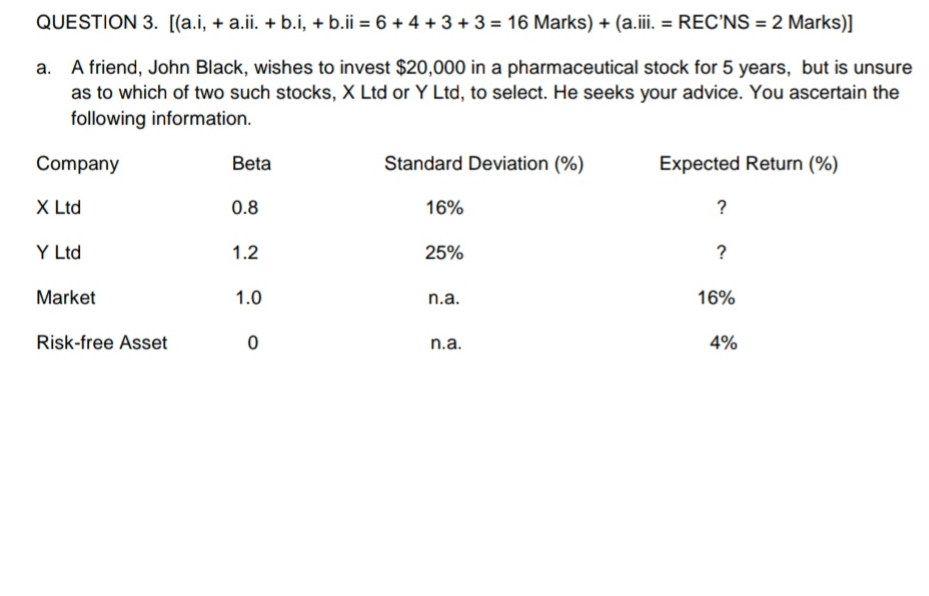

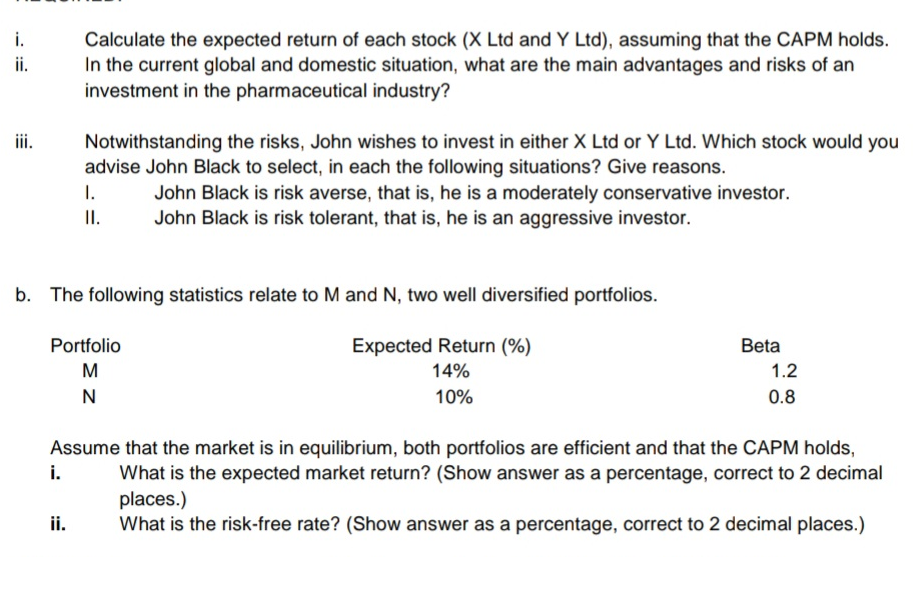

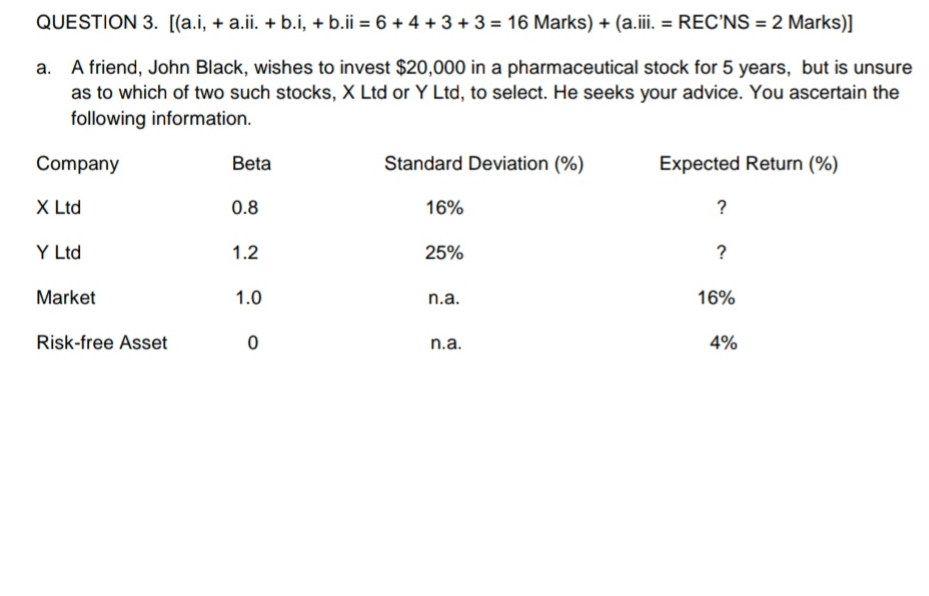

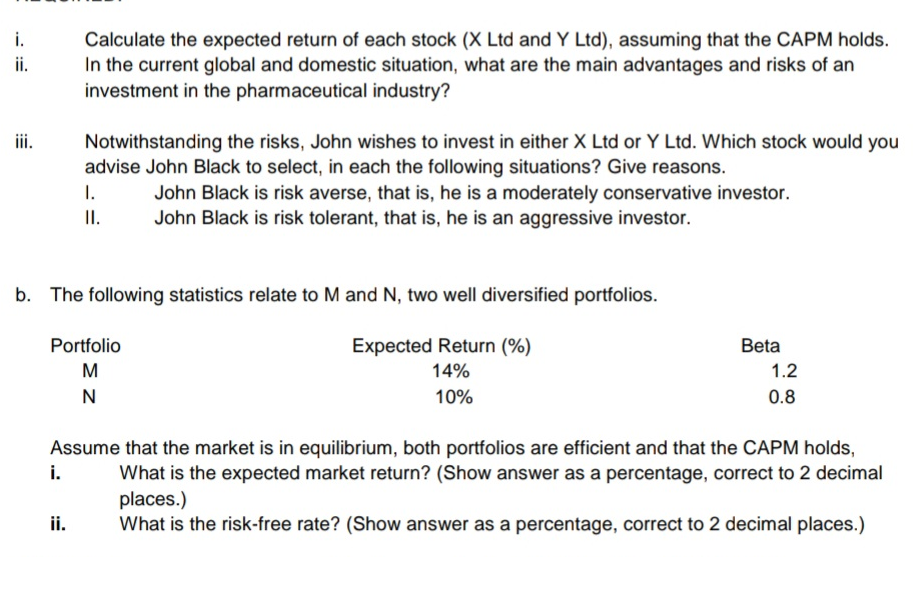

QUESTION 3. [(a.i, + a.ii. + b.i, + b.ii = 6 + 4 +3+3 = 16 Marks) + (a.iii. = RECNS = 2 Marks)] A friend, John Black, wishes to invest $20,000 in a pharmaceutical stock for 5 years, but is unsure as to which of two such stocks, X Ltd or Y Ltd, to select. He seeks your advice. You ascertain the following information. Company Beta Standard Deviation (%) Expected Return (%) X Ltd 0.8 16% ? Y Ltd 1.2 25% ? Market 1.0 n.a. 16% Risk-free Asset 0 n.a. 4% i. ii. Calculate the expected return of each stock (X Ltd and Y Ltd), assuming that the CAPM holds. In the current global and domestic situation, what are the main advantages and risks of an investment in the pharmaceutical industry? Notwithstanding the risks, John wishes to invest in either X Ltd or Y Ltd. Which stock would you advise John Black to select, in each the following situations? Give reasons. 1. John Black is risk averse, that is, he is a moderately conservative investor. II. John Black is risk tolerant, that is, he is an aggressive investor. b. The following statistics relate to M and N, two well diversified portfolios. Portfolio M N Expected Return (%) 14% 10% Beta 1.2 0.8 Assume that the market is in equilibrium, both portfolios are efficient and that the CAPM holds, i. What is the expected market return? (Show answer as a percentage, correct to 2 decimal places.) ii. What is the risk-free rate? (Show answer as a percentage, correct to 2 decimal places.) QUESTION 3. [(a.i, + a.ii. + b.i, + b.ii = 6 + 4 +3+3 = 16 Marks) + (a.iii. = RECNS = 2 Marks)] A friend, John Black, wishes to invest $20,000 in a pharmaceutical stock for 5 years, but is unsure as to which of two such stocks, X Ltd or Y Ltd, to select. He seeks your advice. You ascertain the following information. Company Beta Standard Deviation (%) Expected Return (%) X Ltd 0.8 16% ? Y Ltd 1.2 25% ? Market 1.0 n.a. 16% Risk-free Asset 0 n.a. 4% i. ii. Calculate the expected return of each stock (X Ltd and Y Ltd), assuming that the CAPM holds. In the current global and domestic situation, what are the main advantages and risks of an investment in the pharmaceutical industry? Notwithstanding the risks, John wishes to invest in either X Ltd or Y Ltd. Which stock would you advise John Black to select, in each the following situations? Give reasons. 1. John Black is risk averse, that is, he is a moderately conservative investor. II. John Black is risk tolerant, that is, he is an aggressive investor. b. The following statistics relate to M and N, two well diversified portfolios. Portfolio M N Expected Return (%) 14% 10% Beta 1.2 0.8 Assume that the market is in equilibrium, both portfolios are efficient and that the CAPM holds, i. What is the expected market return? (Show answer as a percentage, correct to 2 decimal places.) ii. What is the risk-free rate? (Show answer as a percentage, correct to 2 decimal places.)