Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question #3. Can you solve this!! is anyone going to answer any of the questions I sent today? Estimating Share Value Using the AOPI Model

Question #3. Can you solve this!!

is anyone going to answer any of the questions I sent today?

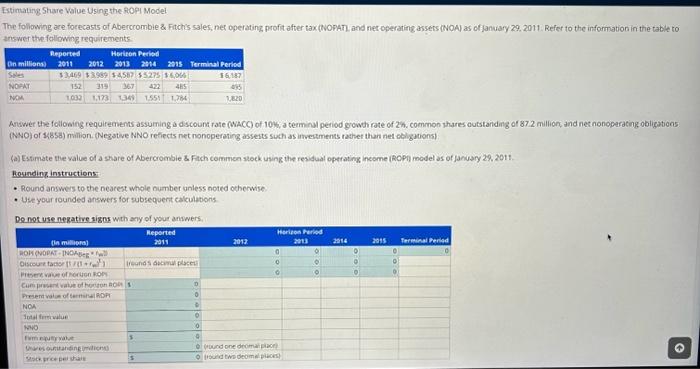

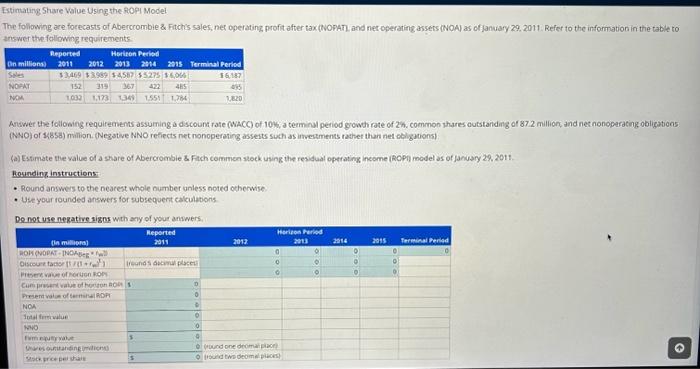

Estimating Share Value Using the AOPI Model The following are forecasts of Aberccombie \& Fitchis sales, ner operating profit after tax (wONATL and net operating assets (NOA) as of january 29,2011 . Refer to the information in the table to answer the following requirements. Arswer the following requirements assuming a discount rate (WACC) of 10 w, a termins period gowth rate of 2 h. common thares outstanding of 87.2 million and net nonoperating obligations (NNO) of 1885 ) milion. (Negstive NNO refiects net nonoperating assests such as investments rather than net obligations) (a) Estumate the value of a share of Abercrombie 3 fitch commen stock using the residual operating income (20.1) model as of january 29.2011. Rosinding instructions - Round answeis to the nearest whole number unless noted ocherwise - Useyour rounded answers for subsequent calculabons. Do not use nerative signs wth any of yout answers; Estimating Share Value Using the AOPI Model The following are forecasts of Aberccombie \& Fitchis sales, ner operating profit after tax (wONATL and net operating assets (NOA) as of january 29,2011 . Refer to the information in the table to answer the following requirements. Arswer the following requirements assuming a discount rate (WACC) of 10 w, a termins period gowth rate of 2 h. common thares outstanding of 87.2 million and net nonoperating obligations (NNO) of 1885 ) milion. (Negstive NNO refiects net nonoperating assests such as investments rather than net obligations) (a) Estumate the value of a share of Abercrombie 3 fitch commen stock using the residual operating income (20.1) model as of january 29.2011. Rosinding instructions - Round answeis to the nearest whole number unless noted ocherwise - Useyour rounded answers for subsequent calculabons. Do not use nerative signs wth any of yout answers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started