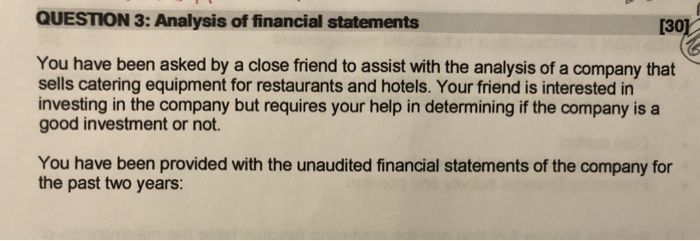

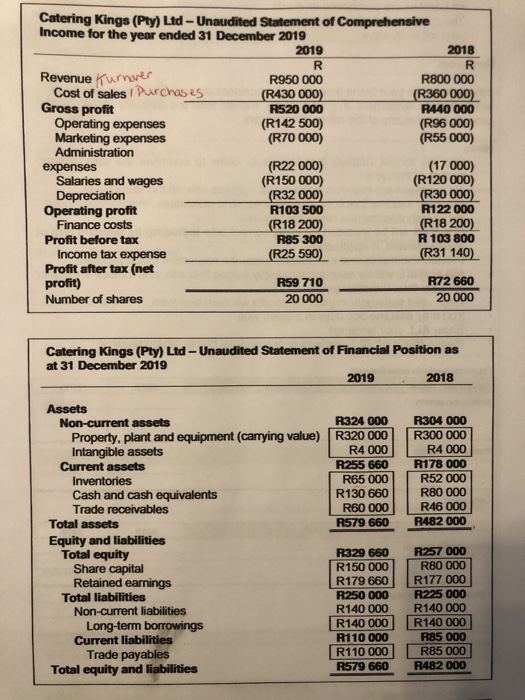

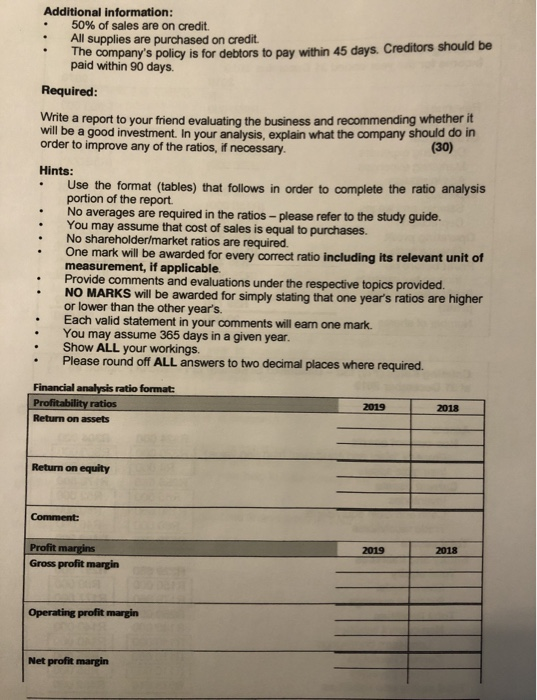

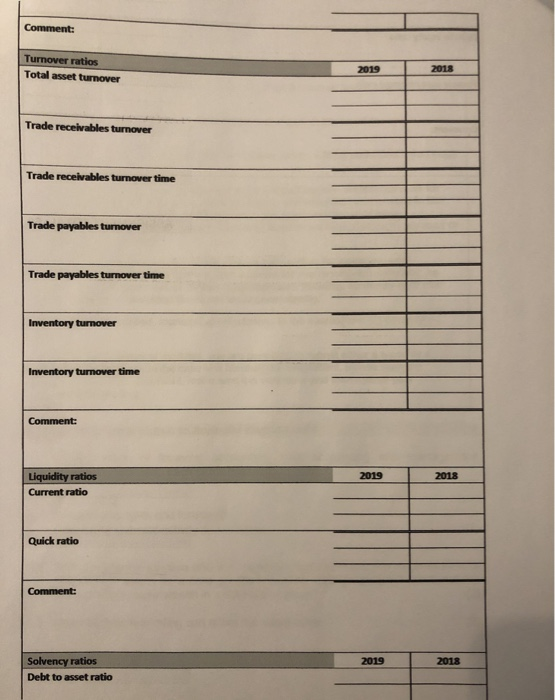

QUESTION 3: Analysis of financial statements [30] You have been asked by a close friend to assist with the analysis of a company that sells catering equipment for restaurants and hotels. Your friend is interested in investing in the company but requires your help in determining if the company is a good investment or not. You have been provided with the unaudited financial statements of the company for the past two years: Catering Kings (Pty) Ltd - Unaudited Statement of Comprehensive Income for the year ended 31 December 2019 2019 2018 R R Revenue Turnover R950 000 R800 000 Cost of sales Purchases (R430 000) (R360 000) Gross profit R520 000 R440 000 Operating expenses (R142 500) (R96 000) Marketing expenses (R70 000) (R55 000) Administration expenses (R22 000) (17000) Salaries and wages (R150 000) (R120 000) Depreciation (R32 000) (R30 000) Operating profit R103 500 R122 000 Finance costs (R18 200) (R18 200) Profit before tax R85 300 R 103 800 Income tax expense (R25 590) (R31 140) Profit after tax (net profit) R59 710 R72 660 Number of shares 20 000 20 000 Catering Kings (Pty) Ltd - Unaudited Statement of Financial Position as at 31 December 2019 2019 2018 R304 000 R300 000 R4 000 R178 000 R52 000 R80 000 R46 000 R482 000 Assets Non-current assets R324 000 Property, plant and equipment (carrying value) R320 000 Intangible assets R4 000 Current assets R255 660 Inventories R65 000 Cash and cash equivalents R130 660 Trade receivables R60 000 Total assets R579 660 Equity and liabilities Total equity R329 660 Share capital R150 000 Retained earnings R179 660 Total liabilities R250 000 Non-current liabilities R140 000 Long-term borrowings R140 000 Current liabilities R110 000 Trade payables R110 000 Total equity and liabilities R579 660 R257 000 R80 000 R177 000 R225 000 R140 000 R140 000 R85 000 R85 000 R482 000 Additional information: 50% of sales are on credit. All supplies are purchased on credit. The company's policy is for debtors to pay within 45 days. Creditors should be paid within 90 days Required: Write a report to your friend evaluating the business and recommending whether it will be a good investment. In your analysis, explain what the company should do in order to improve any of the ratios, if necessary. (30) Hints: Use the format (tables) that follows in order to complete the ratio analysis portion of the report No averages are required in the ratios - please refer to the study guide. You may assume that cost of sales is equal to purchases. No shareholder/market ratios are required. One mark will be awarded for every correct ratio including its relevant unit of measurement, if applicable. Provide comments and evaluations under the respective topics provided. NO MARKS will be awarded for simply stating that one year's ratios are higher or lower than the other year's. Each valid statement in your comments will eam one mark. You may assume 365 days in a given year. Show ALL your workings. Please round off ALL answers to two decimal places where required. Financial analysis ratio format: Profitability ratios Return on assets . . 2019 2018 Return on equity Comment: 2019 2018 Profit margins Gross profit margin Operating profit margin Net profit margin Comment: Turnover ratios Total asset turnover 2019 2018 Trade receivables turnover Trade receivables turnover time Trade payables turnover Trade payables turnover time Inventory turnover Inventory turnover time Comment: 2019 2018 Liquidity ratios Current ratio Quick ratio Comment: 2019 2018 Solvency ratios Debt to asset ratio Debt to equity ratio Finance cost coverage ratio Comment