Answered step by step

Verified Expert Solution

Question

1 Approved Answer

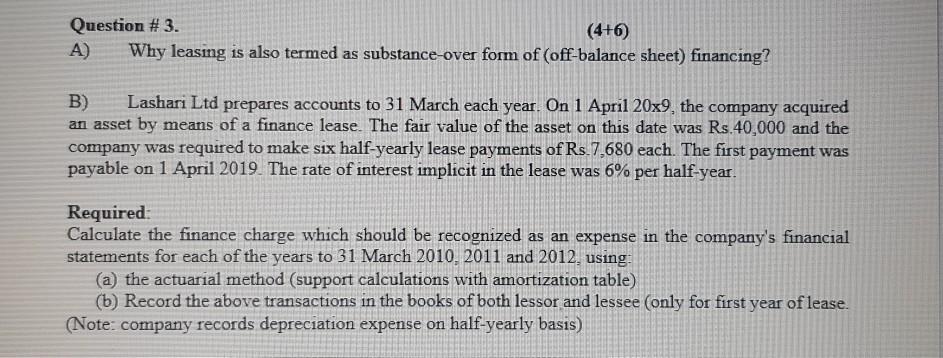

Question # 3. A) (4+6) Why leasing is also termed as substance-over form of (off-balance sheet) financing? Lashari Ltd prepares accounts to 31 March

Question # 3. A) (4+6) Why leasing is also termed as substance-over form of (off-balance sheet) financing? Lashari Ltd prepares accounts to 31 March each year. On 1 April 20x9, the company acquired B) an asset by means of a finance lease. The fair value of the asset on this date was Rs.40,000 and the company was required to make six half-yearly lease payments of Rs.7,680 each. The first payment was payable on 1 April 2019 The rate of interest implicit in the lease was 6% per half-year. Required: Calculate the finance charge which should be recognized as an expense in the company's financial statements for each of the years to 31 March 2010, 2011 and 2012, using: (a) the actuarial method (support calculations with amortization table) (b) Record the above transactions in the books of both lessor and lessee (only for first year of lease. (Note: company records depreciation expense on half-yearly basis)

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

A Substance over form is an accounting concept which means that the economic substance of transactio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started