Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 Bloemenmarkt Inc. is a retailer of flowers and small ornamental plants. Its assets consist mostly of inventory (flowers and other plants). It

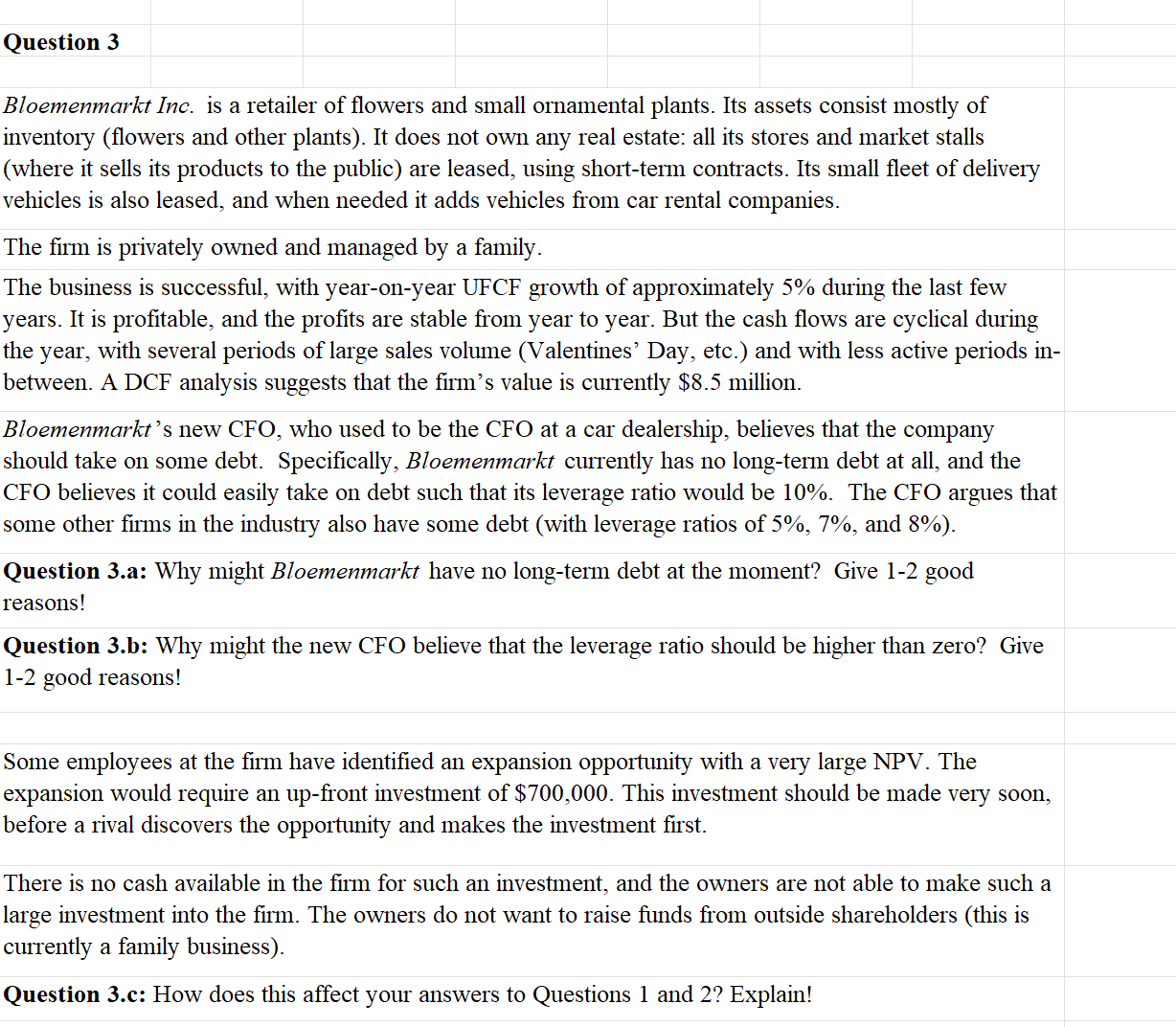

Question 3 Bloemenmarkt Inc. is a retailer of flowers and small ornamental plants. Its assets consist mostly of inventory (flowers and other plants). It does not own any real estate: all its stores and market stalls (where it sells its products to the public) are leased, using short-term contracts. Its small fleet of delivery vehicles is also leased, and when needed it adds vehicles from car rental companies. The firm is privately owned and managed by a family. The business is successful, with year-on-year UFCF growth of approximately 5% during the last few years. It is profitable, and the profits are stable from year to year. But the cash flows are cyclical during the year, with several periods of large sales volume (Valentines' Day, etc.) and with less active periods in- between. A DCF analysis suggests that the firm's value is currently $8.5 million. Bloemenmarkt's new CFO, who used to be the CFO at a car dealership, believes that the company should take on some debt. Specifically, Bloemenmarkt currently has no long-term debt at all, and the CFO believes it could easily take on debt such that its leverage ratio would be 10%. The CFO argues that some other firms in the industry also have some debt (with leverage ratios of 5%, 7%, and 8%). Question 3.a: Why might Bloemenmarkt have no long-term debt at the moment? Give 1-2 good reasons! Question 3.b: Why might the new CFO believe that the leverage ratio should be higher than zero? Give 1-2 good reasons! Some employees at the firm have identified an expansion opportunity with a very large NPV. The expansion would require an up-front investment of $700,000. This investment should be made very soon, before a rival discovers the opportunity and makes the investment first. There is no cash available in the firm for such an investment, and the owners are not able to make such a large investment into the firm. The owners do not want to raise funds from outside shareholders (this is currently a family business). Question 3.c: How does this affect your answers to Questions 1 and 2? Explain!

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

3a Bloemenmarkt may have no longterm debt at the moment for several reasons Firstly since the busine...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started