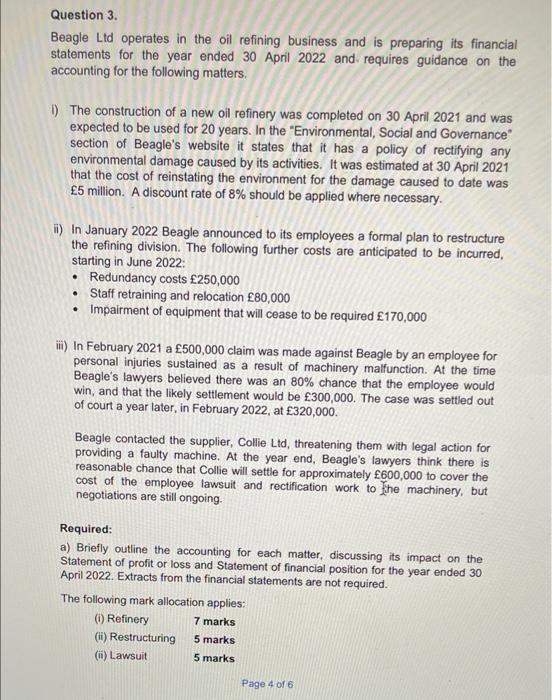

Question 3. Beagle Ltd operates in the oil refining business and is preparing its financial statements for the year ended 30 April 2022 and requires guidance on the accounting for the following matters. i) The construction of a new oil refinery was completed on 30 April 2021 and was expected to be used for 20 years. In the "Environmental, Social and Governance" section of Beagle's website it states that it has a policy of rectifying any environmental damage caused by its activities. It was estimated at 30 April 2021 that the cost of reinstating the environment for the damage caused to date was 5 million. A discount rate of 8% should be applied where necessary. ii) In January 2022 Beagle announced to its employees a formal plan to restructure the refining division. The following further costs are anticipated to be incurred, starting in June 2022: . Redundancy costs 250,000 . Staff retraining and relocation 80,000 . Impairment of equipment that will cease to be required 170,000 iii) In February 2021 a 500,000 claim was made against Beagle by an employee for personal injuries sustained as a result of machinery malfunction. At the time Beagle's lawyers believed there was an 80% chance that the employee would win, and that the likely settlement would be 300,000. The case was settled out of court a year later, in February 2022, at 320,000. Beagle contacted the supplier, Collie Ltd, threatening them with legal action for providing a faulty machine. At the year end, Beagle's lawyers think there is reasonable chance that Collie will settle for approximately 600,000 to cover the cost of the employee lawsuit and rectification work to the machinery, but negotiations are still ongoing. Required: a) Briefly outline the accounting for each matter, discussing its impact on the Statement of profit or loss and Statement of financial position for the year ended 30 April 2022. Extracts from the financial statements are not required. The following mark allocation applies: (i) Refinery 7 marks (ii) Restructuring 5 marks (ii) Lawsuit 5 marks Page 4 of 6 b) Prepare the provisions note showing the numerical table for inclusion in the financial statements of Beagle for the year ended 30 April 2022. Narrative disclosures are not required. 8 marks Total 25 marks