Answered step by step

Verified Expert Solution

Question

1 Approved Answer

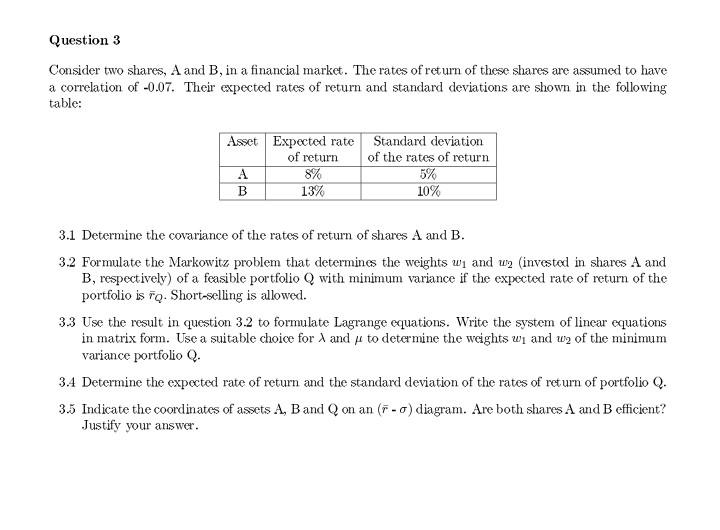

Question 3 Consider two shares, A and B, in a financial market. The rates of return of these shares are assumed to have a

Question 3 Consider two shares, A and B, in a financial market. The rates of return of these shares are assumed to have a correlation of -0.07. Their expected rates of return and standard deviations are shown in the following table: Asset Expected rate of return A 8% B 13% Standard deviation of the rates of return 5% 10% 3.1 Determine the covariance of the rates of return of shares A and B. 3.2 Formulate the Markowitz problem that determines the weights w and w2 (invested in shares A and B, respectively) of a feasible portfolio Q with minimum variance if the expected rate of return of the portfolio is FQ. Short-selling is allowed. 3.3 Use the result in question 3.2 to formulate Lagrange equations. Write the system of linear equations in matrix form. Use a suitable choice for A and to determine the weights w and w of the minimum variance portfolio Q. 3.4 Determine the expected rate of return and the standard deviation of the rates of return of portfolio Q. 3.5 Indicate the coordinates of assets A, B and Q on an (-) diagram. Are both shares A and B efficient? Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started