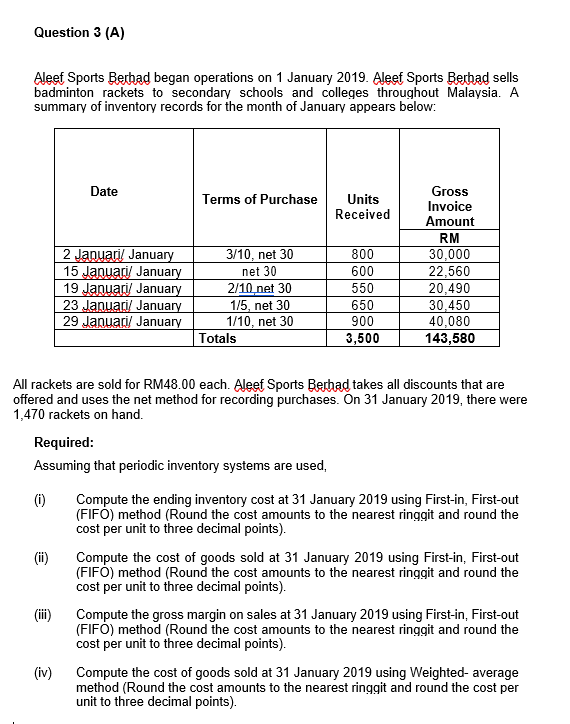

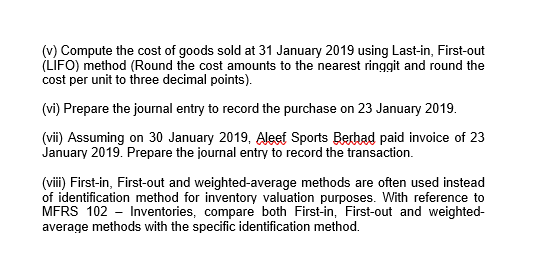

Question 3 (A) Aleef Sports Berhad began operations on 1 January 2019. Aleef Sports Berhad sells badminton rackets to secondary schools and colleges throughout Malaysia. A summary of inventory records for the month of January appears below: Date Terms of Purchase Units Received 2 Januari/ January 15 Januari January 19 Januari January 23 Januari January 29 Januari/ January 3/10, net 30 net 30 2/10 net 30 1/5, net 30 1/10, net 30 Totals 800 600 550 650 900 3,500 Gross Invoice Amount RM 30,000 22,560 20,490 30,450 40,080 143,580 All rackets are sold for RM48.00 each. Aleef Sports Berhad takes all discounts that are offered and uses the net method for recording purchases. On 31 January 2019, there were 1,470 rackets on hand. Required: Assuming that periodic inventory systems are used, (0) (ii) Compute the ending inventory cost at 31 January 2019 using First-in, First-out (FIFO) method (Round the cost amounts to the nearest ringgit and round the cost per unit to three decimal points). Compute the cost of goods sold at 31 January 2019 using First-in, First-out (FIFO) method (Round the cost amounts to the nearest ringgit and round the cost per unit to three decimal points). Compute the gross margin on sales at 31 January 2019 using First-in, First-out (FIFO) method (Round the cost amounts to the nearest ringgit and round the cost per unit to three decimal points). Compute the cost of goods sold at 31 January 2019 using Weighted average method (Round the cost amounts to the nearest ringgit and round the cost per unit to three decimal points). ii) (iv) (v) Compute the cost of goods sold at 31 January 2019 using Last-in, First-out (LIFO) method (Round the cost amounts to the nearest ringgit and round the cost per unit to three decimal points). (vi) Prepare the journal entry to record the purchase on 23 January 2019. (vii) Assuming on 30 January 2019, Aleef Sports Berhad paid invoice of 23 January 2019. Prepare the journal entry to record the transaction. (viii) First-in, First-out and weighted average methods are often used instead of identification method for inventory valuation purposes. With reference to MFRS 102 - Inventories, compare both First-in, First-out and weighted- average methods with the specific identification method