Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: (a) Harib, a resident of the UK has sold and gifted the following assets during the tax year 2020/21: (i) Harib purchased

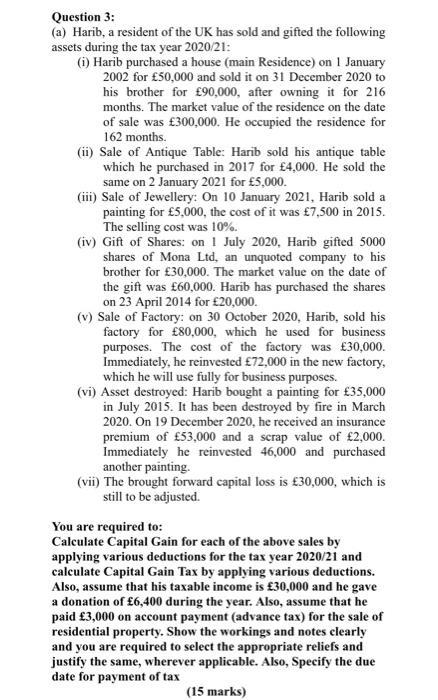

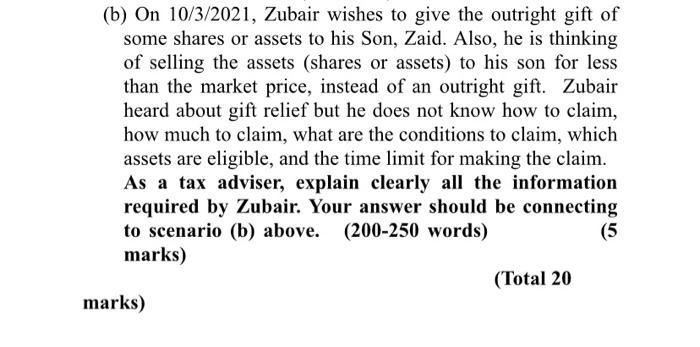

Question 3: (a) Harib, a resident of the UK has sold and gifted the following assets during the tax year 2020/21: (i) Harib purchased a house (main Residence) on 1 January 2002 for 50,000 and sold it on 31 December 2020 to his brother for 90,000, after owning it for 216 months. The market value of the residence on the date of sale was 300,000. He occupied the residence for 162 months. (ii) Sale of Antique Table: Harib sold his antique table which he purchased in 2017 for 4,000. He sold the same on 2 January 2021 for 5,000. (iii) Sale of Jewellery: On 10 January 2021, Harib sold a painting for 5,000, the cost of it was 7,500 in 2015. The selling cost was 10%. (iv) Gift of Shares: on 1 July 2020, Harib gifted 5000 shares of Mona Ltd, an unquoted company to his brother for 30,000. The market value on the date of the gift was 60,000. Harib has purchased the shares on 23 April 2014 for 20,000. (v) Sale of Factory: on 30 October 2020, Harib, sold his factory for 80,000, which he used for business purposes. The cost of the factory was 30,000. Immediately, he reinvested 72,000 in the new factory, which he will use fully for business purposes. (vi) Asset destroyed: Harib bought a painting for 35,000 in July 2015. It has been destroyed by fire in March 2020. On 19 December 2020, he received an insurance premium of 53,000 and a scrap value of 2,000. Immediately he reinvested 46,000 and purchased another painting. (vii) The brought forward capital loss is 30,000, which is still to be adjusted. You are required to: Calculate Capital Gain for each of the above sales by applying various deductions for the tax year 2020/21 and calculate Capital Gain Tax by applying various deductions. Also, assume that his taxable income is 30,000 and he gave a donation of 6,400 during the year. Also, assume that he paid 3,000 on account payment (advance tax) for the sale of residential property. Show the workings and notes clearly and you are required to select the appropriate reliefs and justify the same, wherever applicable. Also, Specify the due date for payment of tax (15 marks) (b) On 10/3/2021, Zubair wishes to give the outright gift of some shares or assets to his Son, Zaid. Also, he is thinking of selling the assets (shares or assets) to his son for less than the market price, instead of an outright gift. Zubair heard about gift relief but he does not know how to claim, how much to claim, what are the conditions to claim, which assets are eligible, and the time limit for making the claim. As a tax adviser, explain clearly all the information required by Zubair. Your answer should be connecting to scenario (b) above. (200-250 words) (5 marks) marks) (Total 20

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Calculation of Capital Gains and Capital Gains Tax i Capital gain on the sale of the main residence Proceeds of sale 90000 Less Cost of acquisition 50000300000 x 90000 15000 Less Cost of impr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started