Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3. (a) Cox Ross and Rubinstein published their seminal paper where they developed the Binomial Option Pricing Method (BOPM) in 1979. In particular they

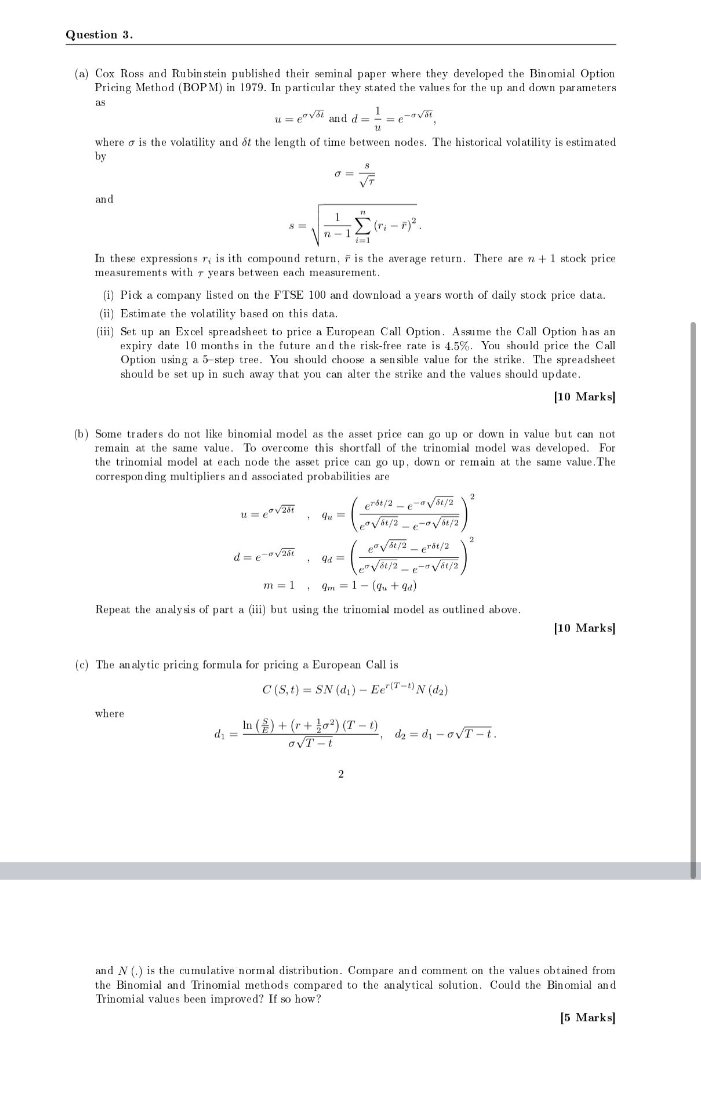

Question 3. (a) Cox Ross and Rubinstein published their seminal paper where they developed the Binomial Option Pricing Method (BOPM) in 1979. In particular they stated the values for the up and down parameters u = eV and da 1 35 where o is the volatility and St the length of time between nodes. The historical volatility is estimated by VT and 1 In these expressions ri is ith compound return, F is the average return. There are n + 1 stock price measurements with 7 years between each measurement. (i) Pick a company listed on the FTSE 100 and download a years worth of daily stock price data. (ii) Estimate the volatility based on this data. (iii) Set up an Excel spreadsheet to price a European Call Option. Assime the Call Option has an expiry date 10 months in the future and the risk-free rate is 4.5%. You should price the Call Option using a 5-step tree. You should choose a sensible value for the strike. The spreadsheet should be set up in such away that you can alter the strike and the values should update. [10 Marks] (b) Some traders do not like binomial model as the asset price can go up or down in value but can not remain at the same value. To overcome this shortfall of the trinomial model was developed. For the trinomial model at each node the asset price can go up, down remain at the same value. The corresponding multipliers and associated probabilities are 2 ent/ 2-1/2 8/2--/ 51/2 - 18/2 4d le/81/ 2012 m = 1, 9m = 1 - (0..+ ) Repeat the analysis of part (iii) but using the trinomial model as outlined above. (10 Marks) + (c) The analytic pricing formula for pricing a European Call is C(s, t) = SN (di) - EerT-N (da) where In () + (r +202) (T-) de = di-VT-7. OVT-7 2 and ) is the cumulative normal distribution. Compare and comment on the values obtained from the Binomial and Trinomial methods compared to the analytical solution. Could the Binomial and Trinomial values been improved? If so how? [5 Marks Question 3. (a) Cox Ross and Rubinstein published their seminal paper where they developed the Binomial Option Pricing Method (BOPM) in 1979. In particular they stated the values for the up and down parameters u = eV and da 1 35 where o is the volatility and St the length of time between nodes. The historical volatility is estimated by VT and 1 In these expressions ri is ith compound return, F is the average return. There are n + 1 stock price measurements with 7 years between each measurement. (i) Pick a company listed on the FTSE 100 and download a years worth of daily stock price data. (ii) Estimate the volatility based on this data. (iii) Set up an Excel spreadsheet to price a European Call Option. Assime the Call Option has an expiry date 10 months in the future and the risk-free rate is 4.5%. You should price the Call Option using a 5-step tree. You should choose a sensible value for the strike. The spreadsheet should be set up in such away that you can alter the strike and the values should update. [10 Marks] (b) Some traders do not like binomial model as the asset price can go up or down in value but can not remain at the same value. To overcome this shortfall of the trinomial model was developed. For the trinomial model at each node the asset price can go up, down remain at the same value. The corresponding multipliers and associated probabilities are 2 ent/ 2-1/2 8/2--/ 51/2 - 18/2 4d le/81/ 2012 m = 1, 9m = 1 - (0..+ ) Repeat the analysis of part (iii) but using the trinomial model as outlined above. (10 Marks) + (c) The analytic pricing formula for pricing a European Call is C(s, t) = SN (di) - EerT-N (da) where In () + (r +202) (T-) de = di-VT-7. OVT-7 2 and ) is the cumulative normal distribution. Compare and comment on the values obtained from the Binomial and Trinomial methods compared to the analytical solution. Could the Binomial and Trinomial values been improved? If so how? [5 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started