Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (Case Study) Consider a hospital that wishes to target a standard deviation of 9%. The current yield of the STP is 3.2%. The

Question 3 (Case Study)

Consider a hospital that wishes to target a standard deviation of 9%. The current yield of the STP is 3.2%. The expected return of the baseline LTP are 11.65% and its standard deviation is 12.02%.

- How much would this hospital have had in the STP and in the baseline LTP?

- What would be the expected return of the hospitals overall portfolio?

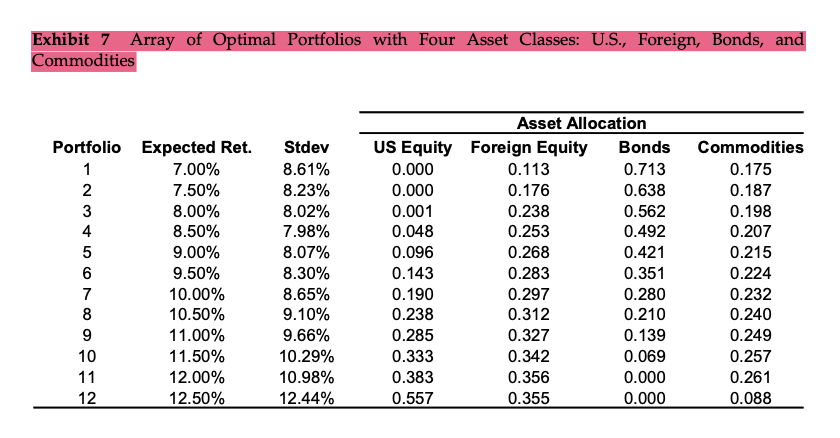

- Suppose Partners decides to add commodities to its baseline LTP. Use exhibit 7 to find the optimal LTP. What is the Sharpe ration of your optimal LTP? Please report at least four decimal places.

- Consider the same hospital wishing to target a standard deviation of 9%. How much would the hospital invest in the STP and the optimal LTP? The expected return and the standard deviation of the optimal MTP can be found from exhibit 7.

- How much is the expected return of the hospitals overall portfolio improved?

Exhibit 7:

Exhibit 7 Array of Optimal Portfolios with Four Asset Classes: U.S., Foreign, Bonds, and Commodities

Exhibit 7 Array of Optimal Portfolios with Four Asset Classes: U.S., Foreign, Bonds, and Commodities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started