Answered step by step

Verified Expert Solution

Question

1 Approved Answer

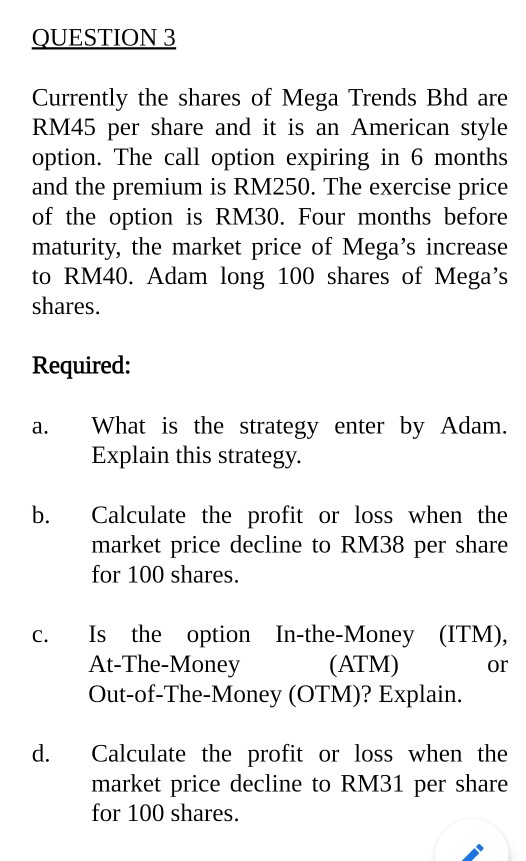

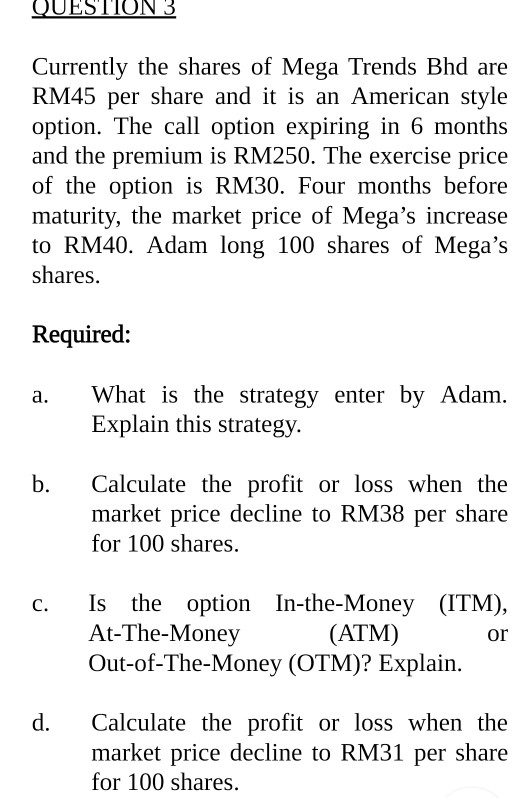

QUESTION 3 Currently the shares of Mega Trends Bhd are RM45 per share and it is an American style option. The call option expiring in

QUESTION 3 Currently the shares of Mega Trends Bhd are RM45 per share and it is an American style option. The call option expiring in 6 months and the premium is RM250. The exercise price of the option is RM30. Four months before maturity, the market price of Mega's increase to RM40. Adam long 100 shares of Mega's shares. Required: What is the strategy enter by Adam. Explain this strategy. b. Calculate the profit or loss when the market price decline to RM38 per share for 100 shares. Is the option In-the-Money (ITM), At-The-Money (ATM) or Out-of-The-Money (OTM)? Explain. Calculate the profit or loss when the market price decline to RM31 per share for 100 shares. QUESTION 3 Currently the shares of Mega Trends Bhd are RM45 per share and it is an American style option. The call option expiring in 6 months and the premium is RM250. The exercise price of the option is RM30. Four months before maturity, the market price of Mega's increase to RM40. Adam long 100 shares of Mega's shares. Required: What is the strategy enter by Adam. Explain this strategy. b. Calculate the profit or loss when the market price decline to RM38 per share for 100 shares. Is the option In-the-Money (ITM), At-The-Money (ATM) or Out-of-The-Money (OTM)? Explain. Calculate the profit or loss when the market price decline to RM31 per share for 100 shares. QUESTION 3 Currently the shares of Mega Trends Bhd are RM45 per share and it is an American style option. The call option expiring in 6 months and the premium is RM250. The exercise price of the option is RM30. Four months before maturity, the market price of Mega's increase to RM40. Adam long 100 shares of Mega's shares. Required: What is the strategy enter by Adam. Explain this strategy. b. Calculate the profit or loss when the market price decline to RM38 per share for 100 shares. Is the option In-the-Money (ITM), At-The-Money (ATM) or Out-of-The-Money (OTM)? Explain. Calculate the profit or loss when the market price decline to RM31 per share for 100 shares. QUESTION 3 Currently the shares of Mega Trends Bhd are RM45 per share and it is an American style option. The call option expiring in 6 months and the premium is RM250. The exercise price of the option is RM30. Four months before maturity, the market price of Mega's increase to RM40. Adam long 100 shares of Mega's shares. Required: What is the strategy enter by Adam. Explain this strategy. b. Calculate the profit or loss when the market price decline to RM38 per share for 100 shares. Is the option In-the-Money (ITM), At-The-Money (ATM) or Out-of-The-Money (OTM)? Explain. Calculate the profit or loss when the market price decline to RM31 per share for 100 shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started