Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: Darryan Enterprise started a small business providing transportation services. He bring his own car worth RM80,000 into the business as at 1st

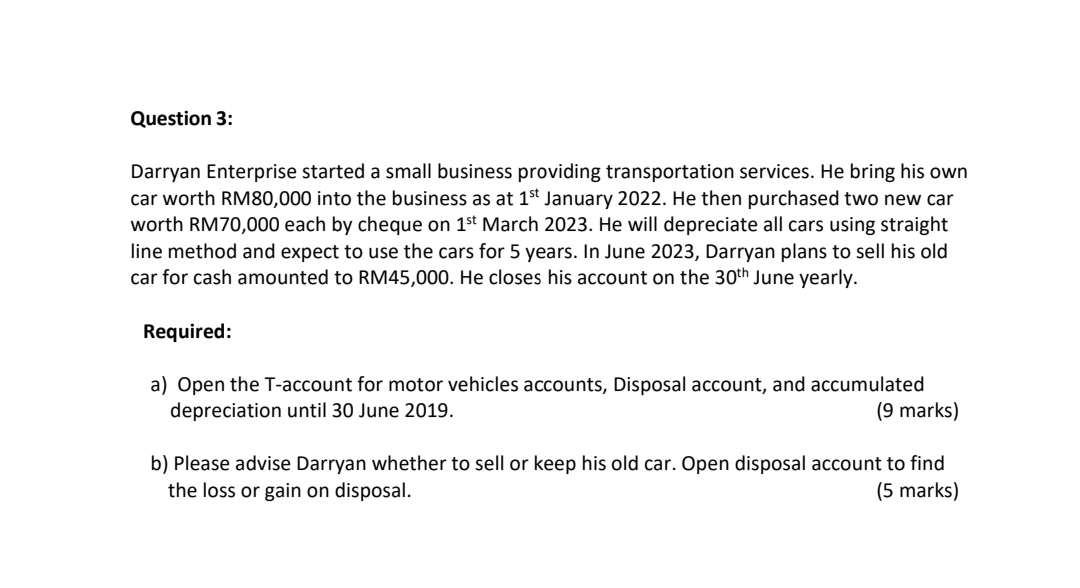

Question 3: Darryan Enterprise started a small business providing transportation services. He bring his own car worth RM80,000 into the business as at 1st January 2022. He then purchased two new car worth RM70,000 each by cheque on 1st March 2023. He will depreciate all cars using straight line method and expect to use the cars for 5 years. In June 2023, Darryan plans to sell his old car for cash amounted to RM45,000. He closes his account on the 30th June yearly. Required: a) Open the T-account for motor vehicles accounts, Disposal account, and accumulated depreciation until 30 June 2019. (9 marks) b) Please advise Darryan whether to sell or keep his old car. Open disposal account to find the loss or gain on disposal. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started