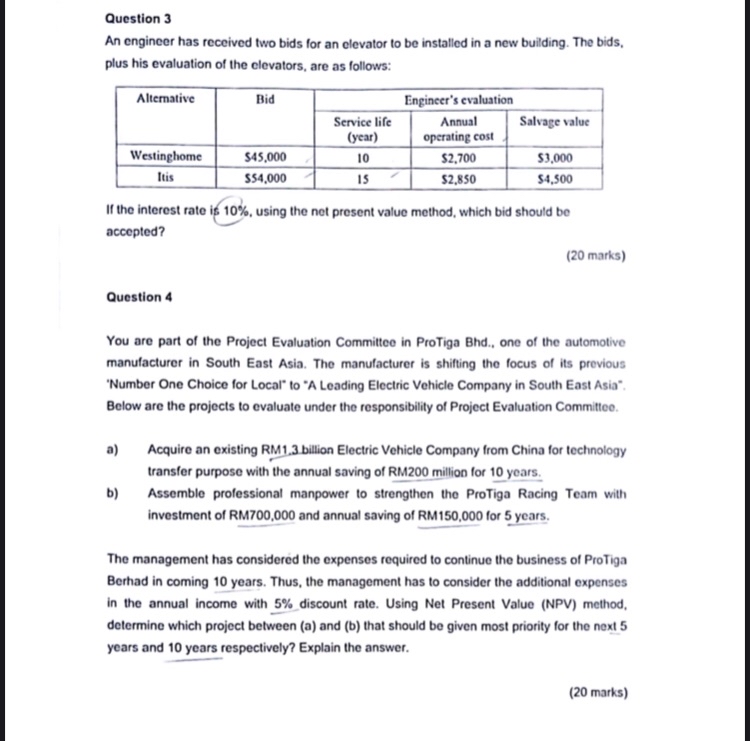

Question: Question 3 An engineer has received two bids for an elevator to be installed in a new building. The bids, plus his evaluation of the

Question 3 An engineer has received two bids for an elevator to be installed in a new building. The bids, plus his evaluation of the clevators, are as follows: If the interest rate is 10%, using the net present value method, which bid should be accepted? ( 20 marks) Question 4 You are part of the Project Evaluation Committee in ProTiga Bhd., one of the automotive manufacturer in South East Asia. The manufacturer is shifting the focus of its previous "Number One Choice for Local" to "A Leading Electric Vehicle Company in South East Asia". Below are the projects to evaluate under the responsibility of Project Evaluation Committeo. a) Acquire an existing RM1.3 billion Electric Vehicle Company from China for technology transfer purpose with the annual saving of RM200 million for 10 years. b) Assemble professional manpower to strengthen the ProTiga Racing Team with investment of RM700,000 and annual saving of RM150,000 for 5 years. The management has considered the expenses required to continue the business of ProTiga Berhad in coming 10 years. Thus, the management has to consider the additional expenses in the annual income with 5% discount rate. Using Net Present Value (NPV) method, determine which project between (a) and (b) that should be given most priority for the next 5 years and 10 years respectively? Explain the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts