Question: Question 3 5 pts In deciding the optimal capital structure for afirm, which consideration should be given the most weight? The imperative to maximize retained

Question

pts

In deciding the optimal capital structure for afirm, which consideration should be given the most weight?

The imperative to maximize retained earnings for future growth.

The firm's historical capital structure and its evolution over time.

The comparative cost of debt relative to equity financing.

The preferences expressed by the firm's largest shareholders.

The consistency of the firm's dividend payout ratios over recent years.

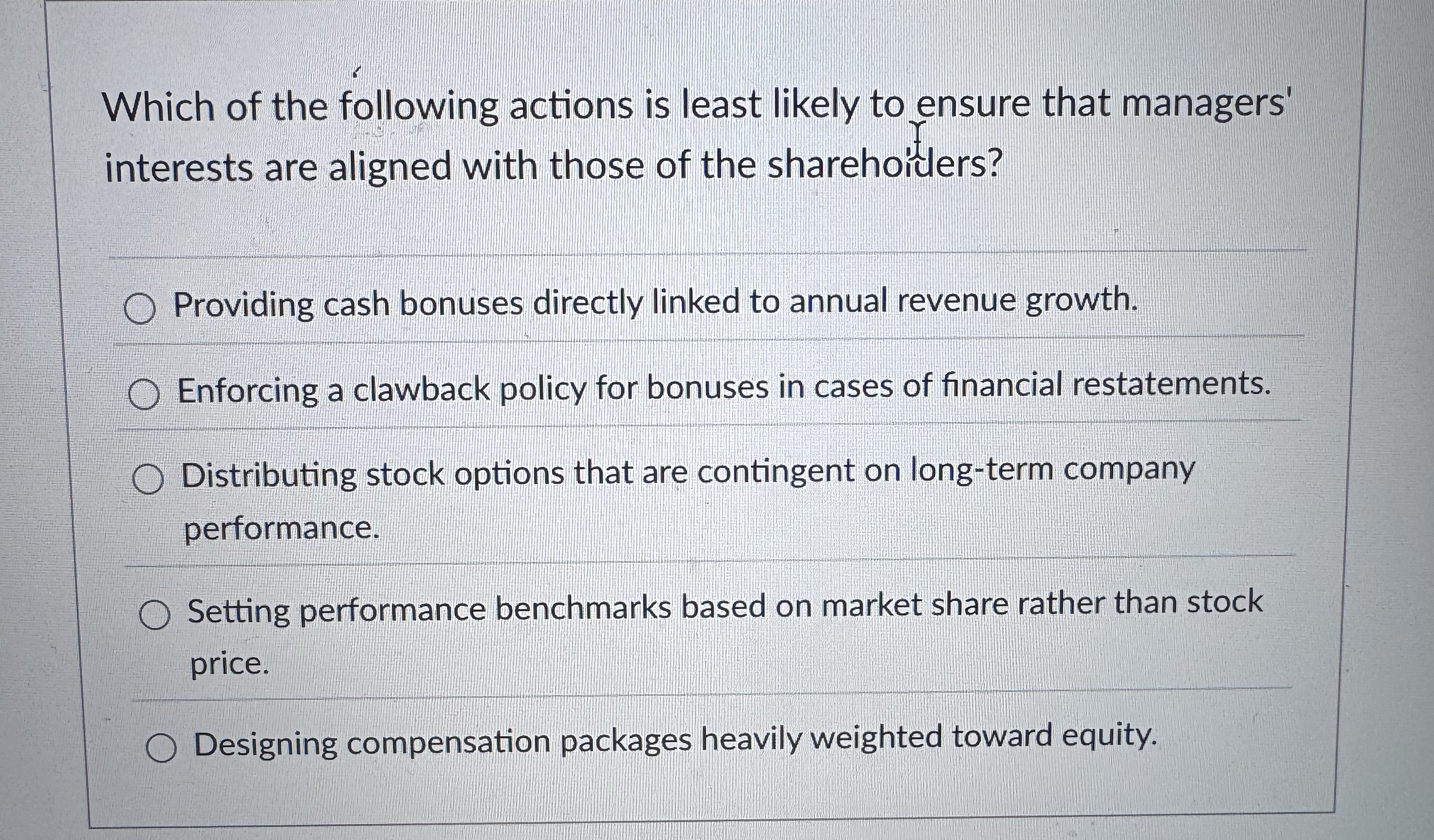

Which of the following actions is least likely to ensure that managers' interests are aligned with those of the sharehoiters?

Providing cash bonuses directly linked to annual revenue growth.

Enforcing a clawback policy for bonuses in cases of financial restatements.

Distributing stock options that are contingent on longterm company performance.

Setting performance benchmarks based on market share rather than stock price.

Designing compensation packages heavily weighted toward equity.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock