Answered step by step

Verified Expert Solution

Question

1 Approved Answer

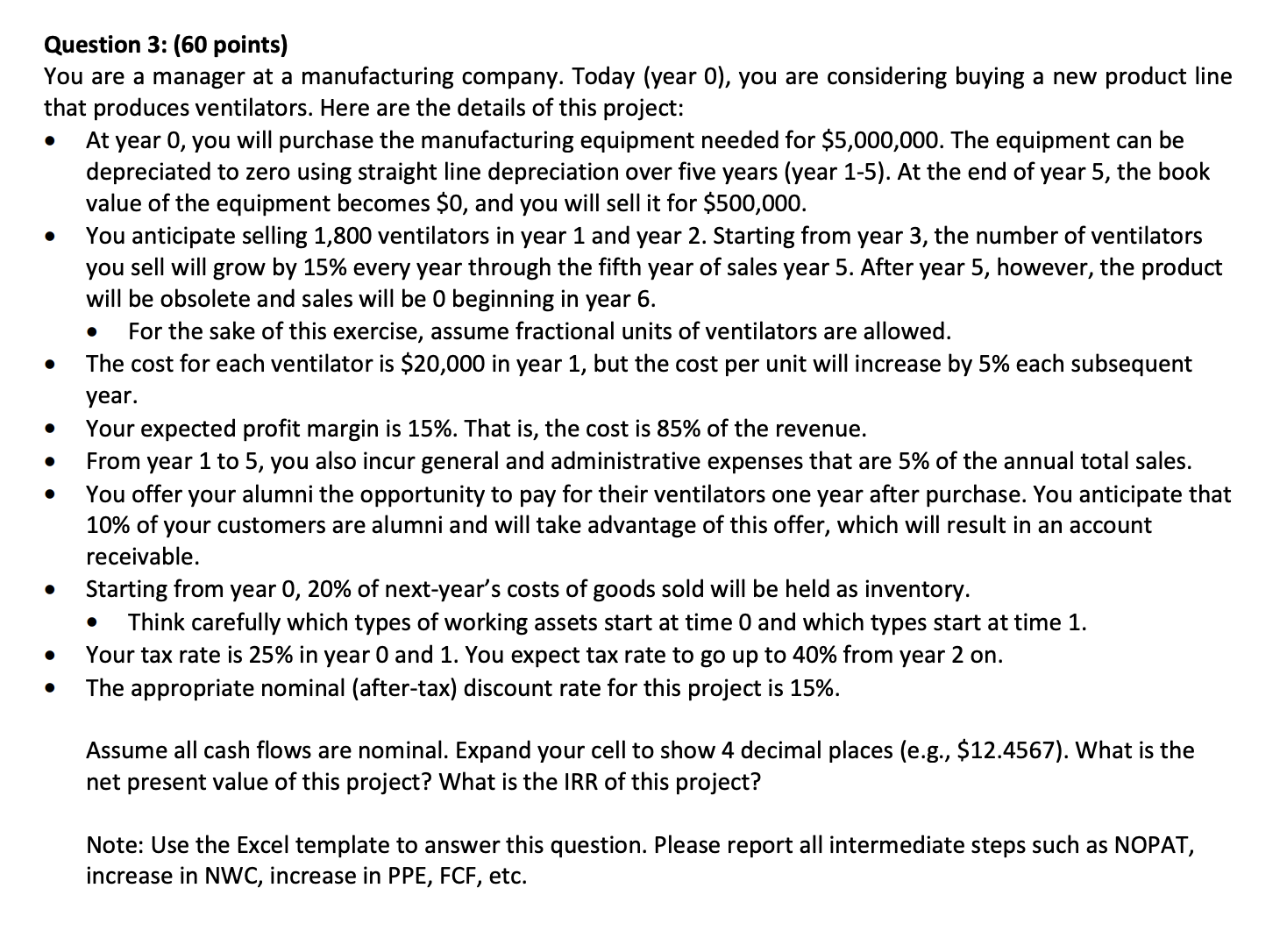

Question 3: (60 points) You are a manager at a manufacturing company. Today (year 0), you are considering buying a new product line that

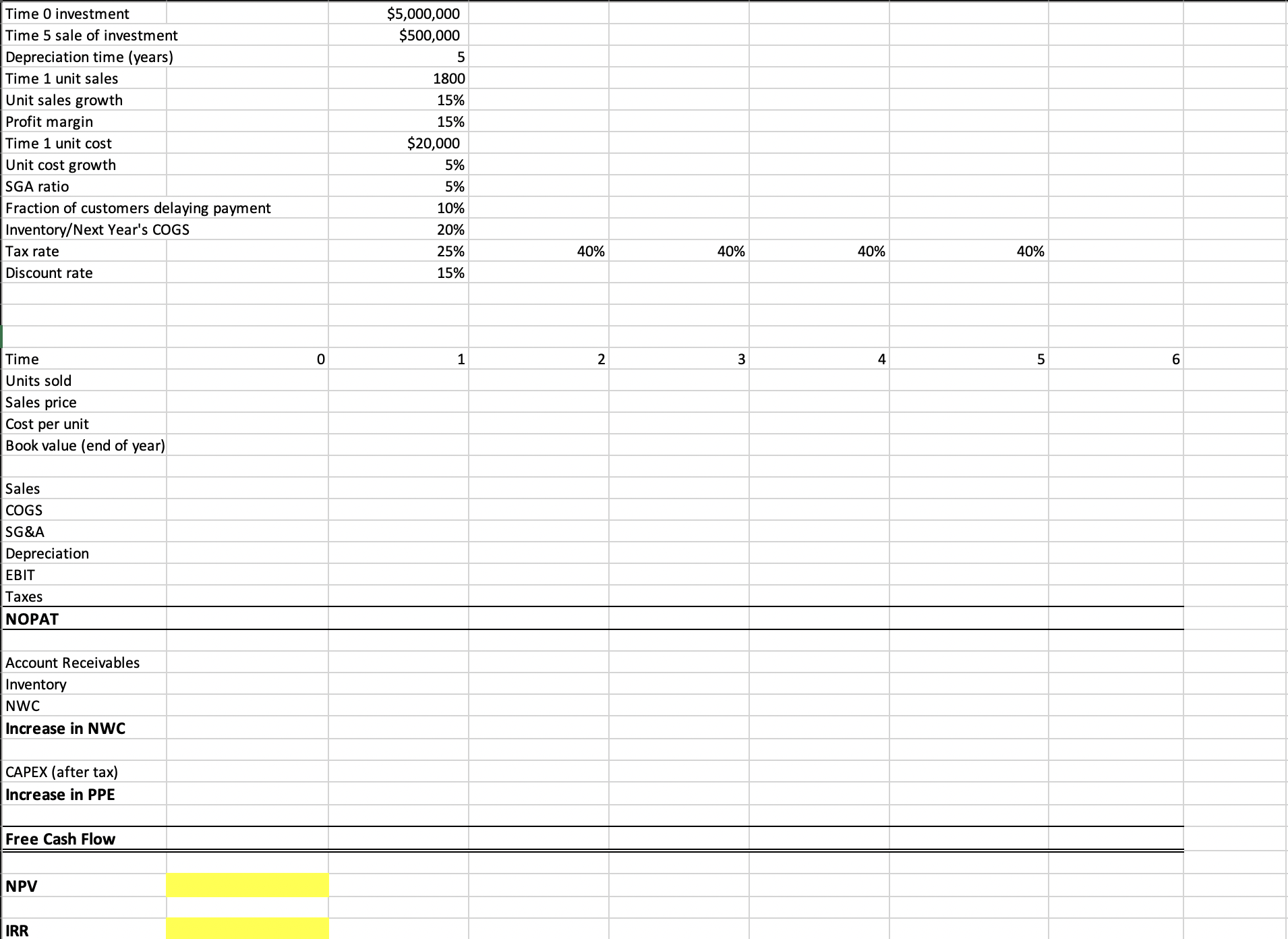

Question 3: (60 points) You are a manager at a manufacturing company. Today (year 0), you are considering buying a new product line that produces ventilators. Here are the details of this project: At year 0, you will purchase the manufacturing equipment needed for $5,000,000. The equipment can be depreciated to zero using straight line depreciation over five years (year 1-5). At the end of year 5, the book value of the equipment becomes $0, and you will sell it for $500,000. You anticipate selling 1,800 ventilators in year 1 and year 2. Starting from year 3, the number of ventilators you sell will grow by 15% every year through the fifth year of sales year 5. After year 5, however, the product will be obsolete and sales will be 0 beginning in year 6. For the sake of this exercise, assume fractional units of ventilators are allowed. The cost for each ventilator is $20,000 in year 1, but the cost per unit will increase by 5% each subsequent year. Your expected profit margin is 15%. That is, the cost is 85% of the revenue. From year 1 to 5, you also incur general and administrative expenses that are 5% of the annual total sales. You offer your alumni the opportunity to pay for their ventilators one year after purchase. You anticipate that 10% of your customers are alumni and will take advantage of this offer, which will result in an account receivable. Starting from year 0, 20% of next-year's costs of goods sold will be held as inventory. Think carefully which types of working assets start at time 0 and which types start at time 1. Your tax rate is 25% in year 0 and 1. You expect tax rate to go up to 40% from year 2 on. The appropriate nominal (after-tax) discount rate for this project is 15%. Assume all cash flows are nominal. Expand your cell to show 4 decimal places (e.g., $12.4567). What is the net present value of this project? What is the IRR of this project? Note: Use the Excel template to answer this question. Please report all intermediate steps such as NOPAT, increase in NWC, increase in PPE, FCF, etc. Time 0 investment Time 5 sale of investment Depreciation time (years) Time 1 unit sales Unit sales growth Profit margin $5,000,000 $500,000 5 1800 15% 15% Time 1 unit cost $20,000 Unit cost growth 5% SGA ratio 5% Fraction of customers delaying payment 10% Inventory/Next Year's COGS 20% Tax rate 25% 40% 40% 40% 40% Discount rate 15% Time Units sold Sales price Cost per unit Book value (end of year) Sales COGS SG&A Depreciation EBIT Taxes NOPAT Account Receivables Inventory NWC Increase in NWC CAPEX (after tax) Increase in PPE Free Cash Flow NPV IRR 0 1 2 3 4 5 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started