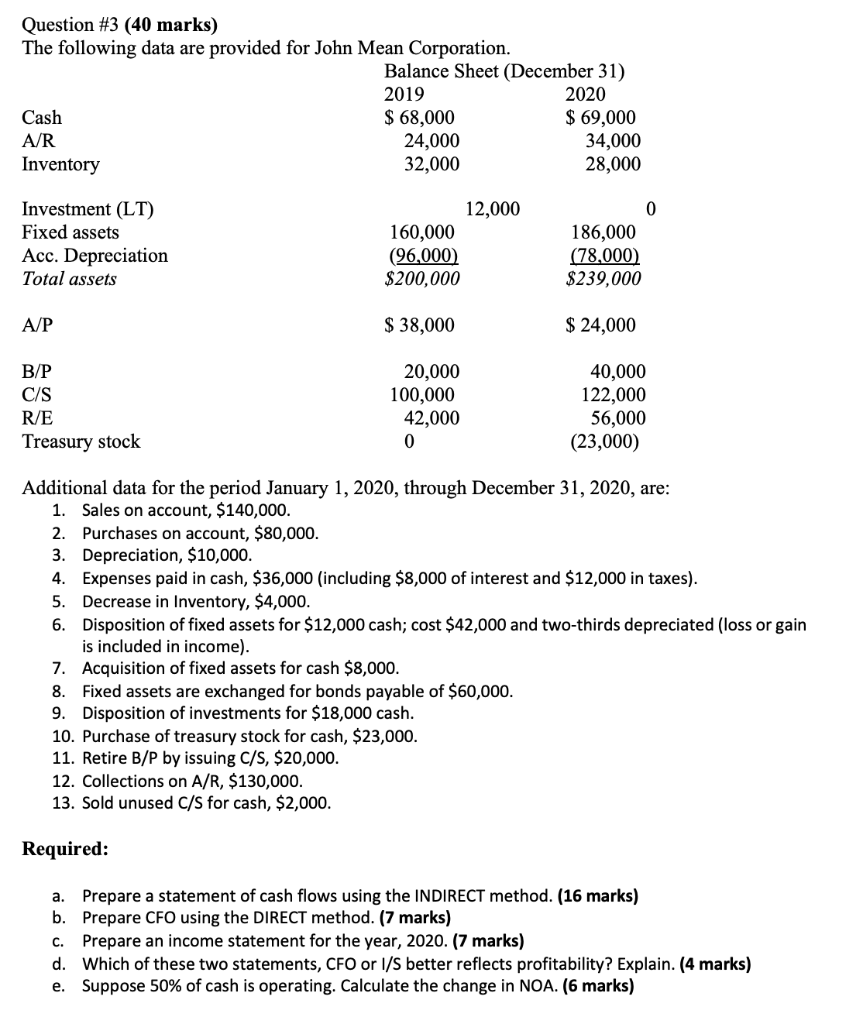

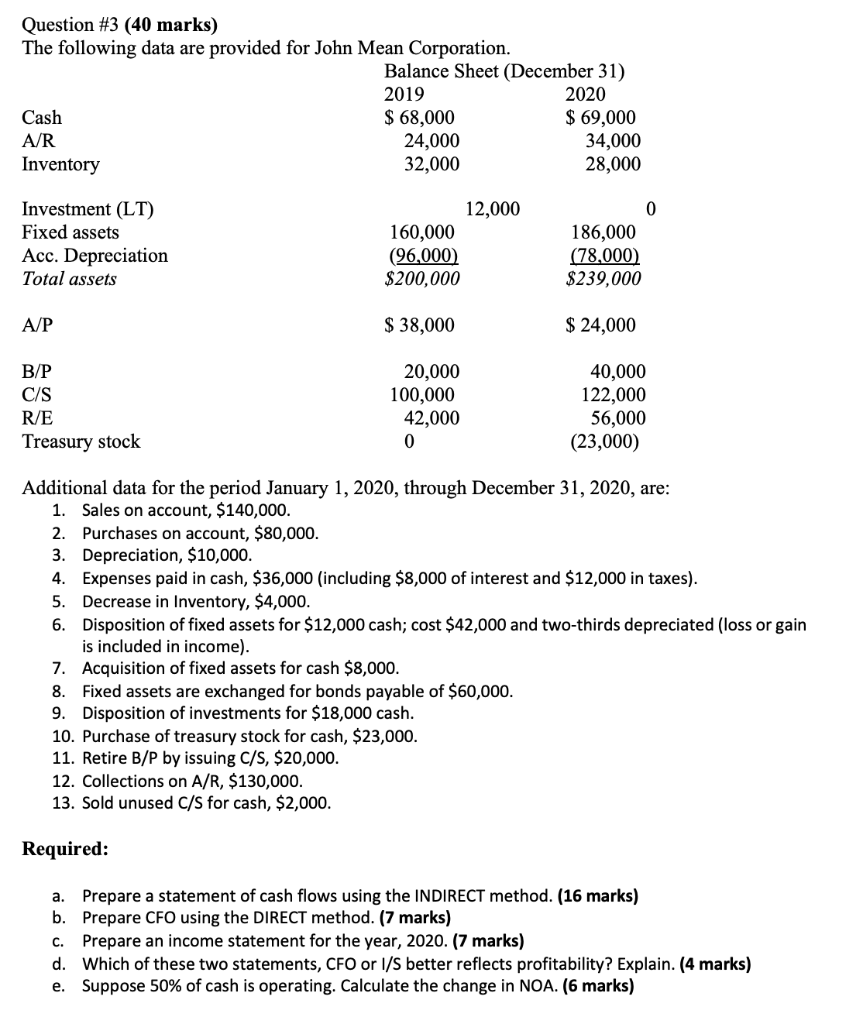

Question #3 (40 marks) The following data are provided for John Mean Corporation. Balance Sheet (December 31) 2019 2020 Cash $ 68,000 $ 69,000 AR 24,000 34,000 Inventory 32,000 28,000 Investment (LT) Fixed assets Acc. Depreciation Total assets 12,000 160,000 (96,000) $200,000 0 186,000 (78,000) $239,000 A/P $ 38,000 $ 24,000 B/P C/S R/E Treasury stock 20,000 100,000 42,000 0 40,000 122,000 56,000 (23,000) Additional data for the period January 1, 2020, through December 31, 2020, are: 1. Sales on account, $140,000. 2. Purchases on account, $80,000. 3. Depreciation, $10,000. 4. Expenses paid in cash, $36,000 (including $8,000 of interest and $12,000 in taxes). 5. Decrease in Inventory, $4,000. 6. Disposition of fixed assets for $12,000 cash; cost $42,000 and two-thirds depreciated (loss or gain is included in income). 7. Acquisition of fixed assets for cash $8,000. 8. Fixed assets are exchanged for bonds payable of $60,000. 9. Disposition of investments for $18,000 cash. 10. Purchase of treasury stock for cash, $23,000. 11. Retire B/P by issuing C/S, $20,000. 12. Collections on A/R, $130,000. 13. Sold unused C/S for cash, $2,000. Required: a. Prepare a statement of cash flows using the INDIRECT method. (16 marks) b. Prepare CFO using the DIRECT method. (7 marks) C. Prepare an income statement for the year, 2020. (7 marks) d. Which of these two statements, CFO or 1/S better reflects profitability? Explain. (4 marks) e. Suppose 50% of cash is operating. Calculate the change in NOA. (6 marks) Question #3 (40 marks) The following data are provided for John Mean Corporation. Balance Sheet (December 31) 2019 2020 Cash $ 68,000 $ 69,000 AR 24,000 34,000 Inventory 32,000 28,000 Investment (LT) Fixed assets Acc. Depreciation Total assets 12,000 160,000 (96,000) $200,000 0 186,000 (78,000) $239,000 A/P $ 38,000 $ 24,000 B/P C/S R/E Treasury stock 20,000 100,000 42,000 0 40,000 122,000 56,000 (23,000) Additional data for the period January 1, 2020, through December 31, 2020, are: 1. Sales on account, $140,000. 2. Purchases on account, $80,000. 3. Depreciation, $10,000. 4. Expenses paid in cash, $36,000 (including $8,000 of interest and $12,000 in taxes). 5. Decrease in Inventory, $4,000. 6. Disposition of fixed assets for $12,000 cash; cost $42,000 and two-thirds depreciated (loss or gain is included in income). 7. Acquisition of fixed assets for cash $8,000. 8. Fixed assets are exchanged for bonds payable of $60,000. 9. Disposition of investments for $18,000 cash. 10. Purchase of treasury stock for cash, $23,000. 11. Retire B/P by issuing C/S, $20,000. 12. Collections on A/R, $130,000. 13. Sold unused C/S for cash, $2,000. Required: a. Prepare a statement of cash flows using the INDIRECT method. (16 marks) b. Prepare CFO using the DIRECT method. (7 marks) C. Prepare an income statement for the year, 2020. (7 marks) d. Which of these two statements, CFO or 1/S better reflects profitability? Explain. (4 marks) e. Suppose 50% of cash is operating. Calculate the change in NOA. (6 marks)