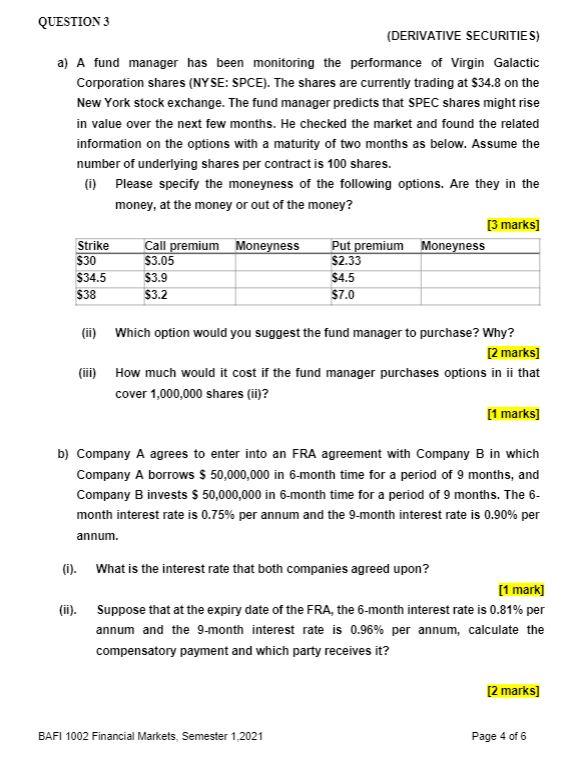

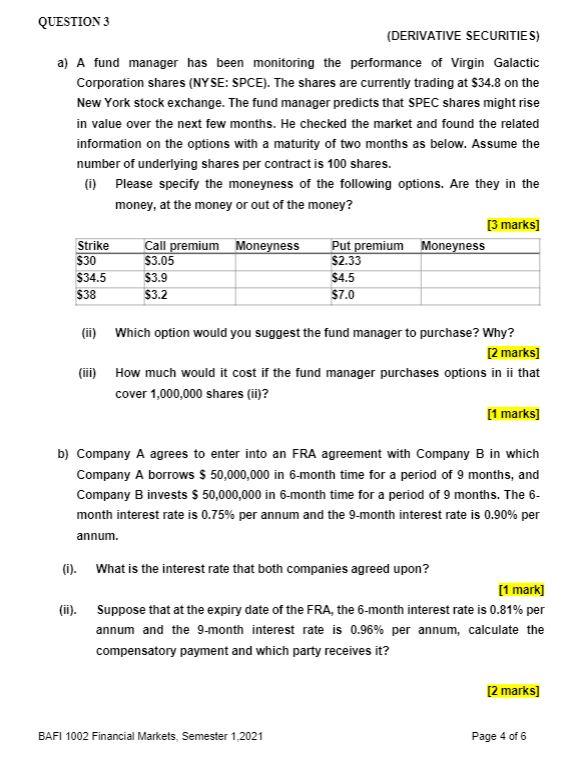

QUESTION 3 (DERIVATIVE SECURITIES) a) A fund manager has been monitoring the performance of Virgin Galactic Corporation shares (NYSE: SPCE). The shares are currently trading at $34.8 on the New York stock exchange. The fund manager predicts that SPEC shares might rise in value over the next few months. He checked the market and found the related information on the options with a maturity of two months as below. Assume the number of underlying shares per contract is 100 shares. (1) Please specify the moneyness of the following options. Are they in the money, at the money or out of the money? Strike $30 Call premium Moneyness $3.05 $3.9 [3 marks] Put premium Moneyness $2.33 $4.5 $34.5 $38 $3.2 $7.0 (ii) Which option would you suggest the fund manager to purchase? Why? [2 marks] (ii) How much would it cost if the fund manager purchases options in ii that cover 1,000,000 shares (ii)? [1 marks] b) Company A agrees to enter into an FRA agreement with Company B in which Company A borrows $ 50,000,000 in 6-month time for a period of 9 months, and Company B invests $ 50,000,000 in 6- month time for a period of 9 months. The 6- month interest rate is 0.75% per annum and the 9-month interest rate is 0.90% per annum (i). What is the interest rate that both companies agreed upon? [1 mark] (ii). Suppose that at the expiry date of the FRA, the 6-month interest rate is 0.81% per annum and the 9-month interest rate is 0.96% per annum, calculate the compensatory payment and which party receives it? [2 marks] BAFI 1002 Financial Markets, Semester 1.2021 Page 4 of 6 QUESTION 3 (DERIVATIVE SECURITIES) a) A fund manager has been monitoring the performance of Virgin Galactic Corporation shares (NYSE: SPCE). The shares are currently trading at $34.8 on the New York stock exchange. The fund manager predicts that SPEC shares might rise in value over the next few months. He checked the market and found the related information on the options with a maturity of two months as below. Assume the number of underlying shares per contract is 100 shares. (1) Please specify the moneyness of the following options. Are they in the money, at the money or out of the money? Strike $30 Call premium Moneyness $3.05 $3.9 [3 marks] Put premium Moneyness $2.33 $4.5 $34.5 $38 $3.2 $7.0 (ii) Which option would you suggest the fund manager to purchase? Why? [2 marks] (ii) How much would it cost if the fund manager purchases options in ii that cover 1,000,000 shares (ii)? [1 marks] b) Company A agrees to enter into an FRA agreement with Company B in which Company A borrows $ 50,000,000 in 6-month time for a period of 9 months, and Company B invests $ 50,000,000 in 6- month time for a period of 9 months. The 6- month interest rate is 0.75% per annum and the 9-month interest rate is 0.90% per annum (i). What is the interest rate that both companies agreed upon? [1 mark] (ii). Suppose that at the expiry date of the FRA, the 6-month interest rate is 0.81% per annum and the 9-month interest rate is 0.96% per annum, calculate the compensatory payment and which party receives it? [2 marks] BAFI 1002 Financial Markets, Semester 1.2021 Page 4 of 6