Answered step by step

Verified Expert Solution

Question

1 Approved Answer

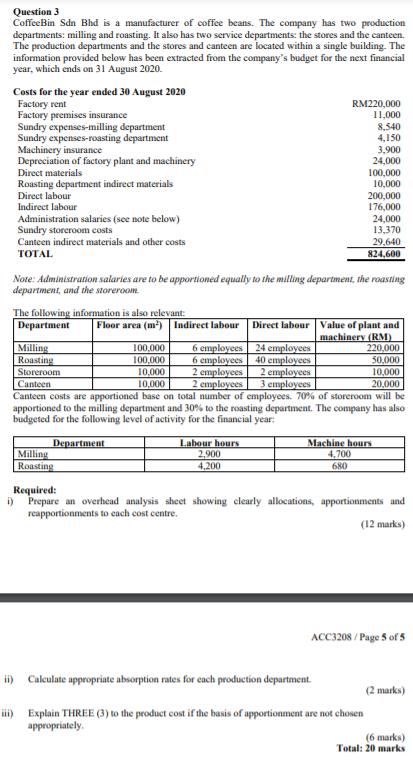

Question 3 Coffee Bin Sdn Bhd is a manufacturer of coffee beans. The company has two production departments: milling and roasting. It also has

Question 3 Coffee Bin Sdn Bhd is a manufacturer of coffee beans. The company has two production departments: milling and roasting. It also has two service departments: the stores and the canteen. The production departments and the stores and canteen are located within a single building. The information provided below has been extracted from the company's budget for the next financial year, which ends on 31 August 2020. Costs for the year ended 30 August 2020 Factory rent Factory premises insurance Sundry expenses-milling department Sundry expenses-roasting department Machinery insurance Depreciation of factory plant and machinery Direct materials Roasting department indirect materials Direct labour Indirect labour Administration salaries (see note below) Sundry storeroom costs Canteen indirect materials and other costs TOTAL The following information is also relevant: Department Floor area (m) i) Note: Administration salaries are to be apportioned equally to the milling department, the roasting department, and the storeroom. Milling Roasting Storeroom 100,000 100,000 Milling Roasting Indirect labour 6 employees 6 employees 2 employees 2 employees RM220,000 11,000 8,540 4,150 3,900 24,000 Direct labour 24 employees 40 employees 2 employees 3 employees Labour hours 2,900 4,200 100,000 10,000 50,000 10,000 10,000 Canteen 10,000 20,000 Canteen costs are apportioned base on total number of employees. 70% of storeroom will be apportioned to the milling department and 30% to the roasting department. The company has also budgeted for the following level of activity for the financial year: Department 200,000 176,000 24,000 13,370 29,640 824,600 Value of plant and machinery (RM) 220,000 Machine hours 4,700 680 Required: Prepare an overhead analysis sheet showing clearly allocations, apportionments and reapportionments to each cost centre. (12 marks) ii) Calculate appropriate absorption rates for each production department. iii) Explain THREE (3) to the product cost if the basis of apportionment are not chosen appropriately. ACC3208/Page 5 of 5 (2 marks) (6 marks) Total: 20 marks

Step by Step Solution

★★★★★

3.38 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

Hello Student I hope you find this answer helpful Wishing you the best of luck in your studies i ii ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started