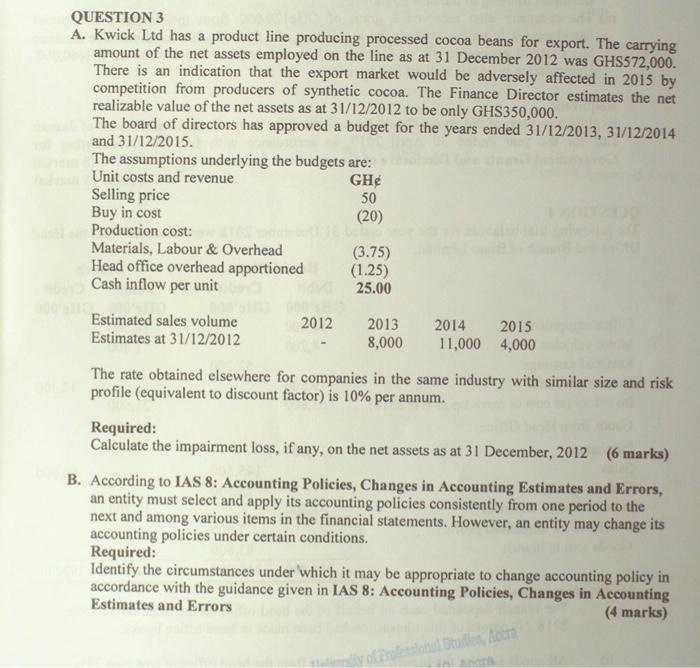

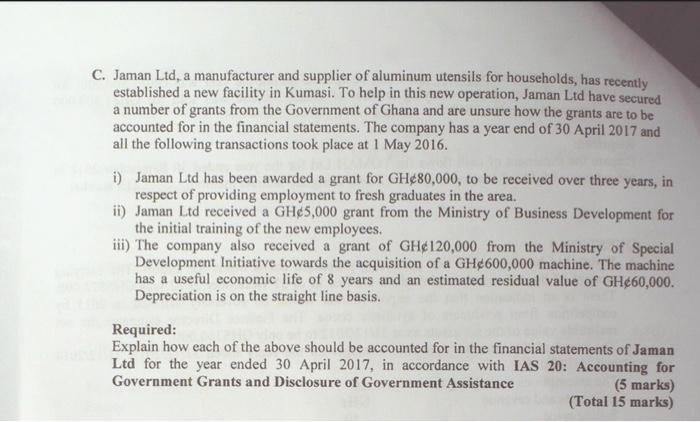

QUESTION 3 A. Kwick Ltd has a product line producing processed cocoa beans for export. The carrying amount of the net assets employed on the line as at 31 December 2012 was GHS572,000. There is an indication that the export market would be adversely affected in 2015 by competition from producers of synthetic cocoa. The Finance Director estimates the net realizable value of the net assets as at 31/12/2012 to be only GHS350,000. The board of directors has approved a budget for the years ended 31/12/2013, 31/12/2014 and 31/12/2015 The assumptions underlying the budgets are: Unit costs and revenue GH Selling price 50 Buy in cost (20) Production cost: Materials, Labour & Overhead (3.75) Head office overhead apportioned (1.25) Cash inflow per unit 25.00 Estimated sales volume 2012 2013 2014 2015 Estimates at 31/12/2012 8,000 11,000 4,000 The rate obtained elsewhere for companies in the same industry with similar size and risk profile (equivalent to discount factor) is 10% per annum. Required: Calculate the impairment loss, if any, on the net assets as at 31 December, 2012 (6 marks) B. According to IAS 8: Accounting Policies, Changes in Accounting Estimates and Errors, an entity must select and apply its accounting policies consistently from one period to the next and among various items in the financial statements. However, an entity may change its accounting policies under certain conditions. Required: Identify the circumstances under which it may be appropriate to change accounting policy in accordance with the guidance given in IAS 8: Accounting Policies, Changes in Accounting Estimates and Errors (4 marks) Store C. Jaman Ltd, a manufacturer and supplier of aluminum utensils for households, has recently established a new facility in Kumasi. To help in this new operation, Jaman Ltd have secured a number of grants from the Government of Ghana and are unsure how the grants are to be accounted for in the financial statements. The company has a year end of 30 April 2017 and all the following transactions took place at 1 May 2016. i) Jaman Ltd has been awarded a grant for GH80,000, to be received over three years, in respect of providing employment to fresh graduates in the area. ii) Jaman Ltd received a GH5,000 grant from the Ministry of Business Development for the initial training of the new employees. iii) The company also received a grant of GH120,000 from the Ministry of Special Development Initiative towards the acquisition of a GH600,000 machine. The machine has a useful economic life of 8 years and an estimated residual value of GH60,000. Depreciation is on the straight line basis. Required: Explain how each of the above should be accounted for in the financial statements of Jaman Ltd for the year ended 30 April 2017, in accordance with IAS 20: Accounting for Government Grants and Disclosure of Government Assistance (5 marks) (Total 15 marks)