Answered step by step

Verified Expert Solution

Question

1 Approved Answer

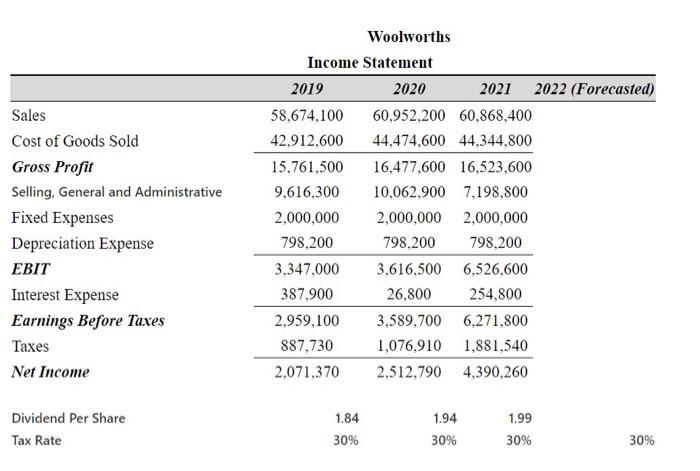

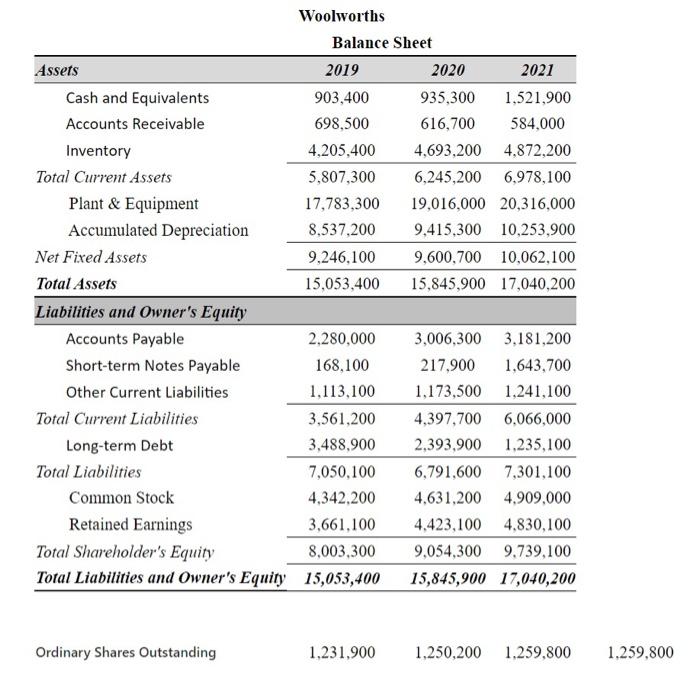

QUESTION 3: Analyse the efficiency position of your company in 2021 compared to 2020 and 2019. Use two efficiency ratios, the inventory turnover and average

QUESTION 3:

Analyse the efficiency position of your company in 2021 compared to 2020 and 2019. Use two efficiency ratios, the inventory turnover and average collection period. Ensure that you analyse in this question, not just describe the ratio values. Create a X Y Scatter chart with straight lines and markers in Excel for your results with clear indication on axis titles.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started