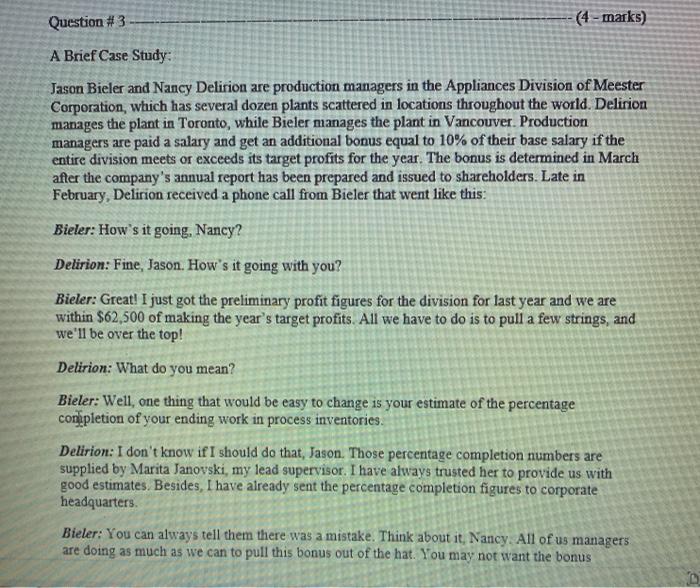

Question #3 -(4-marks) A Brief Case Study: Jason Bieler and Nancy Delirion are production managers in the Appliances Division of Meester Corporation, which has several dozen plants scattered in locations throughout the world. Delirion manages the plant in Toronto, while Bieler manages the plant in Vancouver. Production managers are paid a salary and get an additional bonus equal to 10% of their base salary if the entire division meets or exceeds its target profits for the year. The bonus is determined in March after the company's annual report has been prepared and issued to shareholders. Late in February, Delirion received a phone call from Bieler that went like this: Bieler: How's it going, Nancy? Delirion: Fine, Jason. How's it going with you? Bieler: Great! I just got the preliminary profit figures for the division for last year and we are within $62,500 of making the year's target profits. All we have to do is to pull a few strings, and we'll be over the top! Delirion: What do you mean? Bieler: Well, one thing that would be easy to change is your estimate of the percentage completion of your ending work in process inventories. Delirion: I don't know if I should do that, Jason. Those percentage completion numbers are supplied by Marita Janovski, my lead supervisor. I have always trusted her to provide us with good estimates. Besides, I have already sent the percentage completion figures to corporate headquarters. Bieler: You can always tell them there was a mistake. Think about it, Nancy. All of us managers are doing as much as we can to pull this bonus out of the hat. You may not want the bonus Bieler: You can always tell then there was a mistake, Think about it, Nancy. All of us managers are doing as much as we can to pull this bonus out of the hat You may not want the bonus cheque, but the rest of us sure could use it. The final processing department in Delirion's production facility began the year with no work in process inventories. During the year, 270,000 units were transferred in from the prior processing department and 250,000 units were completed and sold. Costs transferred in from the prior department totaled $49,221,000. No materials are added in the final processing department A total of $16,320,000 of conversion cost was incurred in the final processing department during the year. Required: 1. Janovski estimated that the units in ending inventory in the final processing department were 25% complete with respect to the conversion costs of the final processing department. If this estimate of the percentage completion is used, what will be the cost of goods sold for the year? I 2. What percentage completion figure would result in increasing the reported operating income by $62,500 over the operating income that would be reported if the 25% figure were used? D. Focus