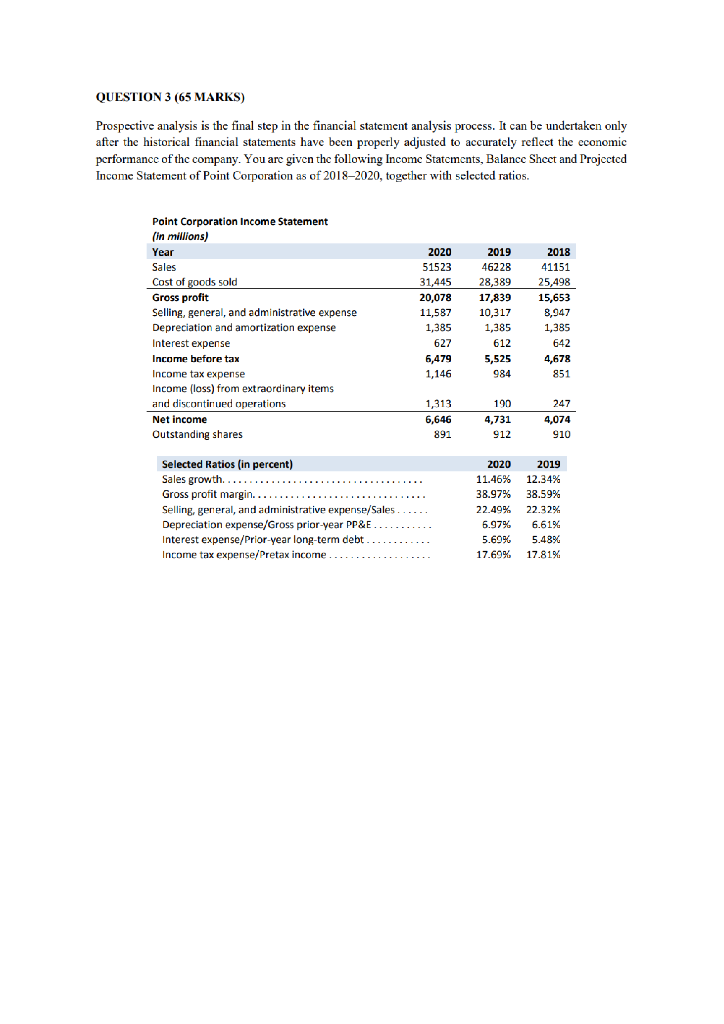

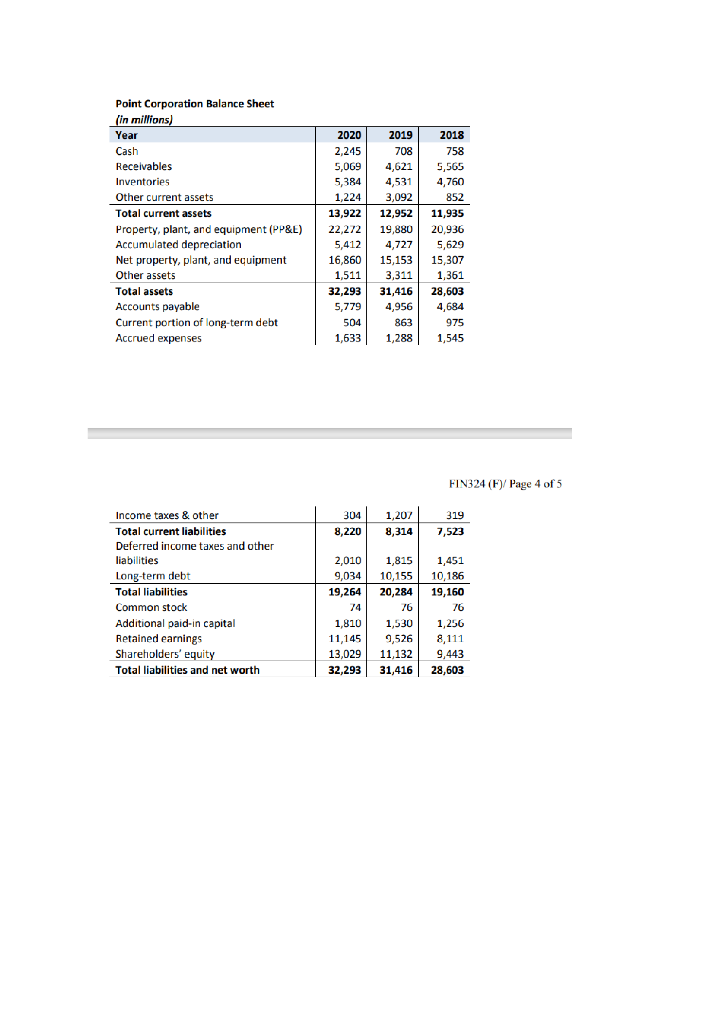

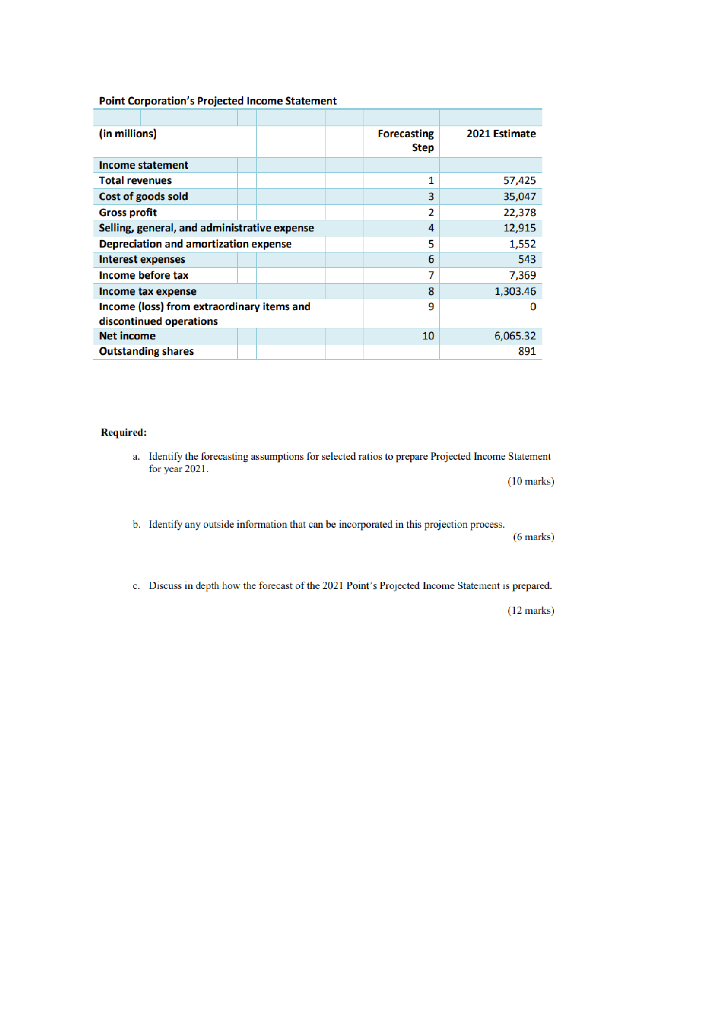

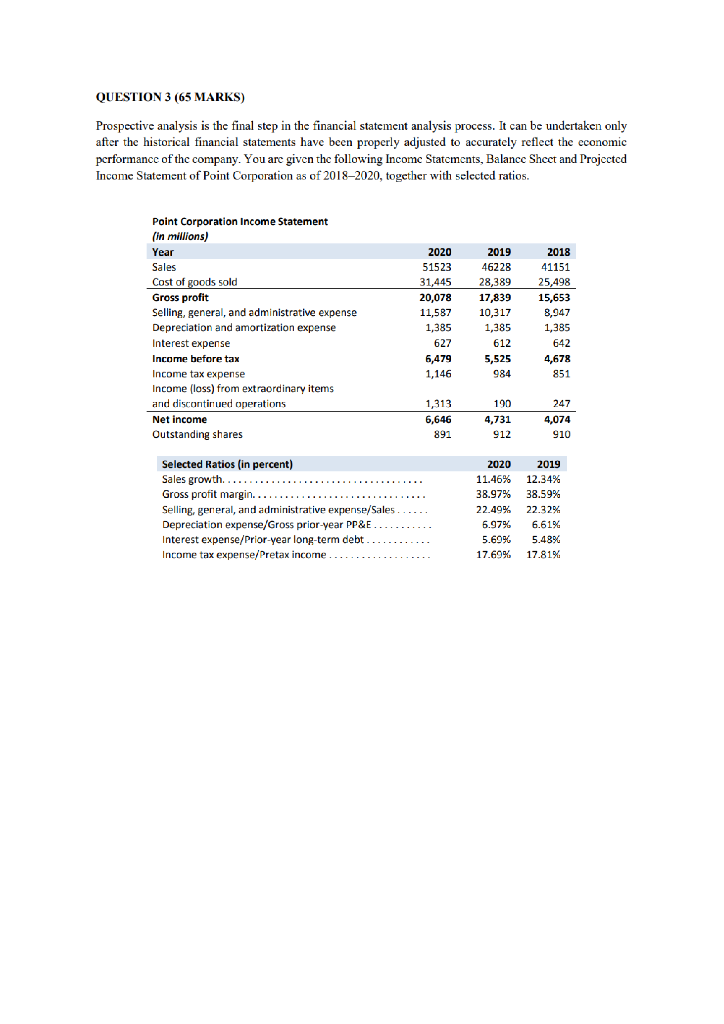

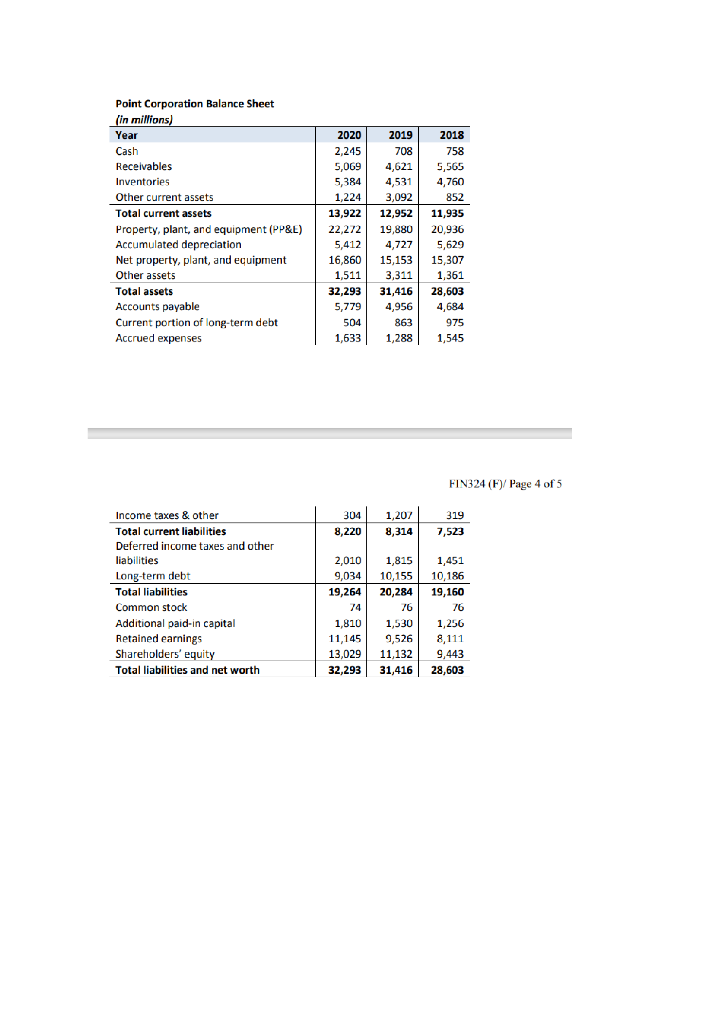

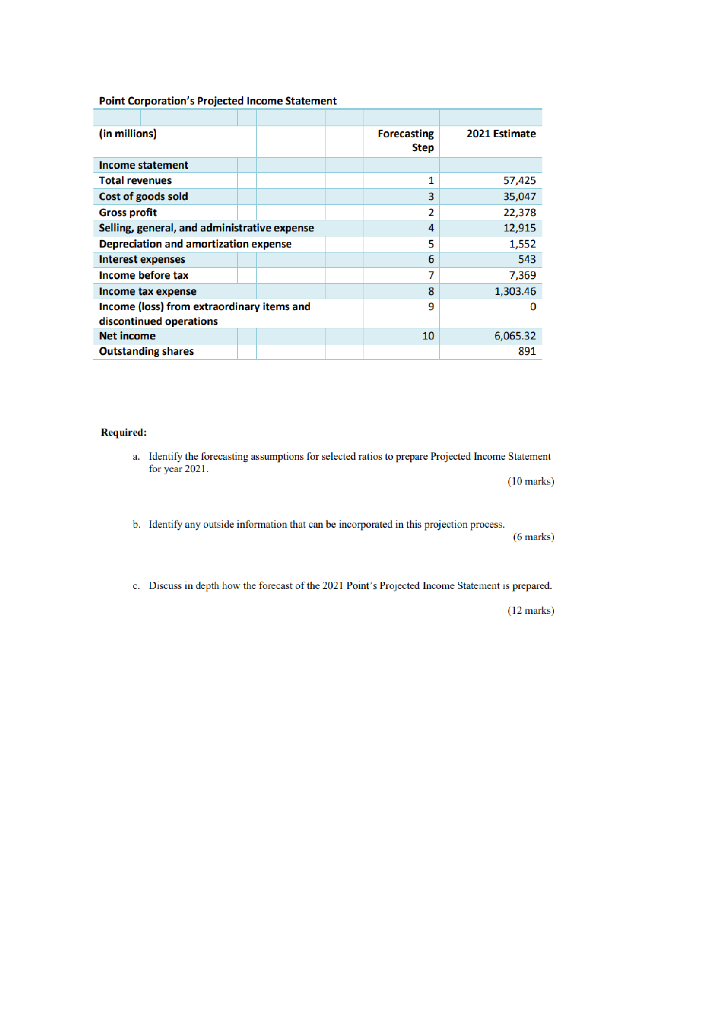

QUESTION 3 (65 MARKS) Prospective analysis is the final step in the financial statement analysis process. It can be undertaken only after the historical financial statements have been properly adjusted to accurately reflect the economic performance of the company. You are given the following Income Statements, Balance Sheet and Projected Income Statement of Point Corporation as of 2018-2020, together with selected ratios. Point Corporation Income Statement (in millions) Year Sales Cost of goods sold Gross profit Selling, general, and administrative expense Depreciation and amortization expense Interest expense Income before tax Income tax expense Income (loss) from extraordinary items and discontinued operations Net income Outstanding shares Selected Ratios (in percent) Sales growth...... Gross profit margin......... Selling, general, and administrative expense/Sales Depreciation expense/Gross prior-year PP&E Interest expense/Prior-year long-term debt Income tax expense/Pretax income 2020 51523 31,445 20,078 11,587 1,385 627 6,479 1,146 1,313 6,646 891 2019 2018 41151 46228 28,389 25,498 17,839 10,317 1,385 612 5,525 984 190 4,731 912 15,653 8,947 1,385 642 4,678 851 247 4,074 910 2020 2019 11.46% 12.34% 38.97% 38.59% 22.49% 6.97% 5.69% 17.69% 22.32% 6.61% 5.48% 17.81% Point Corporation Balance Sheet (in millions) Year Cash Receivables Inventories memorico Other current assets Total current assets Property, plant, and equipment (PP&E) Accumulated depreciation Net property, plant, and equipment Other assets Total assets Accounts payable Current portion of long-term debt Accrued expenses Income taxes & other Total current liabilities Deferred income taxes and other liabilities Long-term debt Total liabilities Common stock Additional paid-in capital Retained earnings Shareholders' equity Total liabilities and net worth 2020 2,245 5,069 2019 708 4,621 4,531 www 3,092 5,384 www 1,224 13,922 12,952 22,272 19,880 24,416 5,412 4,727 16,860 1,511 32,293 31,416 5,779 4,956 504 863 1,633 1,288 2,010 9,034 19,264 74 1,810 11,145 15,153 ww 3,311 2018 758 5,565 4,760 1,815 10.155 20,284 76 1,530 9,526 13,029 11,132 32,293 852 - 11,935 44,000 20,936 5,629 15.307 1.361 28,603 4,684 975 1,545 304 1,207 319 8,220 8,314 7,523 FIN324 (F)/ Page 4 of 5 1,451 10,186 19,160 76 1,256 8,111 9,443 31,416 28,603 Point Corporation's Projected Income Statement (in millions) Income statement Total revenues Cost of goods sold Coor Gross profit wwww Selling, general, and administrative expense Depreciation and amortization expense Interest expenses Income before tax Income tax expense Income (loss) from extraordinary items and discontinued operations Net income Outstanding shares Forecasting Step 1 3 2 4 - 5 6 7 8 9 10 2021 Estimate 57,425 35,047 22,378 12,915 1,552 543 7,369 1,303.46 D 6,065.32 891 Required: a. Identify the forecasting assumptions for selected ratios to prepare Projected Income Statement for year 2021. (10 marks) b. Identify any outside information that can be incorporated in this projection process. (6 marks) c. Discuss in depth how the forecast of the 2021 Point's Projected Income Statement is prepared. (12 marks) d. Discuss the importance of forecasting sales for Point Corporation. e. Calculate return on common equity for Year 2020 using year-end amounts and assuming no preferred dividends. (3 marks) f. Describe how do return on common equity and return on net operating assets differ? 2. (6 marks) h. Describe two methods of reporting cash flow from operations. (8 marks) What are the components of return on common shareholders' equity? Explain what do the components measure? (5 marks) (10 marks) i. How does Point Corporation use special charges to influence investors' perceptions regarding their company value? (5 marks) QUESTION 3 (65 MARKS) Prospective analysis is the final step in the financial statement analysis process. It can be undertaken only after the historical financial statements have been properly adjusted to accurately reflect the economic performance of the company. You are given the following Income Statements, Balance Sheet and Projected Income Statement of Point Corporation as of 2018-2020, together with selected ratios. Point Corporation Income Statement (in millions) Year Sales Cost of goods sold Gross profit Selling, general, and administrative expense Depreciation and amortization expense Interest expense Income before tax Income tax expense Income (loss) from extraordinary items and discontinued operations Net income Outstanding shares Selected Ratios (in percent) Sales growth...... Gross profit margin......... Selling, general, and administrative expense/Sales Depreciation expense/Gross prior-year PP&E Interest expense/Prior-year long-term debt Income tax expense/Pretax income 2020 51523 31,445 20,078 11,587 1,385 627 6,479 1,146 1,313 6,646 891 2019 2018 41151 46228 28,389 25,498 17,839 10,317 1,385 612 5,525 984 190 4,731 912 15,653 8,947 1,385 642 4,678 851 247 4,074 910 2020 2019 11.46% 12.34% 38.97% 38.59% 22.49% 6.97% 5.69% 17.69% 22.32% 6.61% 5.48% 17.81% Point Corporation Balance Sheet (in millions) Year Cash Receivables Inventories memorico Other current assets Total current assets Property, plant, and equipment (PP&E) Accumulated depreciation Net property, plant, and equipment Other assets Total assets Accounts payable Current portion of long-term debt Accrued expenses Income taxes & other Total current liabilities Deferred income taxes and other liabilities Long-term debt Total liabilities Common stock Additional paid-in capital Retained earnings Shareholders' equity Total liabilities and net worth 2020 2,245 5,069 2019 708 4,621 4,531 www 3,092 5,384 www 1,224 13,922 12,952 22,272 19,880 24,416 5,412 4,727 16,860 1,511 32,293 31,416 5,779 4,956 504 863 1,633 1,288 2,010 9,034 19,264 74 1,810 11,145 15,153 ww 3,311 2018 758 5,565 4,760 1,815 10.155 20,284 76 1,530 9,526 13,029 11,132 32,293 852 - 11,935 44,000 20,936 5,629 15.307 1.361 28,603 4,684 975 1,545 304 1,207 319 8,220 8,314 7,523 FIN324 (F)/ Page 4 of 5 1,451 10,186 19,160 76 1,256 8,111 9,443 31,416 28,603 Point Corporation's Projected Income Statement (in millions) Income statement Total revenues Cost of goods sold Coor Gross profit wwww Selling, general, and administrative expense Depreciation and amortization expense Interest expenses Income before tax Income tax expense Income (loss) from extraordinary items and discontinued operations Net income Outstanding shares Forecasting Step 1 3 2 4 - 5 6 7 8 9 10 2021 Estimate 57,425 35,047 22,378 12,915 1,552 543 7,369 1,303.46 D 6,065.32 891 Required: a. Identify the forecasting assumptions for selected ratios to prepare Projected Income Statement for year 2021. (10 marks) b. Identify any outside information that can be incorporated in this projection process. (6 marks) c. Discuss in depth how the forecast of the 2021 Point's Projected Income Statement is prepared. (12 marks) d. Discuss the importance of forecasting sales for Point Corporation. e. Calculate return on common equity for Year 2020 using year-end amounts and assuming no preferred dividends. (3 marks) f. Describe how do return on common equity and return on net operating assets differ? 2. (6 marks) h. Describe two methods of reporting cash flow from operations. (8 marks) What are the components of return on common shareholders' equity? Explain what do the components measure? (5 marks) (10 marks) i. How does Point Corporation use special charges to influence investors' perceptions regarding their company value