Answered step by step

Verified Expert Solution

Question

1 Approved Answer

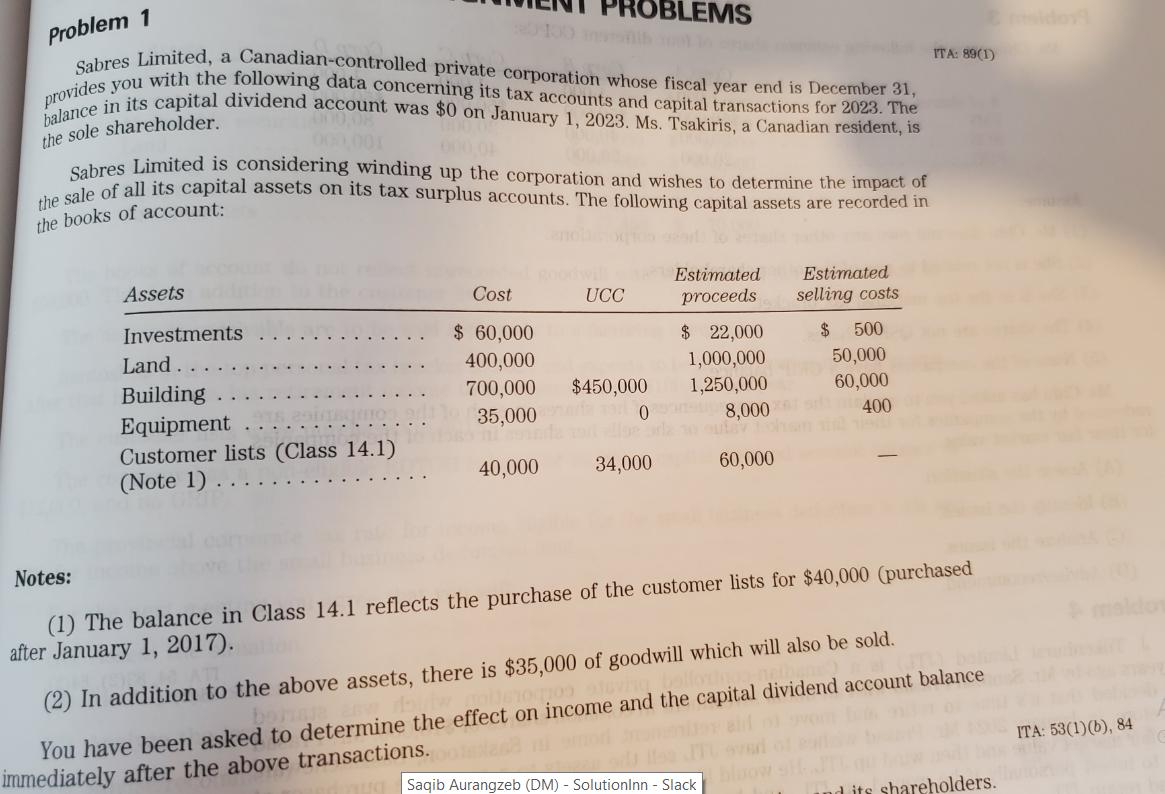

Problem 1 PROBLEMS Sabres Limited, a Canadian-controlled private corporation whose fiscal year end is December 31, provides you with the following data concerning its

Problem 1 PROBLEMS Sabres Limited, a Canadian-controlled private corporation whose fiscal year end is December 31, provides you with the following data concerning its tax accounts and capital transactions for 2023. The balance in its capital dividend account was $0 on January 1, 2023. Ms. Tsakiris, a Canadian resident, is the sole shareholder. 000,08 000,001 000,0 Sabres Limited is considering winding up the corporation and wishes to determine the impact of the sale of all its capital assets on its tax surplus accounts. The following capital assets are recorded in the books of account: Assets Investments Estimated selling costs goodwill Cost UCC Estimated proceeds $ 60,000 $ 22,000 $ 500 Land 400,000 1,000,000 50,000 Building 700,000 $450,000 1,250,000 60,000 Equipment 35,0000 8,000 400 Customer lists (Class 14.1) (Note 1) 40,000 34,000 60,000 ITA: 89(1) Notes: (1) The balance in Class 14.1 reflects the purchase of the customer lists for $40,000 (purchased after January 1, 2017). (2) In addition to the above assets, there is $35,000 of goodwill which will also be sold. bon You have been asked to determine the effect on income and the capital dividend account balance immediately after the above transactions. ni modi ITA: 53(1)(b), 84 Saqib Aurangzeb (DM) - SolutionInn - Slack d its shareholders.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Background Information Sabres Limited is a Canadiancontrolled private corporation Fiscal yearend December 31 2023 Balance in the capital dividend account on January 1 2023 0 Ms Tsakiris a Canadian res...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started