Answered step by step

Verified Expert Solution

Question

1 Approved Answer

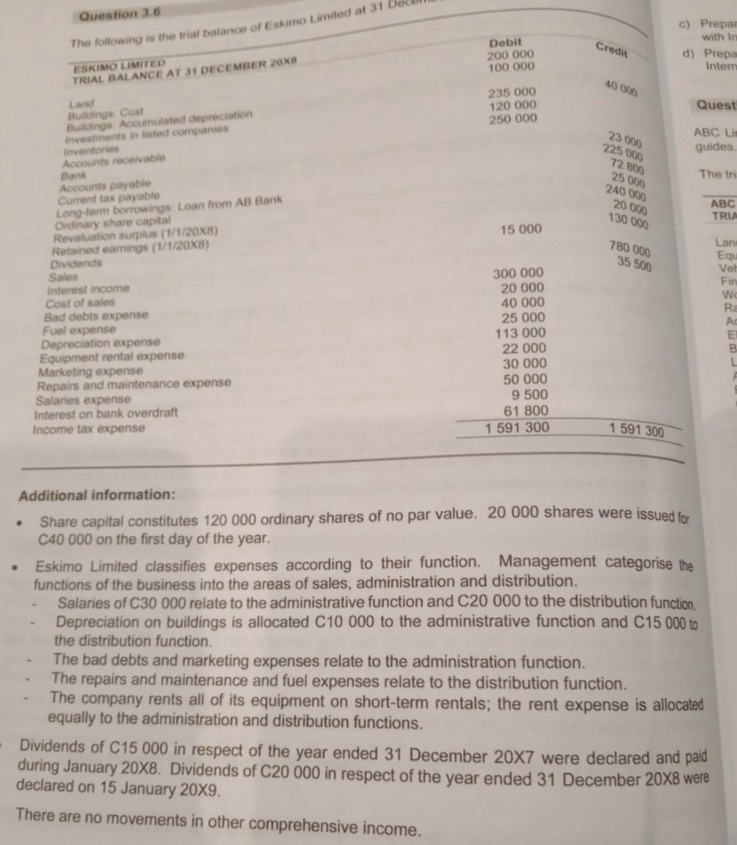

Question 3 . 6 The following is the inal balance of Eskimo Linited at 3 1 Additional information: Share capital constitutes 1 2 0 0

Question

The following is the inal balance of Eskimo Linited at

Additional information:

Share capital constitutes ordinary shares of no par value. shares were issued for C on the first day of the year.

Eskimo Limited classifies expenses according to their function. Management categorise the functions of the business into the areas of sales, administration and distribution.

Salaries of relate to the administrative function and to the distribution function.

Depreciation on buildings is allocated C to the administrative function and C to the distribution function.

The bad debts and marketing expenses relate to the administration function.

The repairs and maintenance and fuel expenses relate to the distribution function.

The company rents all of its equipment on shortterm rentals; the rent expense is allocated equally to the administration and distribution functions.

Dividends of in respect of the year ended December were declared and paid during January X Dividends of C in respect of the year ended December X were declared on January

There are no movements in other comprehensive income

aPrepare the statement of financial position of Eskimo Limited at December x in accordance with the international financial reportung standards.

cPrepare the "profit before tax" and "dividends" notes to the financial statements in accordance with Internationao financial reporting standards

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started