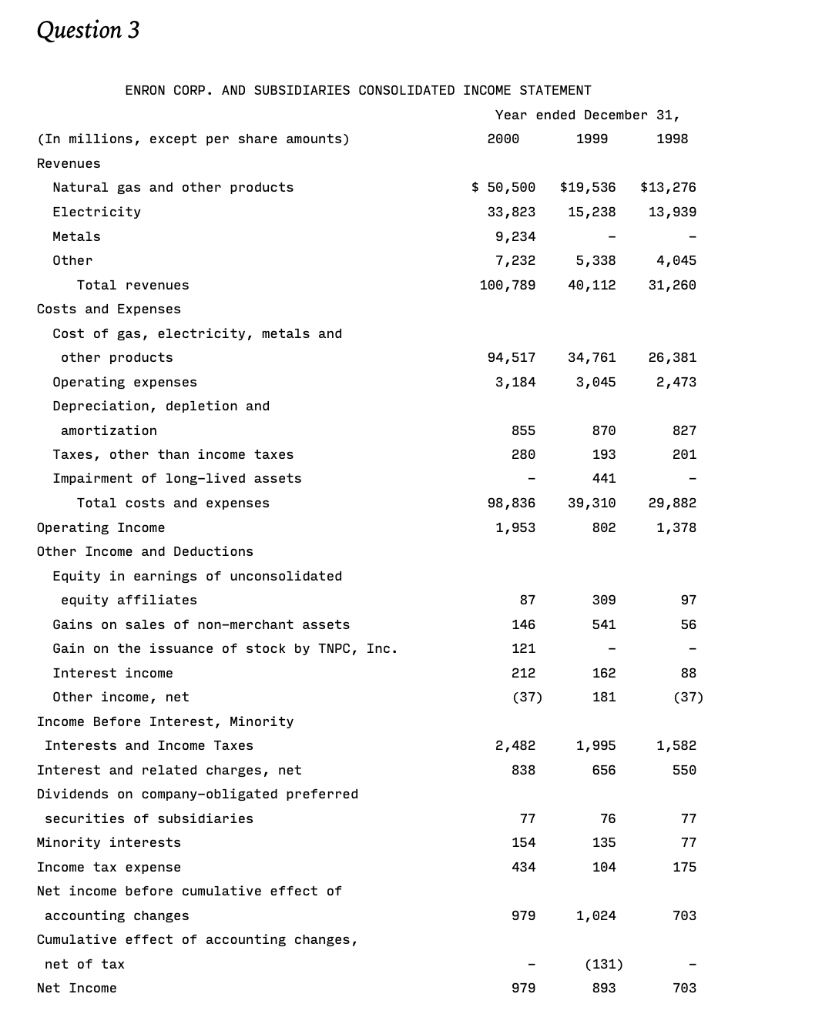

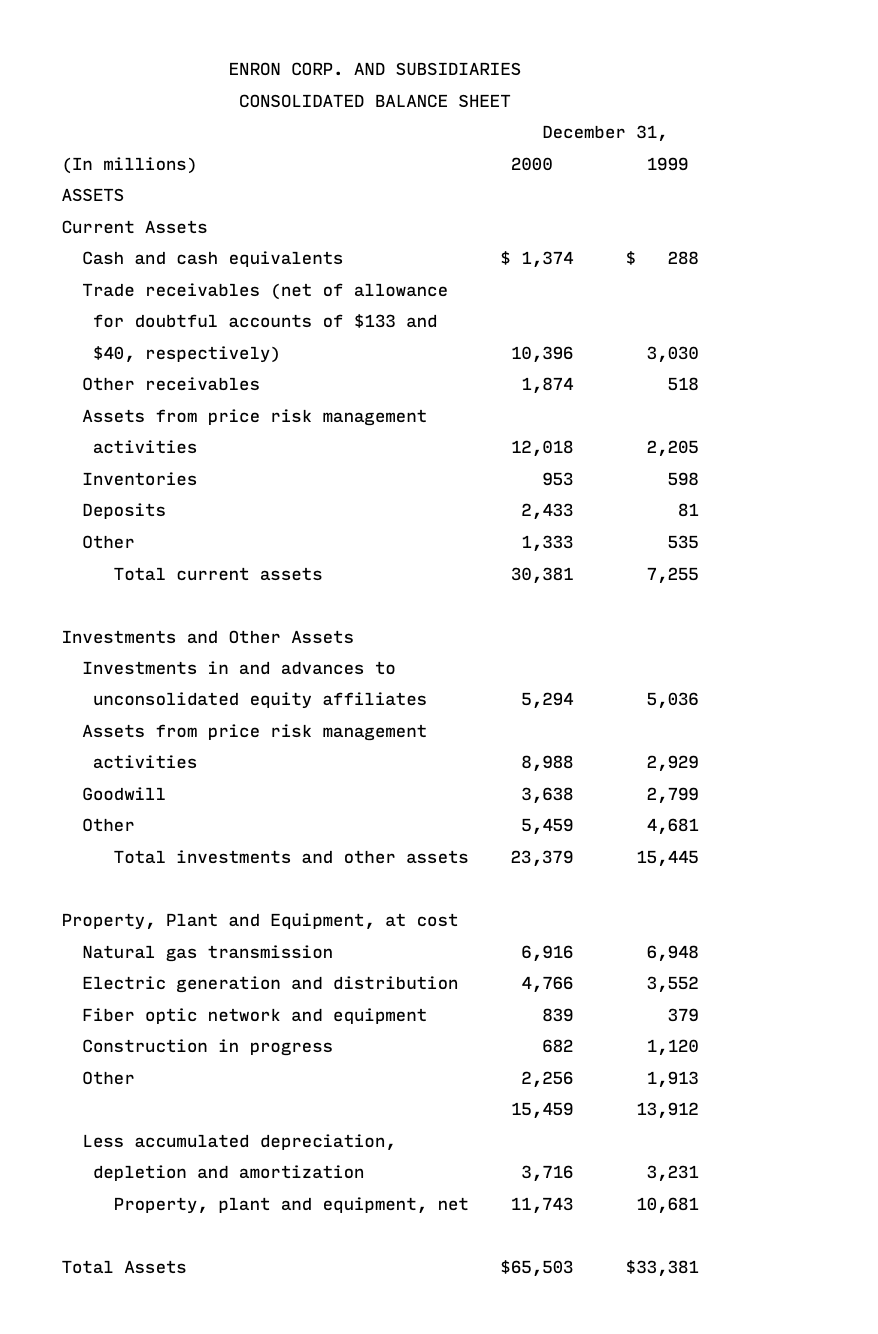

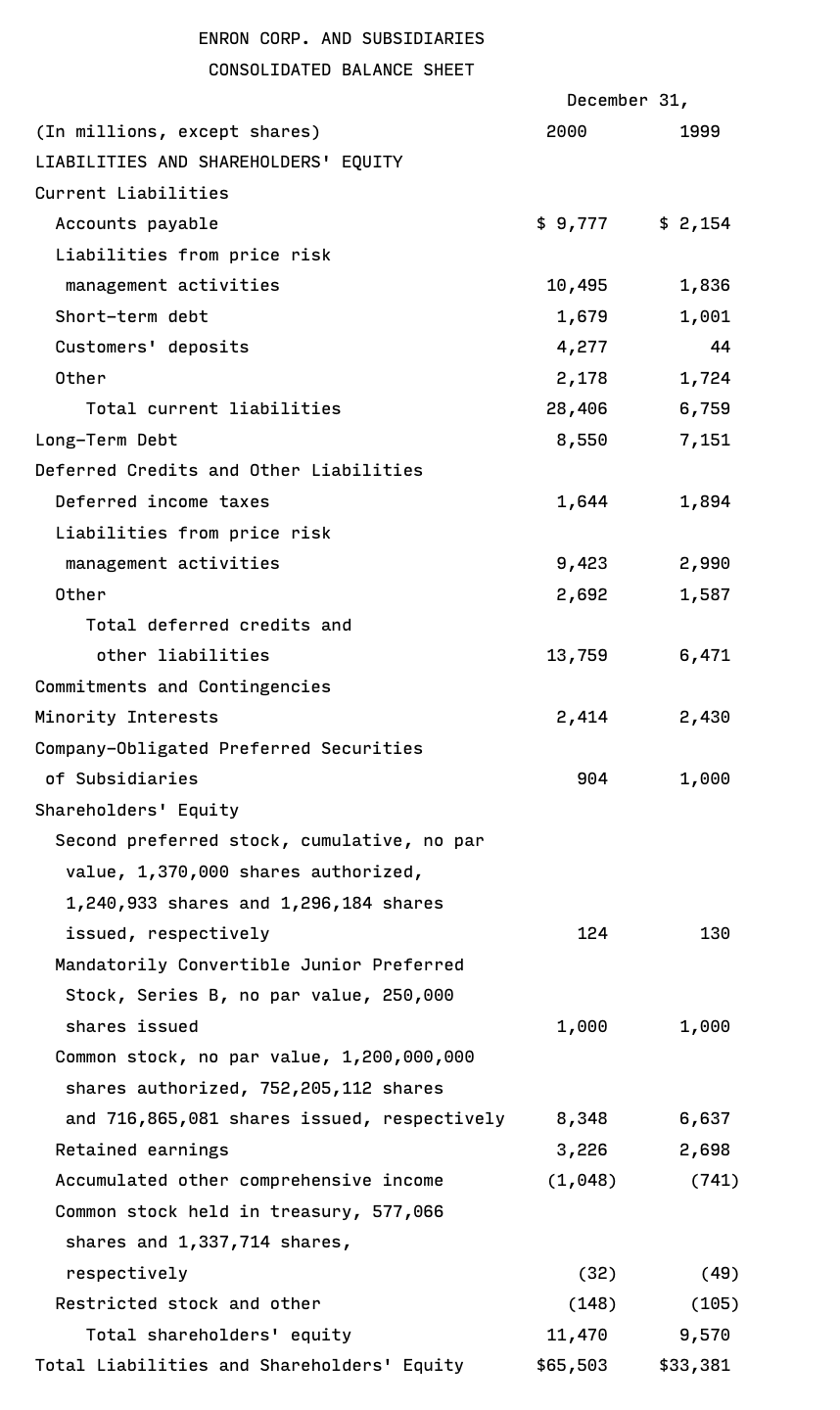

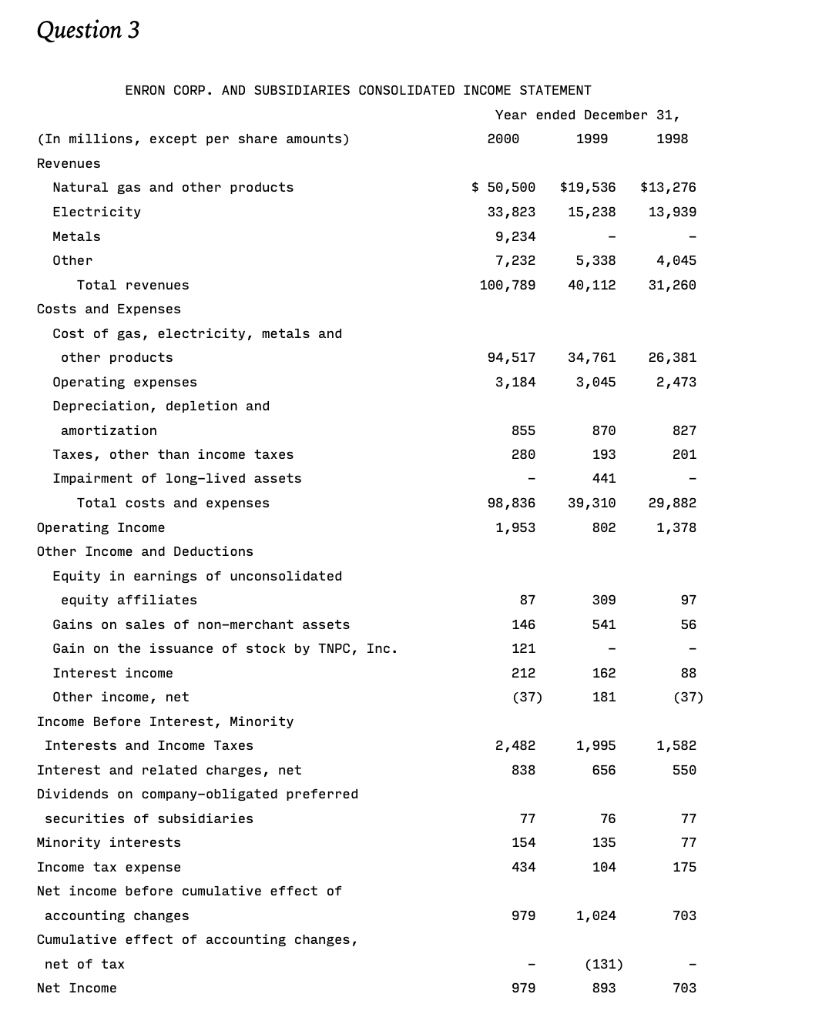

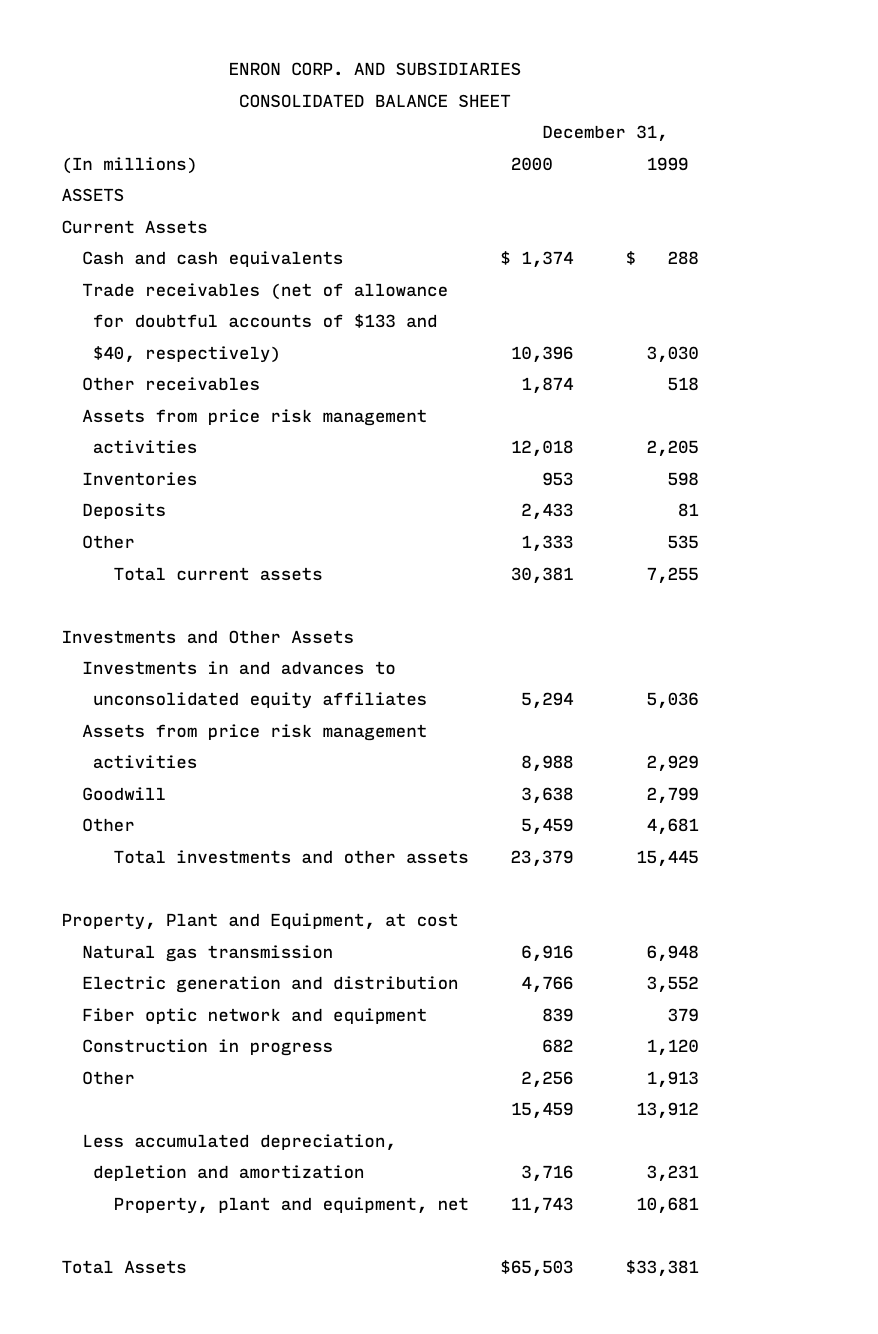

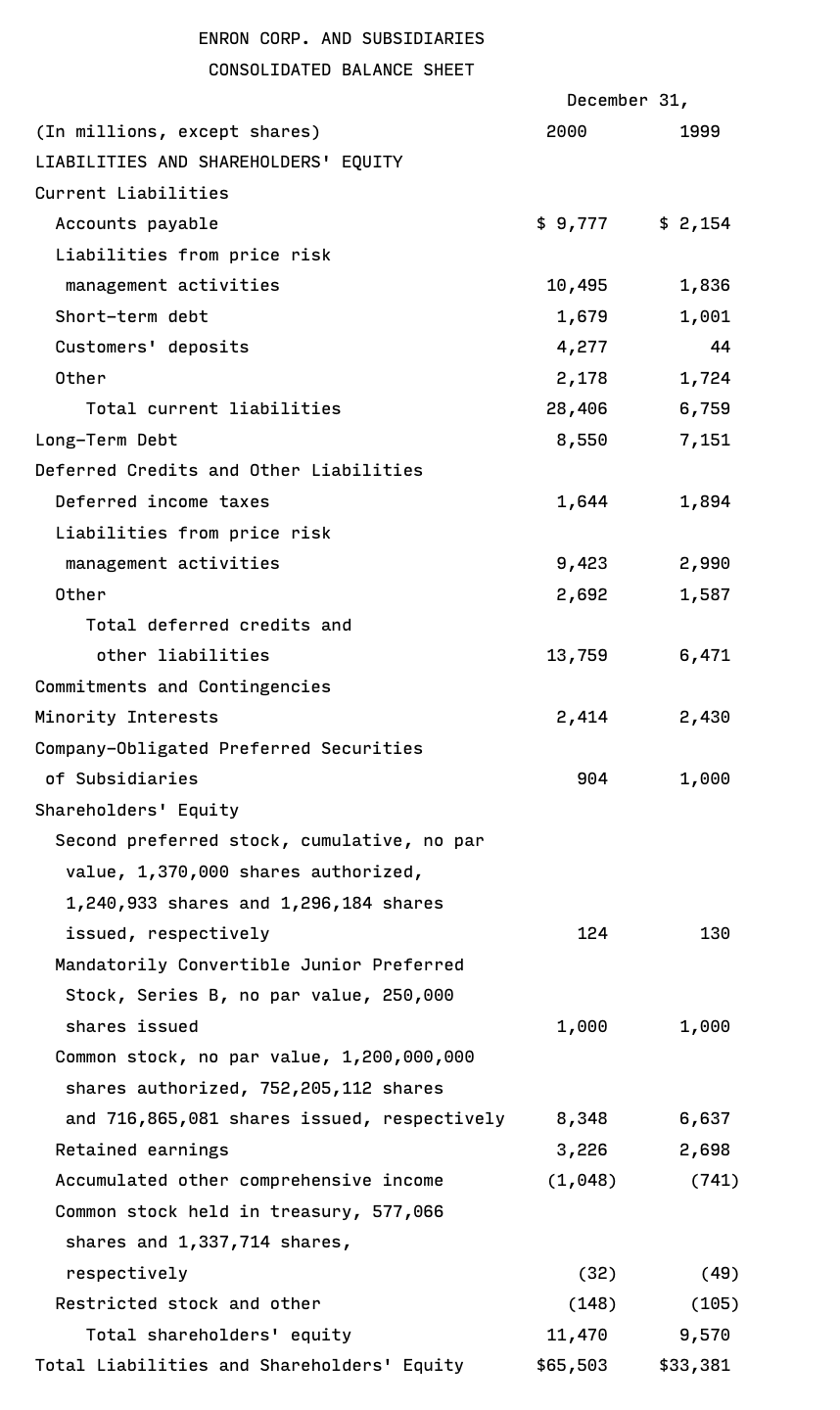

Question 3 ENRON CORP. AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENT Year ended December 31, 2000 1999 1998 $19,536 15,238 $ 50,500 33,823 9,234 7,232 100,789 $13,276 13,939 - 4,045 31,260 5,338 40,112 94,517 3,184 34,761 3,045 26,381 2,473 855 280 (In millions, except per share amounts) Revenues Natural gas and other products Electricity Metals Other Total revenues Costs and Expenses Cost of gas, electricity, metals and other products Operating expenses Depreciation, depletion and amortization Taxes, other than income taxes Impairment of long-lived assets Total costs and expenses Operating Income Other Income and Deductions Equity in earnings of unconsolidated equity affiliates Gains on sales of non-merchant assets Gain on the issuance of stock by TNPC, Inc. Interest income Other income, net Income Before Interest, Minority Interests and Income Taxes Interest and related charges, net Dividends on company-obligated preferred 870 827 193201 441 39,310 29,882 802 1,378 98,836 1,953 87 30997 56 541 146 121 212 (37) 162 181 (37) 1,582 2,482 838 1,995 656 550 securities of subsidiaries 76 77 77 154 434 135 104 175 Minority interests Income tax expense Net income before cumulative effect of accounting changes Cumulative effect of accounting changes, net of tax Net Income 979 1,024 703 (131) 893 979 703 ENRON CORP. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET December 31, 2000 1999 (In millions) ASSETS Current Assets $ 1,374 $ 288 10,396 1,874 3,030 518 Cash and cash equivalents Trade receivables (net of allowance for doubtful accounts of $133 and $40, respectively) Other receivables Assets from price risk management activities Inventories Deposits Other Total current assets 12,018 953 2,433 1,333 30,381 2, 205 598 81 535 7,255 5,294 5,036 Investments and Other Assets Investments in and advances to unconsolidated equity affiliates Assets from price risk management activities Goodwill Other Total investments and other assets 8,988 3,638 5,459 23,379 2,929 2,799 4,681 15,445 Property, plant and Equipment, at cost Natural gas transmission Electric generation and distribution Fiber optic network and equipment Construction in progress 6,916 4,766 839 682 2,256 15,459 6,948 3,552 379 1,120 1,913 13,912 Other Less accumulated depreciation, depletion and amortization Property, plant and equipment, net 3,716 11,743 3,231 10,681 Total Assets $65,503 $33,381 ENRON CORP. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET December 31, 2000 1999 $ 9,777 $ 2,154 10,495 1,679 4,277 2,178 28,406 8,550 1,836 1,001 44 1,724 6,759 7,151 1,644 1,894 9,423 2,692 2,990 1,587 13,759 6,471 2,414 2,430 (In millions, except shares) LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities Accounts payable Liabilities from price risk management activities Short-term debt Customers' deposits Other Total current liabilities Long-Term Debt Deferred Credits and Other Liabilities Deferred income taxes Liabilities from price risk management activities Other Total deferred credits and other liabilities Commitments and Contingencies Minority Interests Company-Obligated Preferred Securities of Subsidiaries Shareholders' Equity Second preferred stock, cumulative, no par value, 1,370,000 shares authorized, 1,240,933 shares and 1,296,184 shares issued, respectively Mandatorily Convertible Junior Preferred Stock, Series B, no par value, 250,000 shares issued Common stock, no par value, 1,200,000,000 shares authorized, 752,205,112 shares and 716,865,081 shares issued, respectively Retained earnings Accumulated other comprehensive income Common stock held in treasury, 577,066 shares and 1,337,714 shares, respectively Restricted stock and other Total shareholders' equity Total Liabilities and Shareholders' Equity 904 1,000 124 130 1,000 1,000 8,348 3,226 (1,048) 6,637 2,698 (741) (32) (148) 11, 470 $65,503 (49) (105) 9,570 $33,381 - ENRON CORP. AND SUBSIDIARIES CONSOLIDATED STATEMENT OF CASH FLOWS Year ended December 31, (In millions) 2000 1999 1998 Cash Flows From Operating Activities Net income $ 979 $ 893 $ 703 Cumulative effect of accounting changes 131 Depreciation, depletion and amortization 855 870 827 Impairment of long-lived assets (including equity investments) 326 441 Deferred income taxes 207 21 Gains on sales of non-merchant assets (146) (541) (82) Changes in components of working capital 1,769 (1,000) (233) Net assets from price risk management activities (763) (395) 350 Merchant assets and investments: Realized gains on sales (104) (756) (628) Proceeds from sales 1,838 2,217 1,434 Additions and unrealized gains (1,295) (827) (721) Other operating activities 1,113 174 (97) Net Cash Provided by Operating Activities 4,779 1,228 1,640 (2,363) (722) 294 (1,905) (1,659) (2,381) (933) 494 (485) Cash Flows From Investing Activities Capital expenditures Equity investments Proceeds from sales of non-merchant assets Acquisition of subsidiary stock Business acquisitions, net of cash acquired Other investing activities Net Cash Used in Investing Activities 239 (180) (182) (4,264) (405) (3,507) (356) (3,965) ...continued... ... continued... 3,994 (2,337) (1,595) 1,776 (1,837) 1,565 1,903 (870) (158) 8 (96) 307 852 500 867 828 (414) 13 Cash Flows From Financing Activities Issuance of long-term debt Repayment of long-term debt Net increase (decrease) in short-term borrowings Net issuance (redemption) of company-obligated preferred securities of subsidiaries Issuance of common stock Issuance of subsidiary equity Dividends paid Net disposition of treasury stock Other financing activities Net Cash Provided by Financing Activities Increase (Decrease) in Cash and Cash Equivalents Cash and Cash Equivalents, Beginning of Year Cash and Cash Equivalents, End of Year Changes in components of Working Capital Receivables Inventories Payables Other Total 89 (523) 327 (6) 571 1,086 288 $ 1,374 568 (467) 139 (140) 2,456 177 111 288 2,266 (59) 170 111 $ $ $(8,203) $ (662) $(1,055) 1,336 (133) (372) 7,167 (246) 433 1,469 41 7 61 $ 1,769 $(1,000) $ (233) 4. Cash from operating activities grew from 1999 to 2000. What category accounted for the biggest increase? 5. What two line items contributed to the biggest increase in working capital from 1999 to 2000? You can look at the balance sheet or at the end of the cash flows for this information. 6. Which two types of revenue had the biggest (dollar, not percent) increase from 1999 to 2000? What was their percent increase? 7. How much did the related PPE items increase in percent terms) from 1999 to 2000